Download PDF version English(2664KB) - Hamon

Download PDF version English(2664KB) - Hamon

Download PDF version English(2664KB) - Hamon

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

98<br />

<strong>Hamon</strong> Annual Report 2010<br />

Forward currency contracts used to hedge the transactional<br />

risks on currencies are accounted as if they were held<br />

for trading.<br />

However, such forward currency contracts are only used<br />

to hedge existing transactions and commitments and are<br />

therefore not speculative by nature.<br />

The fair values were directly recognized in the income<br />

statement in unrealized exchange gains or losses.<br />

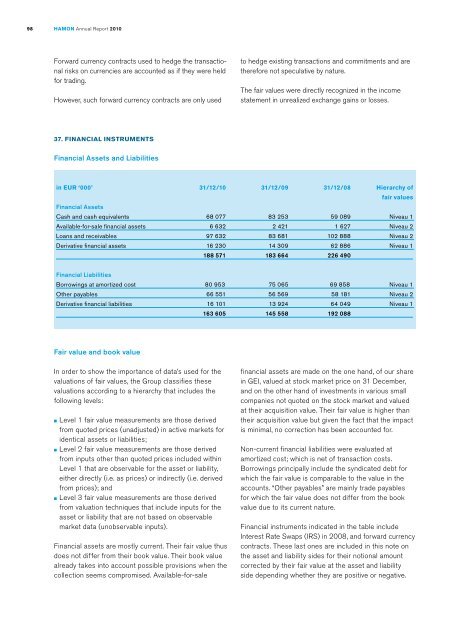

37. FINANCIAL INSTRUMENTS<br />

Financial Assets and Liabilities<br />

in EUR ‘000’ 31/12/10 31/12/09 31/12/08 Hierarchy of<br />

fair values<br />

Financial Assets<br />

Cash and cash equivalents 68 077 83 253 59 089 Niveau 1<br />

Available-for-sale financial assets 6 632 2 421 1 627 Niveau 2<br />

Loans and receivables 97 632 83 681 102 888 Niveau 2<br />

Derivative financial assets 16 230 14 309 62 886 Niveau 1<br />

188 571 183 664 226 490<br />

Financial Liabilities<br />

Borrowings at amortized cost 80 953 75 065 69 858 Niveau 1<br />

Other payables 66 551 56 569 58 181 Niveau 2<br />

Derivative financial liabilities 16 101 13 924 64 049 Niveau 1<br />

163 605 145 558 192 088<br />

Fair value and book value<br />

In order to show the importance of data’s used for the<br />

valuations of fair values, the Group classifies these<br />

valuations according to a hierarchy that includes the<br />

following levels:<br />

■ Level 1 fair value measurements are those derived<br />

from quoted prices (unadjusted) in active markets for<br />

identical assets or liabilities;<br />

■ Level 2 fair value measurements are those derived<br />

from inputs other than quoted prices included within<br />

Level 1 that are observable for the asset or liability,<br />

either directly (i.e. as prices) or indirectly (i.e. derived<br />

from prices); and<br />

■ Level 3 fair value measurements are those derived<br />

from valuation techniques that include inputs for the<br />

asset or liability that are not based on observable<br />

market data (unobservable inputs).<br />

Financial assets are mostly current. Their fair value thus<br />

does not differ from their book value. Their book value<br />

already takes into account possible provisions when the<br />

collection seems compromised. Available-for-sale<br />

financial assets are made on the one hand, of our share<br />

in GEI, valued at stock market price on 31 December,<br />

and on the other hand of investments in various small<br />

companies not quoted on the stock market and valued<br />

at their acquisition value. Their fair value is higher than<br />

their acquisition value but given the fact that the impact<br />

is minimal, no correction has been accounted for.<br />

Non-current financial liabilities were evaluated at<br />

amortized cost; which is net of transaction costs.<br />

Borrowings principally include the syndicated debt for<br />

which the fair value is comparable to the value in the<br />

accounts. “Other payables” are mainly trade payables<br />

for which the fair value does not differ from the book<br />

value due to its current nature.<br />

Financial instruments indicated in the table include<br />

Interest Rate Swaps (IRS) in 2008, and forward currency<br />

contracts. These last ones are included in this note on<br />

the asset and liability sides for their notional amount<br />

corrected by their fair value at the asset and liability<br />

side depending whether they are positive or negative.