Download PDF version English(2664KB) - Hamon

Download PDF version English(2664KB) - Hamon

Download PDF version English(2664KB) - Hamon

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Part 3 - Financial Statements<br />

91<br />

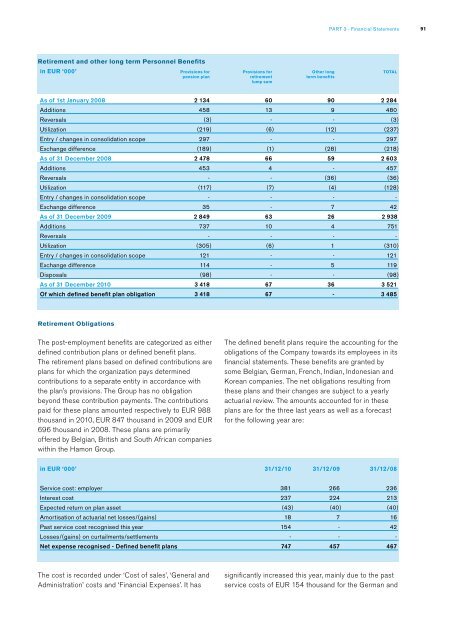

Retirement and other long term Personnel Benefits<br />

in EUR ‘000’ Provisions for Provisions for other long TOTAL<br />

pension plan retirement term benefits<br />

lump sum<br />

As of 1st January 2008 2 134 60 90 2 284<br />

Additions 458 13 9 480<br />

Reversals (3) - - (3)<br />

Utilization (219) (6) (12) (237)<br />

Entry / changes in consolidation scope 297 - - 297<br />

Exchange difference (189) (1) (28) (218)<br />

As of 31 December 2008 2 478 66 59 2 603<br />

Additions 453 4 - 457<br />

Reversals - - (36) (36)<br />

Utilization (117) (7) (4) (128)<br />

Entry / changes in consolidation scope - - - -<br />

Exchange difference 35 - 7 42<br />

As of 31 December 2009 2 849 63 26 2 938<br />

Additions 737 10 4 751<br />

Reversals - - - -<br />

Utilization (305) (6) 1 (310)<br />

Entry / changes in consolidation scope 121 - - 121<br />

Exchange difference 114 - 5 119<br />

Disposals (98) - - (98)<br />

As of 31 December 2010 3 418 67 36 3 521<br />

Of which defined benefit plan obligation 3 418 67 - 3 485<br />

Retirement Obligations<br />

The post-employment benefits are categorized as either<br />

defined contribution plans or defined benefit plans.<br />

The retirement plans based on defined contributions are<br />

plans for which the organization pays determined<br />

contributions to a separate entity in accordance with<br />

the plan’s provisions. The Group has no obligation<br />

beyond these contribution payments. The contributions<br />

paid for these plans amounted respectively to EUR 988<br />

thousand in 2010, EUR 847 thousand in 2009 and EUR<br />

696 thousand in 2008. These plans are primarily<br />

offered by Belgian, British and South African companies<br />

within the <strong>Hamon</strong> Group.<br />

The defined benefit plans require the accounting for the<br />

obligations of the Company towards its employees in its<br />

financial statements. These benefits are granted by<br />

some Belgian, German, French, Indian, Indonesian and<br />

Korean companies. The net obligations resulting from<br />

these plans and their changes are subject to a yearly<br />

actuarial review. The amounts accounted for in these<br />

plans are for the three last years as well as a forecast<br />

for the following year are:<br />

in EUR ‘000’ 31/12/10 31/12/09 31/12/08<br />

Service cost: employer 381 266 236<br />

Interest cost 237 224 213<br />

Expected return on plan asset (43) (40) (40)<br />

Amortisation of actuarial net losses/(gains) 18 7 16<br />

Past service cost recognised this year 154 - 42<br />

Losses/(gains) on curtailments/settlements - - -<br />

Net expense recognised - Defined benefit plans 747 457 467<br />

The cost is recorded under ‘Cost of sales’, ‘General and<br />

Administration’ costs and ‘Financial Expenses’. It has<br />

significantly increased this year, mainly due to the past<br />

service costs of EUR 154 thousand for the German and