Financial Statements of - Shoppers Drug Mart

Financial Statements of - Shoppers Drug Mart

Financial Statements of - Shoppers Drug Mart

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SHOPPERS DRUG MART CORPORATION<br />

Notes to the Consolidated <strong>Financial</strong> <strong>Statements</strong><br />

(unaudited)<br />

(in thousands <strong>of</strong> Canadian dollars, except per share data)<br />

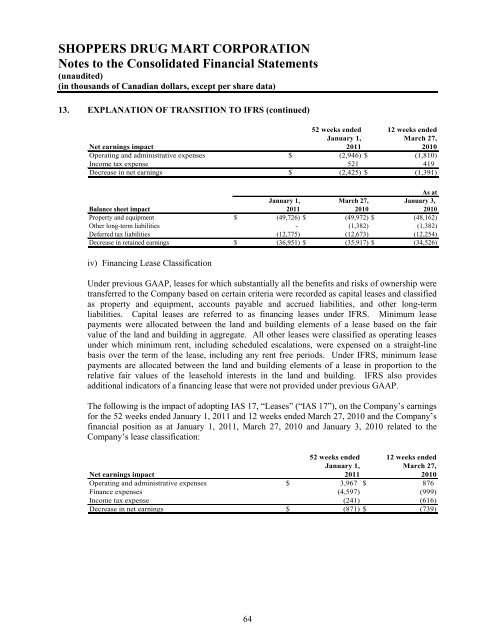

13. EXPLANATION OF TRANSITION TO IFRS (continued)<br />

Net earnings impact<br />

Operating and administrative expenses $<br />

52 weeks ended<br />

January 1,<br />

2011<br />

(2,946) $<br />

12 weeks ended<br />

March 27,<br />

2010<br />

(1,810)<br />

Income tax expense 521 419<br />

Decrease in net earnings $ (2,425) $ (1,391)<br />

As at<br />

Balance sheet impact<br />

Property and equipment $<br />

January 1,<br />

2011<br />

(49,726) $<br />

March 27,<br />

2010<br />

(49,972) $<br />

January 3,<br />

2010<br />

(48,162)<br />

Other long-term liabilities - (1,382) (1,382)<br />

Deferred tax liabilities (12,775) (12,673) (12,254)<br />

Decrease in retained earnings $ (36,951) $ (35,917) $ (34,526)<br />

iv) Financing Lease Classification<br />

Under previous GAAP, leases for which substantially all the benefits and risks <strong>of</strong> ownership were<br />

transferred to the Company based on certain criteria were recorded as capital leases and classified<br />

as property and equipment, accounts payable and accrued liabilities, and other long-term<br />

liabilities. Capital leases are referred to as financing leases under IFRS. Minimum lease<br />

payments were allocated between the land and building elements <strong>of</strong> a lease based on the fair<br />

value <strong>of</strong> the land and building in aggregate. All other leases were classified as operating leases<br />

under which minimum rent, including scheduled escalations, were expensed on a straight-line<br />

basis over the term <strong>of</strong> the lease, including any rent free periods. Under IFRS, minimum lease<br />

payments are allocated between the land and building elements <strong>of</strong> a lease in proportion to the<br />

relative fair values <strong>of</strong> the leasehold interests in the land and building. IFRS also provides<br />

additional indicators <strong>of</strong> a financing lease that were not provided under previous GAAP.<br />

The following is the impact <strong>of</strong> adopting IAS 17, “Leases” (“IAS 17”), on the Company’s earnings<br />

for the 52 weeks ended January 1, 2011 and 12 weeks ended March 27, 2010 and the Company’s<br />

financial position as at January 1, 2011, March 27, 2010 and January 3, 2010 related to the<br />

Company’s lease classification:<br />

Net earnings impact<br />

Operating and administrative expenses $<br />

52 weeks ended<br />

January 1,<br />

2011<br />

3,967 $<br />

12 weeks ended<br />

March 27,<br />

2010<br />

876<br />

Finance expenses (4,597) (999)<br />

Income tax expense (241) (616)<br />

Decrease in net earnings $ (871) $ (739)<br />

64