Complete annual report 2010-11 - Land - NSW Government

Complete annual report 2010-11 - Land - NSW Government

Complete annual report 2010-11 - Land - NSW Government

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

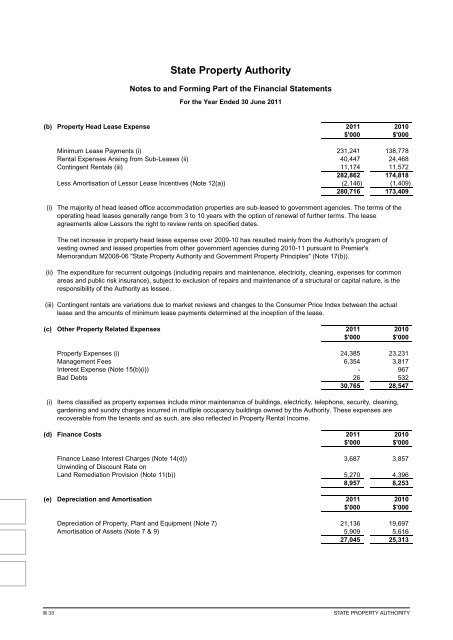

State Property Authority<br />

Notes to and Forming Part of the Financial Statements<br />

For the Year Ended 30 June 20<strong>11</strong><br />

(b) Property Head Lease Expense 20<strong>11</strong> <strong>2010</strong><br />

$'000 $'000<br />

Minimum Lease Payments (i) 231,241 138,778<br />

Rental Expenses Arising from Sub-Leases (ii) 40,447 24,468<br />

Contingent Rentals (iii) <strong>11</strong>,174 <strong>11</strong>,572<br />

282,862 174,818<br />

Less Amortisation of Lessor Lease Incentives (Note 12(a)) (2,146) (1,409)<br />

280,716 173,409<br />

(i) The majority of head leased office accommodation properties are sub-leased to government agencies. The terms of the<br />

operating head leases generally range from 3 to 10 years with the option of renewal of further terms. The lease<br />

agreements allow Lessors the right to review rents on specified dates.<br />

The net increase in property head lease expense over 2009-10 has resulted mainly from the Authority's program of<br />

vesting owned and leased properties from other government agencies during <strong>2010</strong>-<strong>11</strong> pursuant to Premier's<br />

Memorandum M2008-06 "State Property Authority and <strong>Government</strong> Property Principles" (Note 17(b)).<br />

(ii) The expenditure for recurrent outgoings (including repairs and maintenance, electricity, cleaning, expenses for common<br />

areas and public risk insurance), subject to exclusion of repairs and maintenance of a structural or capital nature, is the<br />

responsibility of the Authority as lessee.<br />

(iii) Contingent rentals are variations due to market reviews and changes to the Consumer Price Index between the actual<br />

lease and the amounts of minimum lease payments determined at the inception of the lease.<br />

(c) Other Property Related Expenses 20<strong>11</strong> <strong>2010</strong><br />

$'000 $'000<br />

Property Expenses (i) 24,385 23,231<br />

Management Fees 6,354 3,817<br />

Interest Expense (Note 15(b)(i)) - 967<br />

Bad Debts 26 532<br />

30,765 28,547<br />

(i) Items classified as property expenses include minor maintenance of buildings, electricity, telephone, security, cleaning,<br />

gardening and sundry charges incurred in multiple occupancy buildings owned by the Authority. These expenses are<br />

recoverable from the tenants and as such, are also reflected in Property Rental Income.<br />

(d) Finance Costs 20<strong>11</strong> <strong>2010</strong><br />

$'000 $'000<br />

Finance Lease Interest Charges (Note 14(d)) 3,687 3,857<br />

Unwinding of Discount Rate on<br />

<strong>Land</strong> Remediation Provision (Note <strong>11</strong>(b)) 5,270 4,396<br />

8,957 8,253<br />

(e) Depreciation and Amortisation 20<strong>11</strong> <strong>2010</strong><br />

$'000 $'000<br />

Depreciation of Property, Plant and Equipment (Note 7) 21,136 19,697<br />

Amortisation of Assets (Note 7 & 9) 5,909 5,616<br />

27,045 25,313<br />

38<br />

State Property Authority