Financial Statements of - Shoppers Drug Mart

Financial Statements of - Shoppers Drug Mart

Financial Statements of - Shoppers Drug Mart

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SHOPPERS DRUG MART CORPORATION<br />

Notes to the Consolidated <strong>Financial</strong> <strong>Statements</strong><br />

(unaudited)<br />

(in thousands <strong>of</strong> Canadian dollars, except per share data)<br />

13. EXPLANATION OF TRANSITION TO IFRS (continued)<br />

ii) Sale-leaseback Transactions<br />

Under previous GAAP, the Company had deferred gains on sale-leaseback transactions and was<br />

recognizing the gains in earnings over the lease term. Any losses were recognized in earnings<br />

immediately. Under IFRS, when sale-leaseback transactions result in operating leases, gains or<br />

losses on sale-leaseback transactions that are considered to be conducted at fair value are<br />

recognized in earnings immediately. When sale-leaseback transactions result in financing leases<br />

or if the gains or losses on sale-leaseback transactions arise on transactions that are not<br />

considered to have been transacted at fair value, the gains are deferred and recognized over the<br />

shorter <strong>of</strong> the lease term and the estimated useful life <strong>of</strong> the leased asset, while losses are<br />

recognized in earnings immediately.<br />

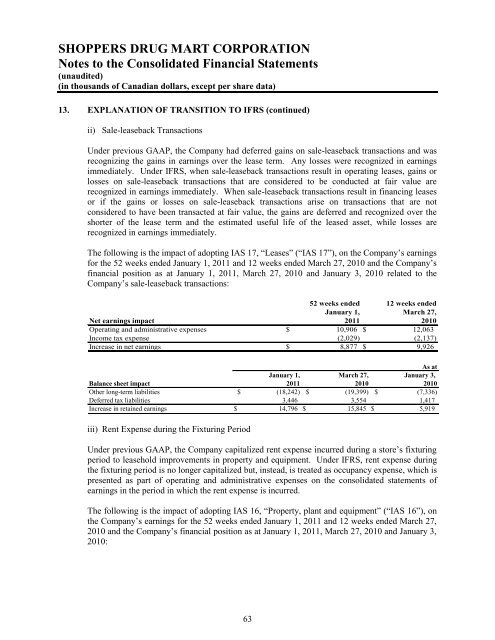

The following is the impact <strong>of</strong> adopting IAS 17, “Leases” (“IAS 17”), on the Company’s earnings<br />

for the 52 weeks ended January 1, 2011 and 12 weeks ended March 27, 2010 and the Company’s<br />

financial position as at January 1, 2011, March 27, 2010 and January 3, 2010 related to the<br />

Company’s sale-leaseback transactions:<br />

52 weeks ended<br />

January 1,<br />

12 weeks ended<br />

March 27,<br />

Net earnings impact<br />

Operating and administrative expenses $<br />

2011<br />

10,906 $<br />

2010<br />

12,063<br />

Income tax expense (2,029) (2,137)<br />

Increase in net earnings $ 8,877 $ 9,926<br />

As at<br />

Balance sheet impact<br />

Other long-term liabilities $<br />

January 1,<br />

2011<br />

(18,242) $<br />

March 27,<br />

2010<br />

(19,399) $<br />

January 3,<br />

2010<br />

(7,336)<br />

Deferred tax liabilities 3,446 3,554 1,417<br />

Increase in retained earnings $ 14,796 $ 15,845 $ 5,919<br />

iii) Rent Expense during the Fixturing Period<br />

Under previous GAAP, the Company capitalized rent expense incurred during a store’s fixturing<br />

period to leasehold improvements in property and equipment. Under IFRS, rent expense during<br />

the fixturing period is no longer capitalized but, instead, is treated as occupancy expense, which is<br />

presented as part <strong>of</strong> operating and administrative expenses on the consolidated statements <strong>of</strong><br />

earnings in the period in which the rent expense is incurred.<br />

The following is the impact <strong>of</strong> adopting IAS 16, “Property, plant and equipment” (“IAS 16”), on<br />

the Company’s earnings for the 52 weeks ended January 1, 2011 and 12 weeks ended March 27,<br />

2010 and the Company’s financial position as at January 1, 2011, March 27, 2010 and January 3,<br />

2010:<br />

63