You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes<br />

Inventory<br />

Valuation of the inventory is performed at whichever is the lower of the acquisition value<br />

and the current value. The value does not exceed the goods’ sale value after deductions<br />

for sale expenses. Deductions are made for obsolescence. The inventory consists mainly<br />

of hardware for further sale.<br />

Taxes<br />

Provision is made for current and deferred tax. Current tax is based on the relevant companies’<br />

taxable profit. Deferred tax takes into consideration the tax effect of the difference<br />

between values included in the accounts and fiscal values, as well as values attributable<br />

to unutilised deductions for loss.<br />

Related companies<br />

There are constant transactions between the <strong>Atea</strong> group and the WM-data group for<br />

business reasons. <strong>Atea</strong> Holding received a loan from WM-data in connection with the<br />

formation of the group. The loan is SEK 100 million. Interest is paid on market terms.<br />

Purchase and sale between group companies<br />

Of the parent company’s total expenses for purchase and sale, 47% of purchases have<br />

come from and 100% of the income has gone to other companies within the group.<br />

Definition of key ratios<br />

Solidity<br />

Equity including equity share of untaxed reserves in relation to balance-sheet total.<br />

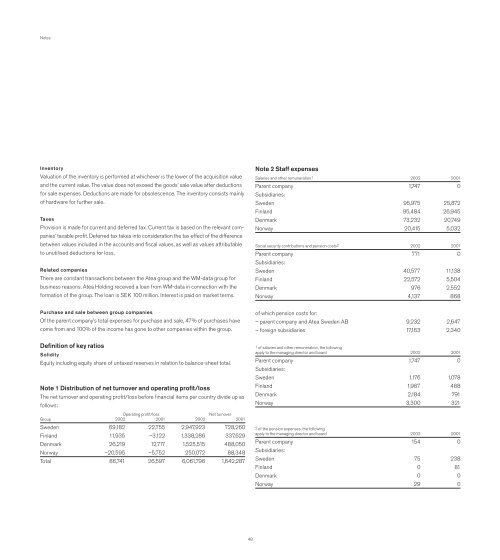

Note 1 Distribution of net turnover and operating profit/loss<br />

The net turnover and operating profit/loss before financial items per country divide up as<br />

follows:<br />

Operating profit/loss Net turnover<br />

Group 2002 2001 2002 2001<br />

Sweden 69,182 22,755 2,947,923 728,260<br />

Finland 11,935 –3,122 1,338,286 337,629<br />

Denmark 26,219 12,717 1,525,515 488,050<br />

Norway –20,595 –5,752 250,072 88,348<br />

Total 86,741 26,597 6,061,796 1,642,287<br />

48<br />

Note 2 Staff expenses<br />

Salaries and other remuneration1 2002 2001<br />

Parent company<br />

Subsidiaries:<br />

1,747 0<br />

Sweden 95,975 25,872<br />

Finland 95,484 26,945<br />

Denmark 73,232 20,749<br />

Norway 20,415 5,032<br />

Social security contributions and pension costs2 2002 2001<br />

Parent company<br />

Subsidiaries:<br />

771 0<br />

Sweden 40,577 11,138<br />

Finland 22,572 5,504<br />

Denmark 976 2,552<br />

Norway 4,137 868<br />

of which pension costs for:<br />

– parent company and <strong>Atea</strong> Sweden AB 9,232 2,647<br />

– foreign subsidiaries 17,163 2,340<br />

1 of salaries and other remuneration, the following<br />

apply to the managing director and board 2002 2001<br />

Parent company<br />

Subsidiaries:<br />

1,747 0<br />

Sweden 1,176 1,078<br />

Finland 1,967 488<br />

Denmark 2,184 791<br />

Norway 3,300 321<br />

2 of the pension expenses, the following<br />

apply to the managing director and board 2002 2001<br />

Parent company<br />

Subsidiaries:<br />

154 0<br />

Sweden 75 238<br />

Finland 0 81<br />

Denmark 0 0<br />

Norway 29 0