Portfolio report - Mangaung.co.za

Portfolio report - Mangaung.co.za

Portfolio report - Mangaung.co.za

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

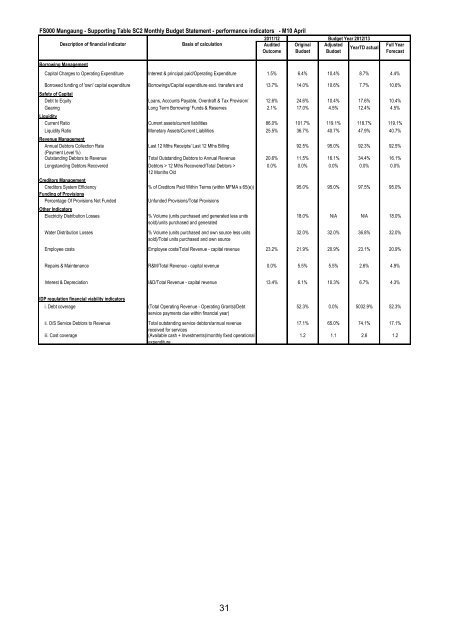

FS000 <strong>Mangaung</strong> - Supporting Table SC2 Monthly Budget Statement - performance indicators - M10 April<br />

2011/12 Budget Year 2012/13<br />

Description of financial indicator<br />

Basis of calculation<br />

Audited Original Adjusted<br />

YearTD actual<br />

Out<strong>co</strong>me Budget Budget<br />

Full Year<br />

Forecast<br />

Borrowing Management<br />

Capital Charges to Operating Expenditure Interest & principal paid/Operating Expenditure 1.5% 6.4% 10.4% 8.7% 4.4%<br />

Borrowed funding of 'own' capital expenditure Borrowings/Capital expenditure excl. transfers and<br />

13.7% 14.0% 10.6% 7.7% 10.6%<br />

Safety of Capital<br />

Debt to Equity<br />

grants<br />

Loans, Ac<strong>co</strong>unts Payable, Overdraft & Tax Provision/ 12.6% 24.6% 10.4% 17.6% 10.4%<br />

Gearing Funds Long Term & Reserves Borrowing/ Funds & Reserves 2.1% 17.0% 4.5% 12.4% 4.5%<br />

Liquidity<br />

Current Ratio Current assets/current liabilities 86.0% 101.7% 119.1% 118.7% 119.1%<br />

Liquidity Ratio Monetary Assets/Current Liabilities 25.5% 36.7% 40.7% 47.9% 40.7%<br />

Revenue Management<br />

Annual Debtors Collection Rate<br />

Last 12 Mths Receipts/ Last 12 Mths Billing 92.5% 95.0% 92.3% 92.5%<br />

(Payment Level %)<br />

Outstanding Debtors to Revenue Total Outstanding Debtors to Annual Revenue 20.6% 11.5% 16.1% 34.4% 16.1%<br />

Longstanding Debtors Re<strong>co</strong>vered Debtors > 12 Mths Re<strong>co</strong>vered/Total Debtors ><br />

12 Months Old<br />

0.0% 0.0% 0.0% 0.0% 0.0%<br />

Creditors Management<br />

Creditors System Efficiency % of Creditors Paid Within Terms (within MFMA s 65(e)) 95.0% 95.0% 97.5% 95.0%<br />

Funding of Provisions<br />

Percentage Of Provisions Not Funded<br />

Unfunded Provisions/Total Provisions<br />

Other Indicators<br />

Electricity Distribution Losses<br />

Water Distribution Losses<br />

% Volume (units purchased and generated less units<br />

sold)/units purchased and generated<br />

% Volume (units purchased and own source less units<br />

sold)/Total units purchased and own source<br />

18.0% N/A N/A 18.0%<br />

32.0% 32.0% 36.8% 32.0%<br />

Employee <strong>co</strong>sts Employee <strong>co</strong>sts/Total Revenue - capital revenue 23.2% 21.9% 20.9% 23.1% 20.9%<br />

Repairs & Maintenance R&M/Total Revenue - capital revenue 0.0% 5.5% 5.5% 2.6% 4.9%<br />

Interest & Depreciation I&D/Total Revenue - capital revenue 13.4% 6.1% 10.3% 6.7% 4.3%<br />

IDP regulation financial viability indicators<br />

i. Debt <strong>co</strong>verage (Total Operating Revenue - Operating Grants)/Debt<br />

service payments due within financial year)<br />

ii. O/S Service Debtors to Revenue<br />

iii. Cost <strong>co</strong>verage<br />

Total outstanding service debtors/annual revenue<br />

received for services<br />

(Available cash + Investments)/monthly fixed operational<br />

expenditure<br />

52.3% 0.0% 5032.9% 52.3%<br />

17.1% 65.0% 74.1% 17.1%<br />

1.2 1.1 2.6 1.2<br />

31