Financial Statements of - Shoppers Drug Mart

Financial Statements of - Shoppers Drug Mart

Financial Statements of - Shoppers Drug Mart

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

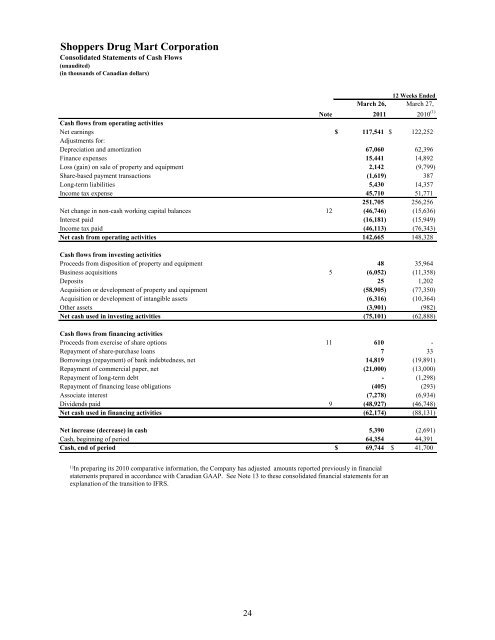

<strong>Shoppers</strong> <strong>Drug</strong> <strong>Mart</strong> Corporation<br />

Consolidated <strong>Statements</strong> <strong>of</strong> Cash Flows<br />

(unaudited)<br />

(in thousands <strong>of</strong> Canadian dollars)<br />

12 Weeks Ended<br />

March 26, March 27,<br />

Note<br />

2011 2010 (1)<br />

Cash flows from operating activities<br />

Net earnings $ 117,541 $ 122,252<br />

Adjustments for:<br />

Depreciation and amortization 67,060 62,396<br />

Finance expenses 15,441 14,892<br />

Loss (gain) on sale <strong>of</strong> property and equipment 2,142 (9,799)<br />

Share-based payment transactions (1,619) 387<br />

Long-term liabilities 5,430 14,357<br />

Income tax expense 45,710 51,771<br />

251,705 256,256<br />

Net change in non-cash working capital balances 12 (46,746) (15,636)<br />

Interest paid (16,181) (15,949)<br />

Income tax paid (46,113) (76,343)<br />

Net cash from operating activities 142,665 148,328<br />

Cash flows from investing activities<br />

Proceeds from disposition <strong>of</strong> property and equipment 48 35,964<br />

Business acquisitions 5 (6,052) (11,358)<br />

Deposits 25 1,202<br />

Acquisition or development <strong>of</strong> property and equipment (58,905) (77,350)<br />

Acquisition or development <strong>of</strong> intangible assets (6,316) (10,364)<br />

Other assets (3,901) (982)<br />

Net cash used in investing activities (75,101) (62,888)<br />

Cash flows from financing activities<br />

Proceeds from exercise <strong>of</strong> share options 11 610 -<br />

Repayment <strong>of</strong> share-purchase loans 7 33<br />

Borrowings (repayment) <strong>of</strong> bank indebtedness, net 14,819 (19,891)<br />

Repayment <strong>of</strong> commercial paper, net (21,000) (13,000)<br />

Repayment <strong>of</strong> long-term debt - (1,298)<br />

Repayment <strong>of</strong> financing lease obligations (405) (293)<br />

Associate interest (7,278) (6,934)<br />

Dividends paid 9 (48,927) (46,748)<br />

Net cash used in financing activities (62,174) (88,131)<br />

Net increase (decrease) in cash 5,390 (2,691)<br />

Cash, beginning <strong>of</strong> period 64,354 44,391<br />

Cash, end <strong>of</strong> period $ 69,744 $ 41,700<br />

1)<br />

In preparing its 2010 comparative information, the Company has adjusted amounts reported previously in financial<br />

statements prepared in accordance with Canadian GAAP. See Note 13 to these consolidated financial statements for an<br />

explanation <strong>of</strong> the transition to IFRS.<br />

24