Assessment Practices Review Panel - St. Louis County

Assessment Practices Review Panel - St. Louis County

Assessment Practices Review Panel - St. Louis County

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Minnesota statute to physically visit each property at least once every five years. New<br />

construction or demolition which requires a permit triggers an automatic review each<br />

year. As part of the assessment the assessor looks for the quality of the construction;<br />

condition of the property; building materials; and characteristics of amenities (land and<br />

structures). Measurements and photos are taken for documentation.<br />

Mass Appraisal and Equalization<br />

Mass appraisal is the process of valuing a group of properties within a jurisdiction as of a<br />

specific date. Each year the DoR and the county assessor review sales ratio studies for a<br />

group of properties within a jurisdiction and apply any necessary valuation changes in a<br />

uniform manner to bring the jurisdiction into <strong>St</strong>ate compliance.<br />

Types of Values<br />

The Minnesota property tax system requires the assessor to determine an estimated<br />

market value for each taxable parcel on January 2nd of each year. This value may be<br />

adjusted for the purpose of calculating tax capacity, thus resulting in two definitions of<br />

market value:<br />

- Estimated Market Value (EMV): Is the value determined by the assessor as the price<br />

the property would likely sell for on the open market.<br />

- Taxable Market Value (TMV): Is the amount of value that is actually used in<br />

calculating property taxes. This can differ from EMV due to special property tax<br />

programs the property may be involved in.<br />

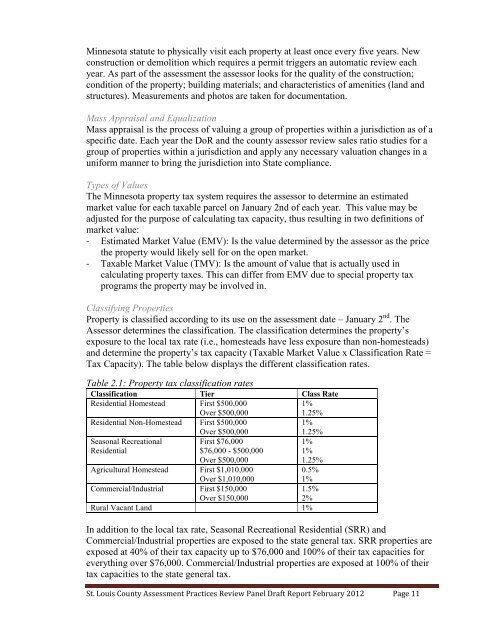

Classifying Properties<br />

Property is classified according to its use on the assessment date – January 2 nd . The<br />

Assessor determines the classification. The classification determines the property’s<br />

exposure to the local tax rate (i.e., homesteads have less exposure than non-homesteads)<br />

and determine the property’s tax capacity (Taxable Market Value x Classification Rate =<br />

Tax Capacity). The table below displays the different classification rates.<br />

Table 2.1: Property tax classification rates<br />

Classification Tier Class Rate<br />

Residential Homestead First $500,000<br />

Over $500,000<br />

1%<br />

1.25%<br />

Residential Non-Homestead First $500,000<br />

Over $500,000<br />

1%<br />

1.25%<br />

Seasonal Recreational<br />

Residential<br />

First $76,000<br />

$76,000 - $500,000<br />

Over $500,000<br />

1%<br />

1%<br />

1.25%<br />

Agricultural Homestead First $1,010,000<br />

0.5%<br />

Over $1,010,000<br />

1%<br />

Commercial/Industrial First $150,000<br />

Over $150,000<br />

Rural Vacant Land 1%<br />

1.5%<br />

2%<br />

In addition to the local tax rate, Seasonal Recreational Residential (SRR) and<br />

Commercial/Industrial properties are exposed to the state general tax. SRR properties are<br />

exposed at 40% of their tax capacity up to $76,000 and 100% of their tax capacities for<br />

everything over $76,000. Commercial/Industrial properties are exposed at 100% of their<br />

tax capacities to the state general tax.<br />

<strong>St</strong>. <strong>Louis</strong> <strong>County</strong> <strong>Assessment</strong> <strong>Practices</strong> <strong>Review</strong> <strong>Panel</strong> Draft Report February 2012 Page 11