Complete annual report 2010-11 - Land - NSW Government

Complete annual report 2010-11 - Land - NSW Government

Complete annual report 2010-11 - Land - NSW Government

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

State Property Authority<br />

<strong>2010</strong>-20<strong>11</strong> Annual Report<br />

State Property Authority<br />

Notes to and Forming Part of the Financial Statements<br />

For the Year Ended 30 June 20<strong>11</strong><br />

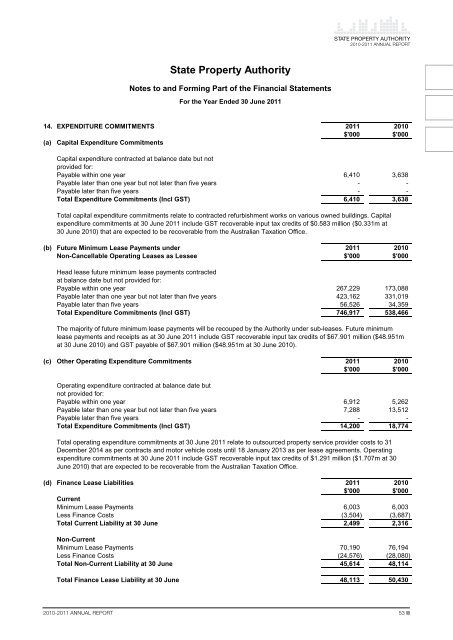

14. EXPENDITURE COMMITMENTS 20<strong>11</strong> <strong>2010</strong><br />

$'000 $'000<br />

(a) Capital Expenditure Commitments<br />

Capital expenditure contracted at balance date but not<br />

provided for:<br />

Payable within one year 6,410 3,638<br />

Payable later than one year but not later than five years - -<br />

Payable later than five years - -<br />

Total Expenditure Commitments (Incl GST) 6,410 3,638<br />

Total capital expenditure commitments relate to contracted refurbishment works on various owned buildings. Capital<br />

expenditure commitments at 30 June 20<strong>11</strong> include GST recoverable input tax credits of $0.583 million ($0.331m at<br />

30 June <strong>2010</strong>) that are expected to be recoverable from the Australian Taxation Office.<br />

(b) Future Minimum Lease Payments under 20<strong>11</strong> <strong>2010</strong><br />

Non-Cancellable Operating Leases as Lessee $'000 $'000<br />

Head lease future minimum lease payments contracted<br />

at balance date but not provided for:<br />

Payable within one year 267,229 173,088<br />

Payable later than one year but not later than five years 423,162 331,019<br />

Payable later than five years 56,526 34,359<br />

Total Expenditure Commitments (Incl GST) 746,917 538,466<br />

The majority of future minimum lease payments will be recouped by the Authority under sub-leases. Future minimum<br />

lease payments and receipts as at 30 June 20<strong>11</strong> include GST recoverable input tax credits of $67.901 million ($48.951m<br />

at 30 June <strong>2010</strong>) and GST payable of $67.901 million ($48.951m at 30 June <strong>2010</strong>).<br />

(c) Other Operating Expenditure Commitments 20<strong>11</strong> <strong>2010</strong><br />

$'000 $'000<br />

Operating expenditure contracted at balance date but<br />

not provided for:<br />

Payable within one year 6,912 5,262<br />

Payable later than one year but not later than five years 7,288 13,512<br />

Payable later than five years - -<br />

Total Expenditure Commitments (Incl GST) 14,200 18,774<br />

Total operating expenditure commitments at 30 June 20<strong>11</strong> relate to outsourced property service provider costs to 31<br />

December 2014 as per contracts and motor vehicle costs until 18 January 2013 as per lease agreements. Operating<br />

expenditure commitments at 30 June 20<strong>11</strong> include GST recoverable input tax credits of $1.291 million ($1.707m at 30<br />

June <strong>2010</strong>) that are expected to be recoverable from the Australian Taxation Office.<br />

(d) Finance Lease Liabilities 20<strong>11</strong> <strong>2010</strong><br />

$'000 $'000<br />

Current<br />

Minimum Lease Payments 6,003 6,003<br />

Less Finance Costs (3,504) (3,687)<br />

Total Current Liability at 30 June 2,499 2,316<br />

Non-Current<br />

Minimum Lease Payments 70,190 76,194<br />

Less Finance Costs (24,576) (28,080)<br />

Total Non-Current Liability at 30 June 45,614 48,<strong>11</strong>4<br />

Total Finance Lease Liability at 30 June 48,<strong>11</strong>3 50,430<br />

<strong>2010</strong>-20<strong>11</strong> Annual Report 53