2005 - Asianbanks.net

2005 - Asianbanks.net

2005 - Asianbanks.net

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

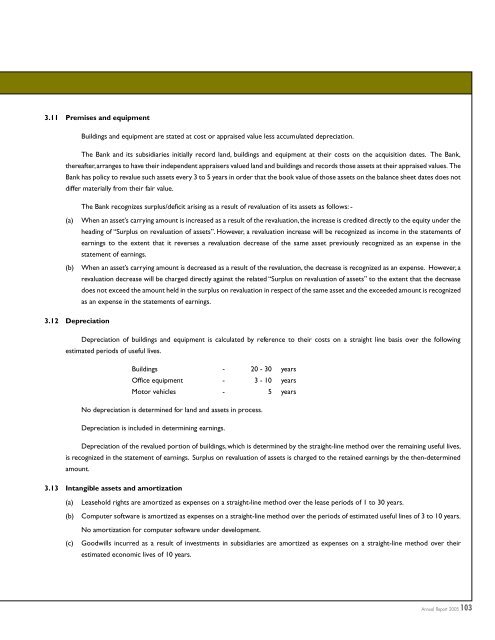

3.11 Premises and equipment<br />

Buildings and equipment are stated at cost or appraised value less accumulated depreciation.<br />

The Bank and its subsidiaries initially record land, buildings and equipment at their costs on the acquisition dates. The Bank,<br />

thereafter, arranges to have their independent appraisers valued land and buildings and records those assets at their appraised values. The<br />

Bank has policy to revalue such assets every 3 to 5 years in order that the book value of those assets on the balance sheet dates does not<br />

differ materially from their fair value.<br />

The Bank recognizes surplus/deficit arising as a result of revaluation of its assets as follows: -<br />

(a)<br />

(b)<br />

When an asset’s carrying amount is increased as a result of the revaluation, the increase is credited directly to the equity under the<br />

heading of “Surplus on revaluation of assets”. However, a revaluation increase will be recognized as income in the statements of<br />

earnings to the extent that it reverses a revaluation decrease of the same asset previously recognized as an expense in the<br />

statement of earnings.<br />

When an asset’s carrying amount is decreased as a result of the revaluation, the decrease is recognized as an expense. However, a<br />

revaluation decrease will be charged directly against the related “Surplus on revaluation of assets” to the extent that the decrease<br />

does not exceed the amount held in the surplus on revaluation in respect of the same asset and the exceeded amount is recognized<br />

as an expense in the statements of earnings.<br />

3.12 Depreciation<br />

Depreciation of buildings and equipment is calculated by reference to their costs on a straight line basis over the following<br />

estimated periods of useful lives.<br />

Buildings - 20 - 30 years<br />

Office equipment - 3 - 10 years<br />

Motor vehicles - 5 years<br />

No depreciation is determined for land and assets in process.<br />

Depreciation is included in determining earnings.<br />

Depreciation of the revalued portion of buildings, which is determined by the straight-line method over the remaining useful lives,<br />

is recognized in the statement of earnings. Surplus on revaluation of assets is charged to the retained earnings by the then-determined<br />

amount.<br />

3.13 Intangible assets and amortization<br />

(a)<br />

(b)<br />

(c)<br />

Leasehold rights are amortized as expenses on a straight-line method over the lease periods of 1 to 30 years.<br />

Computer software is amortized as expenses on a straight-line method over the periods of estimated useful lines of 3 to 10 years.<br />

No amortization for computer software under development.<br />

Goodwills incurred as a result of investments in subsidiaries are amortized as expenses on a straight-line method over their<br />

estimated economic lives of 10 years.<br />

103