Financial Statements of - Shoppers Drug Mart

Financial Statements of - Shoppers Drug Mart

Financial Statements of - Shoppers Drug Mart

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SHOPPERS DRUG MART CORPORATION<br />

Notes to the Consolidated <strong>Financial</strong> <strong>Statements</strong><br />

(unaudited)<br />

(in thousands <strong>of</strong> Canadian dollars, except per share data)<br />

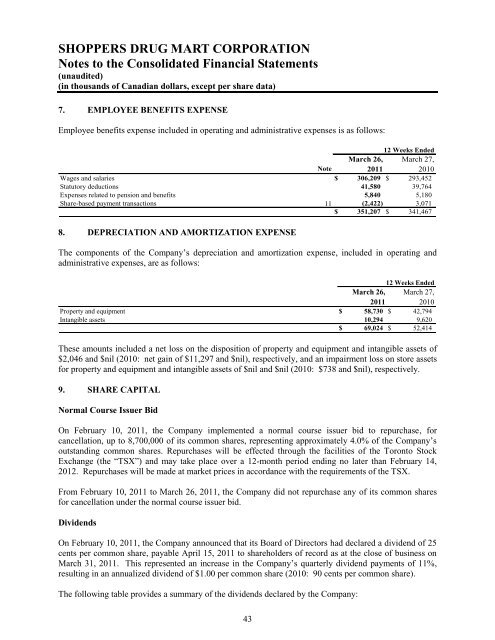

7. EMPLOYEE BENEFITS EXPENSE<br />

Employee benefits expense included in operating and administrative expenses is as follows:<br />

12 Weeks Ended<br />

Note<br />

March 26,<br />

2011<br />

March 27,<br />

2010<br />

Wages and salaries $ 306,209 $ 293,452<br />

Statutory deductions 41,580 39,764<br />

Expenses related to pension and benefits 5,840 5,180<br />

Share-based payment transactions 11 (2,422) 3,071<br />

$ 351,207 $ 341,467<br />

8. DEPRECIATION AND AMORTIZATION EXPENSE<br />

The components <strong>of</strong> the Company’s depreciation and amortization expense, included in operating and<br />

administrative expenses, are as follows:<br />

12 Weeks Ended<br />

March 26,<br />

2011<br />

March 27,<br />

2010<br />

Property and equipment $ 58,730 $ 42,794<br />

Intangible assets 10,294 9,620<br />

$ 69,024 $ 52,414<br />

These amounts included a net loss on the disposition <strong>of</strong> property and equipment and intangible assets <strong>of</strong><br />

$2,046 and $nil (2010: net gain <strong>of</strong> $11,297 and $nil), respectively, and an impairment loss on store assets<br />

for property and equipment and intangible assets <strong>of</strong> $nil and $nil (2010: $738 and $nil), respectively.<br />

9. SHARE CAPITAL<br />

Normal Course Issuer Bid<br />

On February 10, 2011, the Company implemented a normal course issuer bid to repurchase, for<br />

cancellation, up to 8,700,000 <strong>of</strong> its common shares, representing approximately 4.0% <strong>of</strong> the Company’s<br />

outstanding common shares. Repurchases will be effected through the facilities <strong>of</strong> the Toronto Stock<br />

Exchange (the “TSX”) and may take place over a 12-month period ending no later than February 14,<br />

2012. Repurchases will be made at market prices in accordance with the requirements <strong>of</strong> the TSX.<br />

From February 10, 2011 to March 26, 2011, the Company did not repurchase any <strong>of</strong> its common shares<br />

for cancellation under the normal course issuer bid.<br />

Dividends<br />

On February 10, 2011, the Company announced that its Board <strong>of</strong> Directors had declared a dividend <strong>of</strong> 25<br />

cents per common share, payable April 15, 2011 to shareholders <strong>of</strong> record as at the close <strong>of</strong> business on<br />

March 31, 2011. This represented an increase in the Company’s quarterly dividend payments <strong>of</strong> 11%,<br />

resulting in an annualized dividend <strong>of</strong> $1.00 per common share (2010: 90 cents per common share).<br />

The following table provides a summary <strong>of</strong> the dividends declared by the Company:<br />

43