2011 Annual Report - TOM Group

2011 Annual Report - TOM Group

2011 Annual Report - TOM Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

72<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

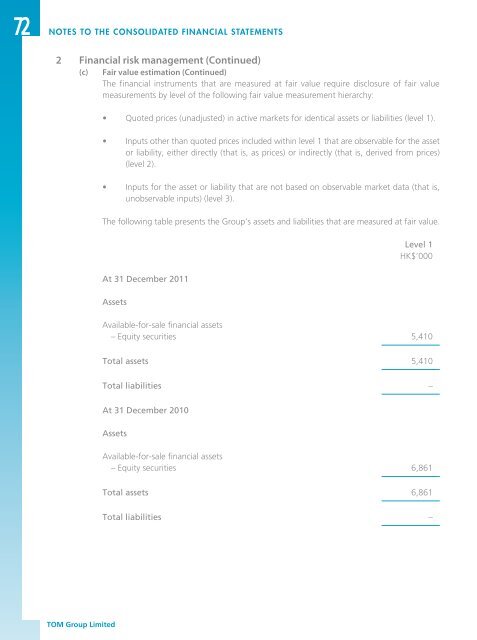

2 Financial risk management (Continued)<br />

(c)<br />

Fair value estimation (Continued)<br />

The financial instruments that are measured at fair value require disclosure of fair value<br />

measurements by level of the following fair value measurement hierarchy:<br />

• Quoted prices (unadjusted) in active markets for identical assets or liabilities (level 1).<br />

• Inputs other than quoted prices included within level 1 that are observable for the asset<br />

or liability, either directly (that is, as prices) or indirectly (that is, derived from prices)<br />

(level 2).<br />

• Inputs for the asset or liability that are not based on observable market data (that is,<br />

unobservable inputs) (level 3).<br />

The following table presents the <strong>Group</strong>’s assets and liabilities that are measured at fair value.<br />

At 31 December <strong>2011</strong><br />

Assets<br />

Level 1<br />

HK$’000<br />

Available-for-sale financial assets<br />

– Equity securities 5,410<br />

Total assets 5,410<br />

Total liabilities –<br />

At 31 December 2010<br />

Assets<br />

Available-for-sale financial assets<br />

– Equity securities 6,861<br />

Total assets 6,861<br />

Total liabilities –<br />

<strong>TOM</strong> <strong>Group</strong> Limited