Complete annual report 2010-11 - Land - NSW Government

Complete annual report 2010-11 - Land - NSW Government

Complete annual report 2010-11 - Land - NSW Government

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

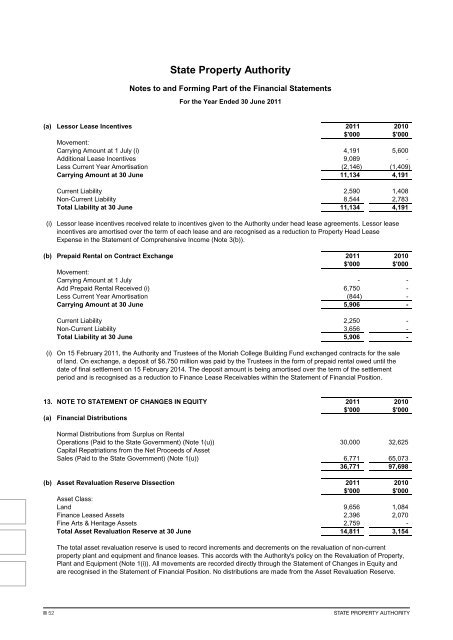

State Property Authority<br />

Notes to and Forming Part of the Financial Statements<br />

For the Year Ended 30 June 20<strong>11</strong><br />

(a) Lessor Lease Incentives 20<strong>11</strong> <strong>2010</strong><br />

$'000 $'000<br />

Movement:<br />

Carrying Amount at 1 July (i) 4,191 5,600<br />

Additional Lease Incentives 9,089 -<br />

Less Current Year Amortisation (2,146) (1,409)<br />

Carrying Amount at 30 June <strong>11</strong>,134 4,191<br />

Current Liability 2,590 1,408<br />

Non-Current Liability 8,544 2,783<br />

Total Liability at 30 June <strong>11</strong>,134 4,191<br />

(i) Lessor lease incentives received relate to incentives given to the Authority under head lease agreements. Lessor lease<br />

incentives are amortised over the term of each lease and are recognised as a reduction to Property Head Lease<br />

Expense in the Statement of Comprehensive Income (Note 3(b)).<br />

(b) Prepaid Rental on Contract Exchange 20<strong>11</strong> <strong>2010</strong><br />

$'000 $'000<br />

Movement:<br />

Carrying Amount at 1 July - -<br />

Add Prepaid Rental Received (i) 6,750 -<br />

Less Current Year Amortisation (844) -<br />

Carrying Amount at 30 June 5,906 -<br />

Current Liability 2,250 -<br />

Non-Current Liability 3,656 -<br />

Total Liability at 30 June 5,906 -<br />

(i) On 15 February 20<strong>11</strong>, the Authority and Trustees of the Moriah College Building Fund exchanged contracts for the sale<br />

of land. On exchange, a deposit of $6.750 million was paid by the Trustees in the form of prepaid rental owed until the<br />

date of final settlement on 15 February 2014. The deposit amount is being amortised over the term of the settlement<br />

period and is recognised as a reduction to Finance Lease Receivables within the Statement of Financial Position.<br />

13. NOTE TO STATEMENT OF CHANGES IN EQUITY 20<strong>11</strong> <strong>2010</strong><br />

$'000 $'000<br />

(a) Financial Distributions<br />

Normal Distributions from Surplus on Rental<br />

Operations (Paid to the State <strong>Government</strong>) (Note 1(u)) 30,000 32,625<br />

Capital Repatriations from the Net Proceeds of Asset<br />

Sales (Paid to the State <strong>Government</strong>) (Note 1(u)) 6,771 65,073<br />

36,771 97,698<br />

(b) Asset Revaluation Reserve Dissection 20<strong>11</strong> <strong>2010</strong><br />

$'000 $'000<br />

Asset Class:<br />

<strong>Land</strong> 9,656 1,084<br />

Finance Leased Assets 2,396 2,070<br />

Fine Arts & Heritage Assets 2,759 -<br />

Total Asset Revaluation Reserve at 30 June 14,8<strong>11</strong> 3,154<br />

The total asset revaluation reserve is used to record increments and decrements on the revaluation of non-current<br />

property plant and equipment and finance leases. This accords with the Authority's policy on the Revaluation of Property,<br />

Plant and Equipment (Note 1(i)). All movements are recorded directly through the Statement of Changes in Equity and<br />

are recognised in the Statement of Financial Position. No distributions are made from the Asset Revaluation Reserve.<br />

52<br />

State Property Authority