Complete annual report 2010-11 - Land - NSW Government

Complete annual report 2010-11 - Land - NSW Government

Complete annual report 2010-11 - Land - NSW Government

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

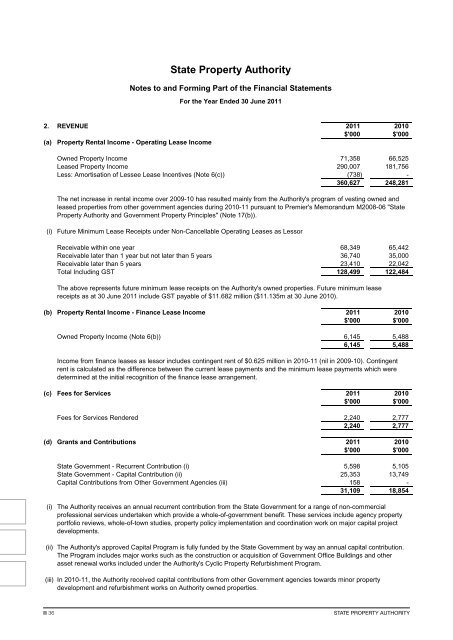

State Property Authority<br />

Notes to and Forming Part of the Financial Statements<br />

For the Year Ended 30 June 20<strong>11</strong><br />

2. REVENUE 20<strong>11</strong> <strong>2010</strong><br />

$'000 $'000<br />

(a) Property Rental Income - Operating Lease Income<br />

Owned Property Income 71,358 66,525<br />

Leased Property Income 290,007 181,756<br />

Less: Amortisation of Lessee Lease Incentives (Note 6(c)) (738) -<br />

360,627 248,281<br />

The net increase in rental income over 2009-10 has resulted mainly from the Authority's program of vesting owned and<br />

leased properties from other government agencies during <strong>2010</strong>-<strong>11</strong> pursuant to Premier's Memorandum M2008-06 "State<br />

Property Authority and <strong>Government</strong> Property Principles" (Note 17(b)).<br />

(i) Future Minimum Lease Receipts under Non-Cancellable Operating Leases as Lessor<br />

Receivable within one year 68,349 65,442<br />

Receivable later than 1 year but not later than 5 years 36,740 35,000<br />

Receivable later than 5 years 23,410 22,042<br />

Total Including GST 128,499 122,484<br />

The above represents future minimum lease receipts on the Authority's owned properties. Future minimum lease<br />

receipts as at 30 June 20<strong>11</strong> include GST payable of $<strong>11</strong>.682 million ($<strong>11</strong>.135m at 30 June <strong>2010</strong>).<br />

(b) Property Rental Income - Finance Lease Income 20<strong>11</strong> <strong>2010</strong><br />

$'000 $'000<br />

Owned Property Income (Note 6(b)) 6,145 5,488<br />

6,145 5,488<br />

Income from finance leases as lessor includes contingent rent of $0.625 million in <strong>2010</strong>-<strong>11</strong> (nil in 2009-10). Contingent<br />

rent is calculated as the difference between the current lease payments and the minimum lease payments which were<br />

determined at the initial recognition of the finance lease arrangement.<br />

(c) Fees for Services 20<strong>11</strong> <strong>2010</strong><br />

$'000 $'000<br />

Fees for Services Rendered 2,240 2,777<br />

2,240 2,777<br />

(d) Grants and Contributions 20<strong>11</strong> <strong>2010</strong><br />

$'000 $'000<br />

State <strong>Government</strong> - Recurrent Contribution (i) 5,598 5,105<br />

State <strong>Government</strong> - Capital Contribution (ii) 25,353 13,749<br />

Capital Contributions from Other <strong>Government</strong> Agencies (iii) 158 -<br />

31,109 18,854<br />

(i) The Authority receives an <strong>annual</strong> recurrent contribution from the State <strong>Government</strong> for a range of non-commercial<br />

professional services undertaken which provide a whole-of-government benefit. These services include agency property<br />

portfolio reviews, whole-of-town studies, property policy implementation and coordination work on major capital project<br />

developments.<br />

(ii) The Authority's approved Capital Program is fully funded by the State <strong>Government</strong> by way an <strong>annual</strong> capital contribution.<br />

The Program includes major works such as the construction or acquisition of <strong>Government</strong> Office Buildings and other<br />

asset renewal works included under the Authority's Cyclic Property Refurbishment Program.<br />

(iii) In <strong>2010</strong>-<strong>11</strong>, the Authority received capital contributions from other <strong>Government</strong> agencies towards minor property<br />

development and refurbishment works on Authority owned properties.<br />

36<br />

State Property Authority