2011 Annual Report - TOM Group

2011 Annual Report - TOM Group

2011 Annual Report - TOM Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

1 Principal accounting policies (Continued)<br />

(f)<br />

Financial assets (Continued)<br />

Interest on available-for-sale financial assets calculated using the effective interest method<br />

is recognised in the consolidated income statement. Dividends on available-for-sale equity<br />

investments are recognised in the consolidated income statement as part of other income<br />

when the <strong>Group</strong>’s right to receive payments is established.<br />

The fair value of quoted investments is based on current bid prices. If the market for a<br />

financial asset is not active (and for unlisted securities), the <strong>Group</strong> establishes fair value<br />

by using valuation techniques. These include the use of recent arm’s length transactions,<br />

reference to other instruments that are substantially the same, or discounted cash<br />

flow analysis refined to reflect the issuer’s specific circumstances. Investments in equity<br />

instruments that do not have a quoted market price in an active market and those fair value<br />

cannot be reliably measured, are measured at cost less impairment.<br />

Financial assets and liabilities are offset and the net amount reported in the statement of<br />

financial position when there is a legally enforceable right to offset the recognised amounts<br />

and there is an intention to settle on a net basis or realise the asset and settle the liability<br />

simultaneously.<br />

The <strong>Group</strong> assesses at the end of each reporting period whether there is objective evidence<br />

that a financial asset or a group of financial assets is impaired. In the case of equity securities<br />

classified as available-for-sale, a significant or prolonged decline in the fair value of the<br />

security below its cost is considered as an indicator that the securities are impaired. If any<br />

such evidence exists for available-for-sale financial assets, the cumulative loss – measured as<br />

the difference between the acquisition cost and the current fair value, less any impairment<br />

loss on that financial asset previously recognised in profit and loss – is removed from equity<br />

and recognised in the consolidated income statement. Impairment losses recognised in<br />

the consolidated income statement on equity instruments are not reversed through the<br />

consolidated income statement. Impairment testing of trade receivables is described in<br />

note 1(l).<br />

(g)<br />

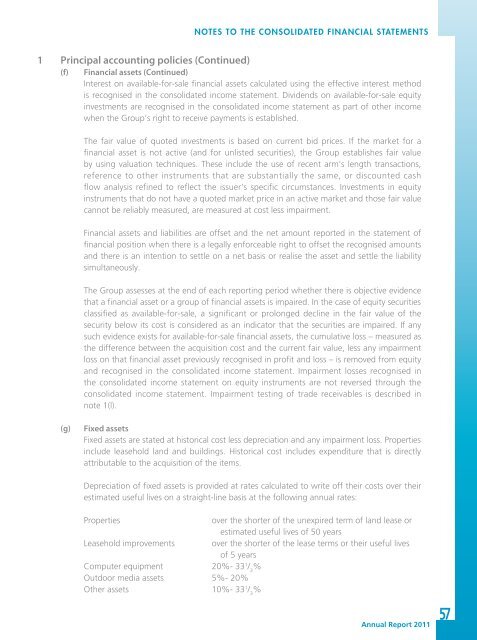

Fixed assets<br />

Fixed assets are stated at historical cost less depreciation and any impairment loss. Properties<br />

include leasehold land and buildings. Historical cost includes expenditure that is directly<br />

attributable to the acquisition of the items.<br />

Depreciation of fixed assets is provided at rates calculated to write off their costs over their<br />

estimated useful lives on a straight-line basis at the following annual rates:<br />

Properties<br />

over the shorter of the unexpired term of land lease or<br />

estimated useful lives of 50 years<br />

Leasehold improvements over the shorter of the lease terms or their useful lives<br />

of 5 years<br />

Computer equipment 20%- 33 1 / 3<br />

%<br />

Outdoor media assets 5%- 20%<br />

Other assets 10%- 33 1 / 3<br />

%<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2011</strong><br />

57