Financial Statements of - Shoppers Drug Mart

Financial Statements of - Shoppers Drug Mart

Financial Statements of - Shoppers Drug Mart

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SHOPPERS DRUG MART CORPORATION<br />

Notes to the Consolidated <strong>Financial</strong> <strong>Statements</strong><br />

(unaudited)<br />

(in thousands <strong>of</strong> Canadian dollars, except per share data)<br />

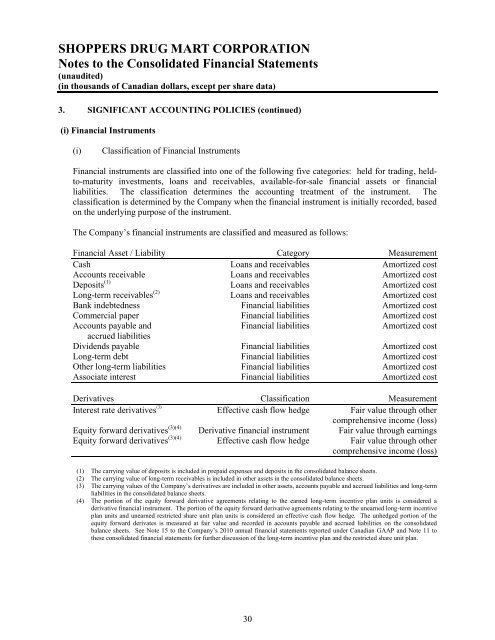

3. SIGNIFICANT ACCOUNTING POLICIES (continued)<br />

(i) <strong>Financial</strong> Instruments<br />

(i)<br />

Classification <strong>of</strong> <strong>Financial</strong> Instruments<br />

<strong>Financial</strong> instruments are classified into one <strong>of</strong> the following five categories: held for trading, heldto-maturity<br />

investments, loans and receivables, available-for-sale financial assets or financial<br />

liabilities. The classification determines the accounting treatment <strong>of</strong> the instrument. The<br />

classification is determined by the Company when the financial instrument is initially recorded, based<br />

on the underlying purpose <strong>of</strong> the instrument.<br />

The Company’s financial instruments are classified and measured as follows:<br />

<strong>Financial</strong> Asset / Liability Category Measurement<br />

Cash Loans and receivables Amortized cost<br />

Accounts receivable Loans and receivables Amortized cost<br />

Deposits (1) Loans and receivables Amortized cost<br />

Long-term receivables (2) Loans and receivables Amortized cost<br />

Bank indebtedness <strong>Financial</strong> liabilities Amortized cost<br />

Commercial paper <strong>Financial</strong> liabilities Amortized cost<br />

Accounts payable and <strong>Financial</strong> liabilities Amortized cost<br />

accrued liabilities<br />

Dividends payable <strong>Financial</strong> liabilities Amortized cost<br />

Long-term debt <strong>Financial</strong> liabilities Amortized cost<br />

Other long-term liabilities <strong>Financial</strong> liabilities Amortized cost<br />

Associate interest <strong>Financial</strong> liabilities Amortized cost<br />

Derivatives Classification Measurement<br />

Interest rate derivatives (3) Effective cash flow hedge Fair value through other<br />

comprehensive income (loss)<br />

Equity forward derivatives (3)(4) Derivative financial instrument Fair value through earnings<br />

Equity forward derivatives (3)(4) Effective cash flow hedge Fair value through other<br />

comprehensive income (loss)<br />

(1) The carrying value <strong>of</strong> deposits is included in prepaid expenses and deposits in the consolidated balance sheets.<br />

(2) The carrying value <strong>of</strong> long-term receivables is included in other assets in the consolidated balance sheets.<br />

(3) The carrying values <strong>of</strong> the Company’s derivatives are included in other assets, accounts payable and accrued liabilities and long-term<br />

liabilities in the consolidated balance sheets.<br />

(4) The portion <strong>of</strong> the equity forward derivative agreements relating to the earned long-term incentive plan units is considered a<br />

derivative financial instrument. The portion <strong>of</strong> the equity forward derivative agreements relating to the unearned long-term incentive<br />

plan units and unearned restricted share unit plan units is considered an effective cash flow hedge. The unhedged portion <strong>of</strong> the<br />

equity forward derivates is measured at fair value and recorded in accounts payable and accrued liabilities on the consolidated<br />

balance sheets. See Note 15 to the Company’s 2010 annual financial statements reported under Canadian GAAP and Note 11 to<br />

these consolidated financial statements for further discussion <strong>of</strong> the long-term incentive plan and the restricted share unit plan.<br />

30