2011 Annual Report - TOM Group

2011 Annual Report - TOM Group

2011 Annual Report - TOM Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

106<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

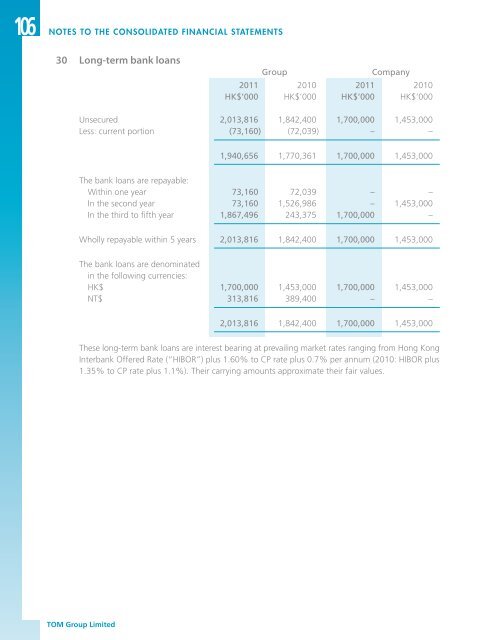

30 Long-term bank loans<br />

<strong>Group</strong><br />

Company<br />

<strong>2011</strong> 2010 <strong>2011</strong> 2010<br />

HK$’000 HK$’000 HK$’000 HK$’000<br />

Unsecured 2,013,816 1,842,400 1,700,000 1,453,000<br />

Less: current portion (73,160) (72,039) – –<br />

1,940,656 1,770,361 1,700,000 1,453,000<br />

The bank loans are repayable:<br />

Within one year 73,160 72,039 – –<br />

In the second year 73,160 1,526,986 – 1,453,000<br />

In the third to fifth year 1,867,496 243,375 1,700,000 –<br />

Wholly repayable within 5 years 2,013,816 1,842,400 1,700,000 1,453,000<br />

The bank loans are denominated<br />

in the following currencies:<br />

HK$ 1,700,000 1,453,000 1,700,000 1,453,000<br />

NT$ 313,816 389,400 – –<br />

2,013,816 1,842,400 1,700,000 1,453,000<br />

These long-term bank loans are interest bearing at prevailing market rates ranging from Hong Kong<br />

Interbank Offered Rate (“HIBOR”) plus 1.60% to CP rate plus 0.7% per annum (2010: HIBOR plus<br />

1.35% to CP rate plus 1.1%). Their carrying amounts approximate their fair values.<br />

<strong>TOM</strong> <strong>Group</strong> Limited