omnia holdings annual report 2010 omnia holdings annu

omnia holdings annual report 2010 omnia holdings annu

omnia holdings annual report 2010 omnia holdings annu

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

102 OMNIA ANNUAL REPORT <strong>2010</strong> FINANCIAL STATEMENTS continued<br />

NOTES TO THE GROUP FINANCIAL STATEMENTS continued<br />

for the year ended 31 March <strong>2010</strong><br />

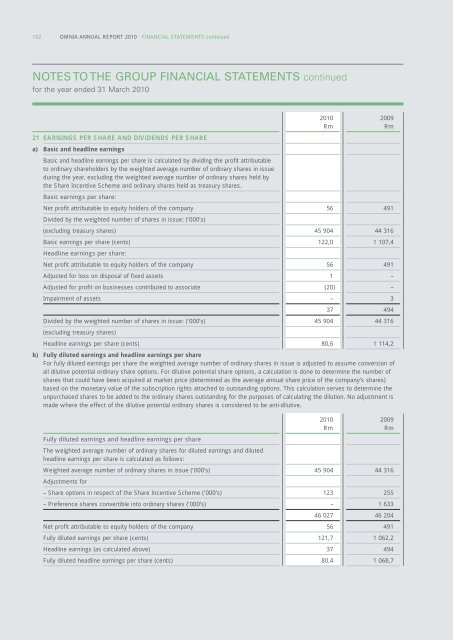

21 EARNINGS PER SHARE AND DIVIDENDS PER SHARE<br />

a) Basic and headline earnings<br />

Basic and headline earnings per share is calculated by dividing the profit attributable<br />

to ordinary shareholders by the weighted average number of ordinary shares in issue<br />

during the year, excluding the weighted average number of ordinary shares held by<br />

the Share Incentive Scheme and ordinary shares held as treasury shares.<br />

Basic earnings per share:<br />

Net profit attributable to equity holders of the company<br />

Divided by the weighted number of shares in issue: (‘000’s)<br />

56 491<br />

(excluding treasury shares) 45 904 44 316<br />

Basic earnings per share (cents)<br />

Headline earnings per share:<br />

122,0 1 107,4<br />

Net profit attributable to equity holders of the company 56 491<br />

Adjusted for loss on disposal of fixed assets 1 –<br />

Adjusted for profit on businesses contributed to associate (20) –<br />

Impairment of assets – 3<br />

37 494<br />

Divided by the weighted number of shares in issue: (‘000’s)<br />

(excluding treasury shares)<br />

45 904 44 316<br />

Headline earnings per share (cents) 80,6 1 114,2<br />

b) Fully diluted earnings and headline earnings per share<br />

For fully diluted earnings per share the weighted average number of ordinary shares in issue is adjusted to assume conversion of<br />

all dilutive potential ordinary share options. For dilutive potential share options, a calculation is done to determine the number of<br />

shares that could have been acquired at market price (determined as the average <strong><strong>annu</strong>al</strong> share price of the company’s shares)<br />

based on the monetary value of the subscription rights attached to outstanding options. This calculation serves to determine the<br />

unpurchased shares to be added to the ordinary shares outstanding for the purposes of calculating the dilution. No adjustment is<br />

made where the effect of the dilutive potential ordinary shares is considered to be anti-dilutive.<br />

Fully diluted earnings and headline earnings per share<br />

The weighted average number of ordinary shares for diluted earnings and diluted<br />

headline earnings per share is calculated as follows:<br />

Weighted average number of ordinary shares in issue (‘000’s)<br />

Adjustments for<br />

45 904 44 316<br />

– Share options in respect of the Share Incentive Scheme (‘000’s) 123 255<br />

– Preference shares convertible into ordinary shares (‘000’s) – 1 633<br />

46 027 46 204<br />

Net profit attributable to equity holders of the company 56 491<br />

Fully diluted earnings per share (cents) 121,7 1 062,2<br />

Headline earnings (as calculated above) 37 494<br />

Fully diluted headline earnings per share (cents) 80,4 1 068,7<br />

<strong>2010</strong><br />

Rm<br />

<strong>2010</strong><br />

Rm<br />

2009<br />

Rm<br />

2009<br />

Rm