DIGITAL MARKETING HUB v2.0 - AdExchanger

DIGITAL MARKETING HUB v2.0 - AdExchanger

DIGITAL MARKETING HUB v2.0 - AdExchanger

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Digital Marketing Hub <strong>v2.0</strong><br />

BMO Capital Markets<br />

data assets are primed for leverage as the marketing world shifts to an IP worldview. Social<br />

TV is also helping support the medium as the television screen remains the center-point of a<br />

critical marketing environment, the living room, and marketers are finding ways to help viewers<br />

interact via social platforms (e.g., dancing and singing contest shows have introduced realtime<br />

voting to TV), which helps buttress TV advertising budgets.<br />

…And Who Has Challenges?<br />

Yahoo!<br />

Although there is more clarity on board/management turmoil and Asian asset monetization,<br />

Yahoo! still faces considerable challenges in its core IP advertising franchises. The<br />

search agreement with Microsoft has not yet yielded the expected return. Worse yet, prior<br />

management’s focus on this part of the business in the 2007-2009 time period likely played a<br />

role in Yahoo! losing its edge in display advertising. Unlike Google, which acquired YouTube<br />

in 2007, Yahoo! missed the opportunity to create or buy into a large social media play. And<br />

after decisively leading the display advertising business toward exchanges and RTB with the<br />

acquisition of Right Media in 2007, the asset has languished as key employees left and innovation<br />

slowed. The company’s recent focus on leveraging Yahoo!’s still massive audience<br />

data sets was a clear positive, in our view. The launch of Yahoo! Genome – a new audiencebuying<br />

solution, integrating much of the technology acquired from interclick – is a strong first<br />

step in this direction, but until management is settled, it’s difficult to judge if the product will<br />

flourish or languish.<br />

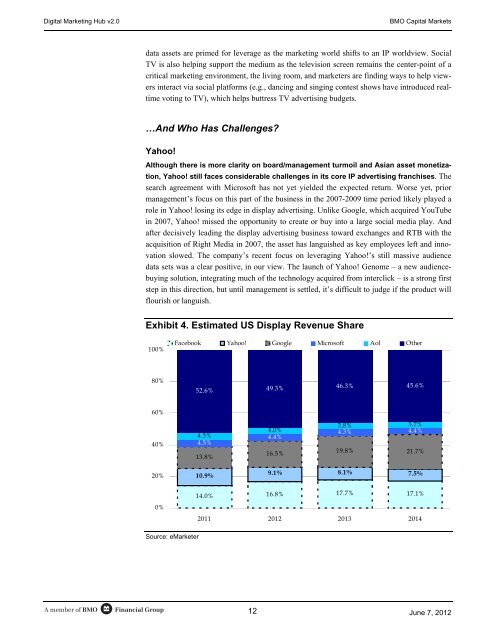

Exhibit 4. Estimated US Display Revenue Share<br />

100%<br />

Facebook Yahoo! Google Microsoft Aol Other<br />

80%<br />

52.6% 49.3% 46.3% 45.6%<br />

60%<br />

40%<br />

4.3%<br />

4.5%<br />

13.8%<br />

4.0%<br />

4.4%<br />

16.5%<br />

3.8% 3.7%<br />

4.3% 4.4%<br />

19.8% 21.7%<br />

20%<br />

10.9%<br />

9.1% 8.1% 7.5%<br />

0%<br />

14.0% 16.8% 17.7% 17.1%<br />

2011 2012 2013 2014<br />

Source: eMarketer<br />

A member of BMO<br />

Financial Group<br />

12<br />

June 7, 2012