Financial Statements of - Shoppers Drug Mart

Financial Statements of - Shoppers Drug Mart

Financial Statements of - Shoppers Drug Mart

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SHOPPERS DRUG MART CORPORATION<br />

Notes to the Consolidated <strong>Financial</strong> <strong>Statements</strong><br />

(unaudited)<br />

(in thousands <strong>of</strong> Canadian dollars, except per share data)<br />

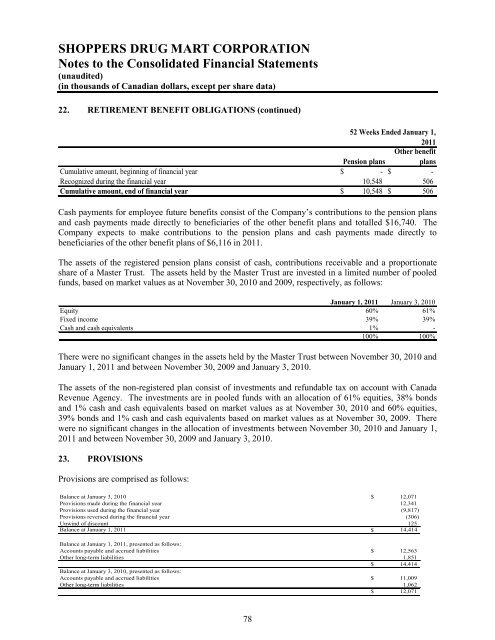

22. RETIREMENT BENEFIT OBLIGATIONS (continued)<br />

52 Weeks Ended January 1,<br />

2011<br />

Other benefit<br />

Pension plans plans<br />

Cumulative amount, beginning <strong>of</strong> financial year $ - $ -<br />

Recognized during the financial year 10,548 506<br />

Cumulative amount, end <strong>of</strong> financial year $ 10,548 $ 506<br />

Cash payments for employee future benefits consist <strong>of</strong> the Company’s contributions to the pension plans<br />

and cash payments made directly to beneficiaries <strong>of</strong> the other benefit plans and totalled $16,740. The<br />

Company expects to make contributions to the pension plans and cash payments made directly to<br />

beneficiaries <strong>of</strong> the other benefit plans <strong>of</strong> $6,116 in 2011.<br />

The assets <strong>of</strong> the registered pension plans consist <strong>of</strong> cash, contributions receivable and a proportionate<br />

share <strong>of</strong> a Master Trust. The assets held by the Master Trust are invested in a limited number <strong>of</strong> pooled<br />

funds, based on market values as at November 30, 2010 and 2009, respectively, as follows:<br />

January 1, 2011 January 3, 2010<br />

Equity 60% 61%<br />

Fixed income 39% 39%<br />

Cash and cash equivalents 1% -<br />

100% 100%<br />

There were no significant changes in the assets held by the Master Trust between November 30, 2010 and<br />

January 1, 2011 and between November 30, 2009 and January 3, 2010.<br />

The assets <strong>of</strong> the non-registered plan consist <strong>of</strong> investments and refundable tax on account with Canada<br />

Revenue Agency. The investments are in pooled funds with an allocation <strong>of</strong> 61% equities, 38% bonds<br />

and 1% cash and cash equivalents based on market values as at November 30, 2010 and 60% equities,<br />

39% bonds and 1% cash and cash equivalents based on market values as at November 30, 2009. There<br />

were no significant changes in the allocation <strong>of</strong> investments between November 30, 2010 and January 1,<br />

2011 and between November 30, 2009 and January 3, 2010.<br />

23. PROVISIONS<br />

Provisions are comprised as follows:<br />

Balance at January 3, 2010 $ 12,071<br />

Provisions made during the financial year 12,341<br />

Provisions used during the financial year (9,817)<br />

Provisions reversed during the financial year (306)<br />

Unwind <strong>of</strong> discount 125<br />

Balance at January 1, 2011 $ 14,414<br />

Balance at January 1, 2011, presented as follows:<br />

Accounts payable and accrued liabilities $ 12,563<br />

Other long-term liabilities 1,851<br />

$ 14,414<br />

Balance at January 3, 2010, presented as follows:<br />

Accounts payable and accrued liabilities $ 11,009<br />

Other long-term liabilities 1,062<br />

$ 12,071<br />

78