Workplace Safety & Insurance Coverage - wsib

Workplace Safety & Insurance Coverage - wsib

Workplace Safety & Insurance Coverage - wsib

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Chapter 6 -Account Administration<br />

■ total benefit costs (including those<br />

covered by advances)<br />

■ physicians’ fees<br />

The administration fees are based on a projected<br />

administration rate that is set at the beginning of<br />

each year.<br />

Did You Know<br />

Since October 1990 physicians under the Ontario’s<br />

health insurance plan (OHIP) no longer bill the WSIB<br />

directly. They bill WSIB claim related costs to the<br />

Ministry of Health who, in turn, bills the WSIB.<br />

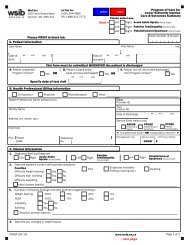

Late Filing of Accident Report (0183)<br />

This is issued daily, as they occur. This form notifies an<br />

employer when they are charged a late filing penalty.<br />

The charge is $250 for each occurrence.<br />

Physician Fee Adjustment<br />

Employers receive this notice annually, normally in<br />

March. It shows the difference between the estimated<br />

amount and the actual amount paid by the WSIB to the<br />

Ministry of Health for the previous year for physician fees.<br />

Fines for late reporting of accidents are recorded<br />

on the monthly statement as an AD invoice number.<br />

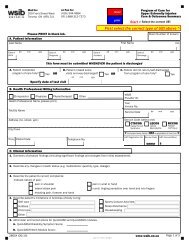

Average weekly Average reimbursement<br />

X – Deposit<br />

Costs pattern + 2 weeks on Hand<br />

Interest Charged<br />

The late payment interest charge notice is sent when<br />

interest is charged. The WSIB charges interest at the rate<br />

of two per cent each month end on the amount of<br />

overdue invoices not covered by a deposit.<br />

Late payment interest charges are recorded on<br />

the monthly statement as an AC invoice number.<br />

Interest Earned<br />

A notice of interest earned is sent when earned.<br />

The WSIB pays interest on deposits at each month end on<br />

the portion of the deposit greater than the accounts<br />

receivable balance.<br />

Invoice Cancellation Notice<br />

This notice is sent when the WSIB cancels an invoice<br />

previously charged to a Schedule 2 employer, such as<br />

when we cancel a late reporting charge.<br />

Interest earned is recorded on the<br />

monthly statement as a BB invoice number.<br />

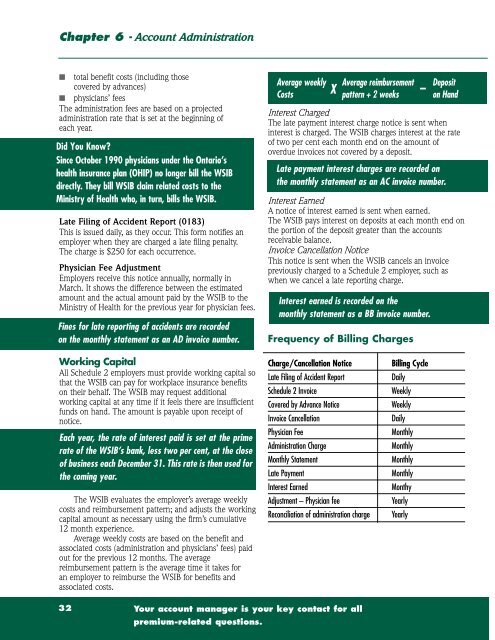

Frequency of Billing Charges<br />

Working Capital<br />

All Schedule 2 employers must provide working capital so<br />

that the WSIB can pay for workplace insurance benefits<br />

on their behalf. The WSIB may request additional<br />

working capital at any time if it feels there are insufficient<br />

funds on hand. The amount is payable upon receipt of<br />

notice.<br />

Each year, the rate of interest paid is set at the prime<br />

rate of the WSIB’s bank, less two per cent, at the close<br />

of business each December 31. This rate is then used for<br />

the coming year.<br />

The WSIB evaluates the employer’s average weekly<br />

costs and reimbursement pattern; and adjusts the working<br />

capital amount as necessary using the firm’s cumulative<br />

12 month experience.<br />

Average weekly costs are based on the benefit and<br />

associated costs (administration and physicians’ fees) paid<br />

out for the previous 12 months. The average<br />

reimbursement pattern is the average time it takes for<br />

an employer to reimburse the WSIB for benefits and<br />

associated costs.<br />

Charge/Cancellation Notice<br />

Late Filing of Accident Report<br />

Schedule 2 Invoice<br />

Covered by Advance Notice<br />

Invoice Cancellation<br />

Physician Fee<br />

Administration Charge<br />

Monthly Statement<br />

Late Payment<br />

Interest Earned<br />

Adjustment – Physician fee<br />

Reconciliation of administration charge<br />

Billing Cycle<br />

Daily<br />

Weekly<br />

Weekly<br />

Daily<br />

Monthly<br />

Monthly<br />

Monthly<br />

Monthly<br />

Monthy<br />

Yearly<br />

Yearly<br />

32 Your account manager is your key contact for all<br />

premium-related questions.