2005 - Asianbanks.net

2005 - Asianbanks.net

2005 - Asianbanks.net

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

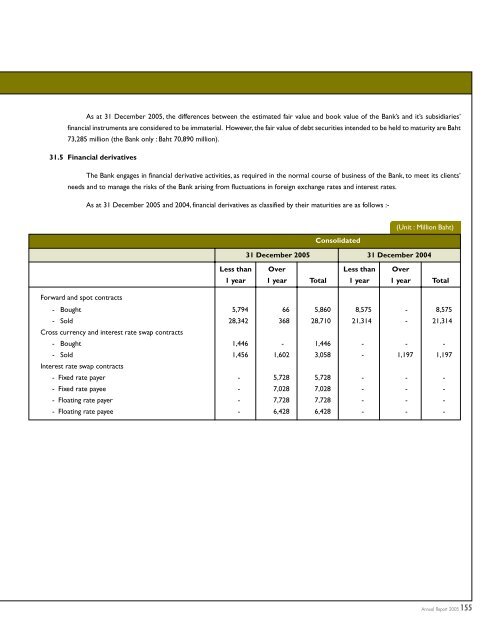

As at 31 December <strong>2005</strong>, the differences between the estimated fair value and book value of the Bank’s and it’s subsidiaries’<br />

financial instruments are considered to be immaterial. However, the fair value of debt securities intended to be held to maturity are Baht<br />

73,285 million (the Bank only : Baht 70,890 million).<br />

31.5 Financial derivatives<br />

The Bank engages in financial derivative activities, as required in the normal course of business of the Bank, to meet its clients’<br />

needs and to manage the risks of the Bank arising from fluctuations in foreign exchange rates and interest rates.<br />

As at 31 December <strong>2005</strong> and 2004, financial derivatives as classified by their maturities are as follows :-<br />

(Unit : Million Baht)<br />

Consolidated<br />

31 December <strong>2005</strong> 31 December 2004<br />

Less than Over Less than Over<br />

1 year 1 year Total 1 year 1 year Total<br />

Forward and spot contracts<br />

- Bought 5,794 66 5,860 8,575 - 8,575<br />

- Sold 28,342 368 28,710 21,314 - 21,314<br />

Cross currency and interest rate swap contracts<br />

- Bought 1,446 - 1,446 - - -<br />

- Sold 1,456 1,602 3,058 - 1,197 1,197<br />

Interest rate swap contracts<br />

- Fixed rate payer - 5,728 5,728 - - -<br />

- Fixed rate payee - 7,028 7,028 - - -<br />

- Floating rate payer - 7,728 7,728 - - -<br />

- Floating rate payee - 6,428 6,428 - - -<br />

155