DIGITAL MARKETING HUB v2.0 - AdExchanger

DIGITAL MARKETING HUB v2.0 - AdExchanger

DIGITAL MARKETING HUB v2.0 - AdExchanger

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Digital Marketing Hub <strong>v2.0</strong><br />

BMO Capital Markets<br />

What Are the Best Positioned Stocks for the IP Marketing World…<br />

Google<br />

Google offers YouTube’s video ad inventory – where branding dollars are increasingly<br />

headed -- and a dominant display technology stack. While Google is not the leader in the<br />

sale of display ads on proprietary media/products and DoubleClick and other “ad tech” services<br />

are not in and of themselves major revenue drivers, we believe their value to Google is<br />

underappreciated by investors. Estimates vary, but DoubleClick probably serves around half<br />

of the web’s non-Facebook display ads; and on June 5, the company unveiled a more unified<br />

technology suite called simply DoubleClick Digital Marketing. Having a dominant franchise<br />

in other areas of the media value chain has always mattered in advertising (see TV below) and<br />

in our opinion, they are only becoming more valuable because of the data they generate. DoubleClick’s<br />

unparalleled reach gives Google another dominant dataset to go alongside its flow<br />

of search keywords (from both PCs and mobile) and the still growing usership of YouTube.<br />

Moreover, Google has executed the strongest acquisition strategy of any major IP Marketing<br />

company and the latest one – sell-side platform AdMeld – comes as ad tech innovation<br />

swings to the publisher side, and away from the buy-side. From buying platforms like Invite<br />

Media and AdWords through marketplaces like DoubleClick Ad Exchange that blur into<br />

nominally sell-side products like AdMeld, AdMob, and AdSense, Google has defined the<br />

value chain with its end-to-end system. When fortified with products like Google Analytics<br />

(and the original acquisition, Urchin) and internally built Google TV Ads, we believe Google<br />

has unparalleled IP marketing assets.<br />

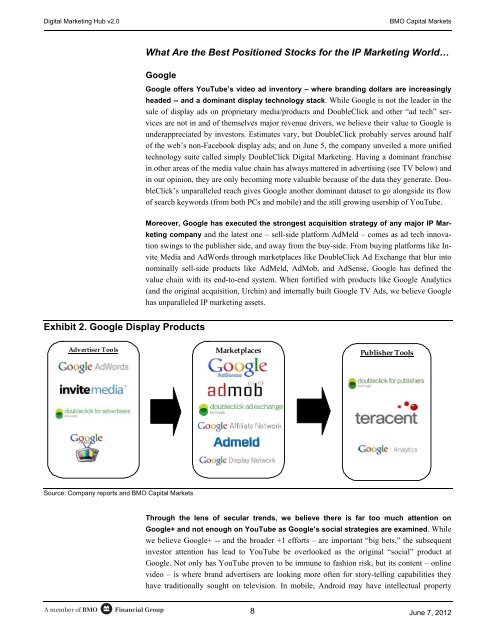

Exhibit 2. Google Display Products<br />

Advertiser Tools<br />

Marketplaces<br />

Publisher Tools<br />

Source: Company reports and BMO Capital Markets<br />

Through the lens of secular trends, we believe there is far too much attention on<br />

Google+ and not enough on YouTube as Google’s social strategies are examined. While<br />

we believe Google+ -- and the broader +1 efforts – are important “big bets,” the subsequent<br />

investor attention has lead to YouTube be overlooked as the original “social” product at<br />

Google. Not only has YouTube proven to be immune to fashion risk, but its content – online<br />

video – is where brand advertisers are looking more often for story-telling capabilities they<br />

have traditionally sought on television. In mobile, Android may have intellectual property<br />

A member of BMO<br />

Financial Group<br />

8<br />

June 7, 2012