Download PDF version English(2664KB) - Hamon

Download PDF version English(2664KB) - Hamon

Download PDF version English(2664KB) - Hamon

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Part 3 - Financial Statements<br />

79<br />

As a reminder, the costs supported by the Group on<br />

discontinued operations during the last years consisted<br />

for the most part of:<br />

■ various costs coming from the sale at the end of 2005<br />

of our Italian subsidiary FBM to KNM Group Berhad<br />

and the liquidation, at the beginning of 2005, of the<br />

remaining Italian activities carried out through one<br />

subsidiary – <strong>Hamon</strong> Research Cottrell Italia Srl;<br />

■ cost of the transactional agreement concluded<br />

between <strong>Hamon</strong> and SPX in December 2008<br />

regarding the Holdback Transaction of EUR 5 million<br />

related to the sale, in December 2003, of the global<br />

Dry and Wet NAFTA Cooling activities;<br />

■ post disposal costs of Air Industrie Thermique-Loreatt.<br />

The impact of discontinued activities on the result and<br />

on the cash flow of the Group amounts, for the 2010<br />

financial year, to EUR -22 thousand (EUR -242 thousand<br />

and EUR -441 thousand for the 2009 and 2008<br />

financial years) (see note 20).<br />

As of 31 December 2010, 2009 and 2008, assets and<br />

liabilities of discontinued activities amount to zero.<br />

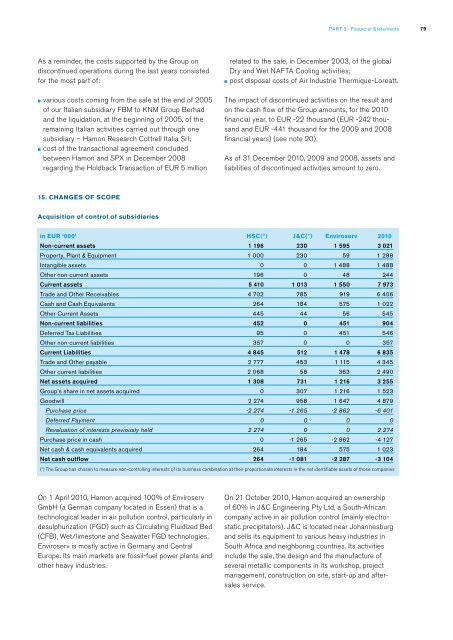

15. Changes of scope<br />

Acquisition of control of subsidiaries<br />

in EUR ‘000’ HSC(*) J&C(*) Enviroserv 2010<br />

Non-current assets 1 196 230 1 595 3 021<br />

Property, Plant & Equipment 1 000 230 59 1 288<br />

Intangible assets 0 0 1 488 1 488<br />

Other non-current assets 196 0 48 244<br />

Current assets 5 410 1 013 1 550 7 973<br />

Trade and Other Receivables 4 702 785 919 6 406<br />

Cash and Cash Equivalents 264 184 575 1 022<br />

Other Current Assets 445 44 56 545<br />

Non-current liabilities 452 0 451 904<br />

Deferred Tax Liabilities 95 0 451 546<br />

Other non-current liabilities 357 0 0 357<br />

Current Liabilities 4 845 512 1 478 6 835<br />

Trade and Other payable 2 777 453 1 115 4 345<br />

Other current liabilities 2 068 58 363 2 490<br />

Net assets acquired 1 308 731 1 216 3 255<br />

Group’s share in net assets acquired 0 307 1 216 1 523<br />

Goodwill 2 274 958 1 647 4 879<br />

Purchase price -2 274 -1 265 -2 862 -6 401<br />

Deferred Payment 0 0 0 0<br />

Revaluation of interests previously held 2 274 0 0 2 274<br />

Purchase price in cash 0 -1 265 -2 862 -4 127<br />

Net cash & cash equivalents acquired 264 184 575 1 023<br />

Net cash outflow 264 -1 081 -2 287 -3 104<br />

(*) The Group has chosen to measure non-controlling interests of its business combination at their proportionate interests in the net identifiable assets of those companies<br />

On 1 April 2010, <strong>Hamon</strong> acquired 100% of Enviroserv<br />

GmbH (a German company located in Essen) that is a<br />

technological leader in air pollution control, particularly in<br />

desulphurization (FGD) such as Circulating Fluidized Bed<br />

(CFB), Wet/limestone and Seawater FGD technologies.<br />

Enviroserv is mostly active in Germany and Central<br />

Europe. Its main markets are fossil-fuel power plants and<br />

other heavy industries.<br />

On 21 October 2010, <strong>Hamon</strong> acquired an ownership<br />

of 60% in J&C Engineering Pty Ltd, a South-African<br />

company active in air pollution control (mainly electrostatic<br />

precipitators). J&C is located near Johannesburg<br />

and sells its equipment to various heavy industries in<br />

South Africa and neighboring countries. Its activities<br />

include the sale, the design and the manufacture of<br />

several metallic components in its workshop, project<br />

management, construction on site, start-up and aftersales<br />

service.