Financial Statements of - Shoppers Drug Mart

Financial Statements of - Shoppers Drug Mart

Financial Statements of - Shoppers Drug Mart

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SHOPPERS DRUG MART CORPORATION<br />

Notes to the Consolidated <strong>Financial</strong> <strong>Statements</strong><br />

(unaudited)<br />

(in thousands <strong>of</strong> Canadian dollars, except per share data)<br />

11. SHARE-BASED PAYMENTS (continued)<br />

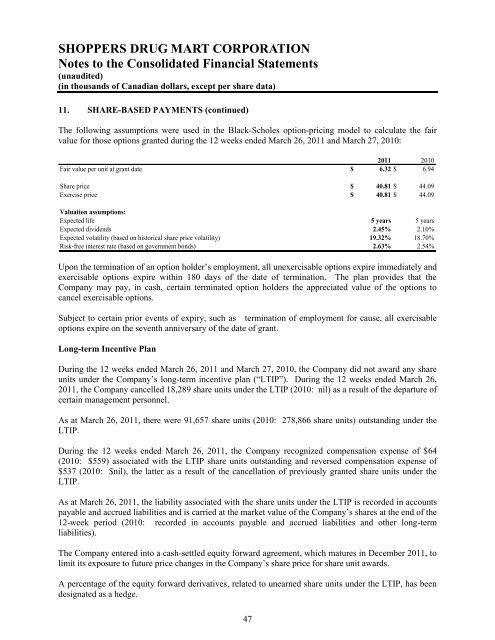

The following assumptions were used in the Black-Scholes option-pricing model to calculate the fair<br />

value for those options granted during the 12 weeks ended March 26, 2011 and March 27, 2010:<br />

2011 2010<br />

Fair value per unit at grant date $ 6.32 $ 6.94<br />

Share price $ 40.81 $ 44.09<br />

Exercise price $ 40.81 $ 44.09<br />

Valuation assumptions:<br />

Expected life 5 years 5 years<br />

Expected dividends 2.45% 2.10%<br />

Expected volatility (based on historical share price volatility) 19.32% 18.70%<br />

Risk-free interest rate (based on government bonds) 2.63% 2.54%<br />

Upon the termination <strong>of</strong> an option holder’s employment, all unexercisable options expire immediately and<br />

exercisable options expire within 180 days <strong>of</strong> the date <strong>of</strong> termination. The plan provides that the<br />

Company may pay, in cash, certain terminated option holders the appreciated value <strong>of</strong> the options to<br />

cancel exercisable options.<br />

Subject to certain prior events <strong>of</strong> expiry, such as termination <strong>of</strong> employment for cause, all exercisable<br />

options expire on the seventh anniversary <strong>of</strong> the date <strong>of</strong> grant.<br />

Long-term Incentive Plan<br />

During the 12 weeks ended March 26, 2011 and March 27, 2010, the Company did not award any share<br />

units under the Company’s long-term incentive plan (“LTIP”). During the 12 weeks ended March 26,<br />

2011, the Company cancelled 18,289 share units under the LTIP (2010: nil) as a result <strong>of</strong> the departure <strong>of</strong><br />

certain management personnel.<br />

As at March 26, 2011, there were 91,657 share units (2010: 278,866 share units) outstanding under the<br />

LTIP.<br />

During the 12 weeks ended March 26, 2011, the Company recognized compensation expense <strong>of</strong> $64<br />

(2010: $559) associated with the LTIP share units outstanding and reversed compensation expense <strong>of</strong><br />

$537 (2010: $nil), the latter as a result <strong>of</strong> the cancellation <strong>of</strong> previously granted share units under the<br />

LTIP.<br />

As at March 26, 2011, the liability associated with the share units under the LTIP is recorded in accounts<br />

payable and accrued liabilities and is carried at the market value <strong>of</strong> the Company’s shares at the end <strong>of</strong> the<br />

12-week period (2010: recorded in accounts payable and accrued liabilities and other long-term<br />

liabilities).<br />

The Company entered into a cash-settled equity forward agreement, which matures in December 2011, to<br />

limit its exposure to future price changes in the Company’s share price for share unit awards.<br />

A percentage <strong>of</strong> the equity forward derivatives, related to unearned share units under the LTIP, has been<br />

designated as a hedge.<br />

47