2005 - Asianbanks.net

2005 - Asianbanks.net

2005 - Asianbanks.net

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Credit Review Department is responsible for reviewing credit quality to ensure that all loans have already been processed in accordance with<br />

the procedures established within the Bank, which include those for reviewing the correctness of loan classification, procedures for dealing<br />

with troubled debtors, and evaluating systems for monitoring borrowers in term of qualitative criteria after credit has been granted.<br />

The Bank has a policy to grant credit to all business types and industries which have potential and make significant contributions to the<br />

country’s economic growth. Furthermore, the Bank also focuses on the provision of credit to small and retail enterprises in order to diversify<br />

risk. In addition, the Bank puts emphasis on risk management both before and after credit is approved. For example, credit officers are<br />

required to check the credit information of customers with the Credit Bureau before submitting a credit application for approval of lending to<br />

new borrowers or to increase a credit limit to an existing borrower.<br />

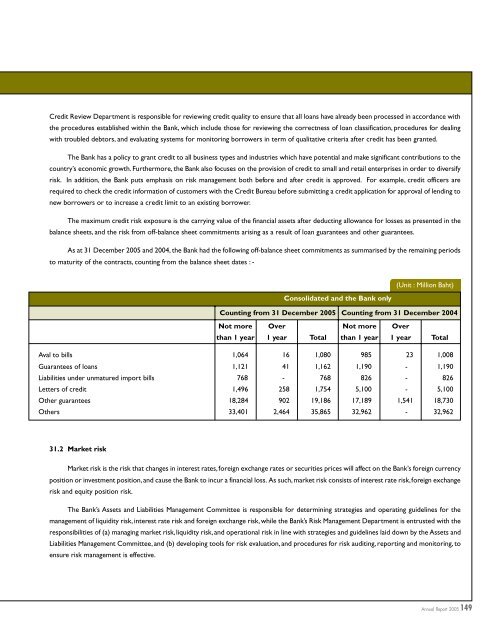

The maximum credit risk exposure is the carrying value of the financial assets after deducting allowance for losses as presented in the<br />

balance sheets, and the risk from off-balance sheet commitments arising as a result of loan guarantees and other guarantees.<br />

As at 31 December <strong>2005</strong> and 2004, the Bank had the following off-balance sheet commitments as summarised by the remaining periods<br />

to maturity of the contracts, counting from the balance sheet dates : -<br />

(Unit : Million Baht)<br />

Consolidated and the Bank only<br />

Counting from 31 December <strong>2005</strong> Counting from 31 December 2004<br />

Not more Over Not more Over<br />

than 1 year 1 year Total than 1 year 1 year Total<br />

Aval to bills 1,064 16 1,080 985 23 1,008<br />

Guarantees of loans 1,121 41 1,162 1,190 - 1,190<br />

Liabilities under unmatured import bills 768 - 768 826 - 826<br />

Letters of credit 1,496 258 1,754 5,100 - 5,100<br />

Other guarantees 18,284 902 19,186 17,189 1,541 18,730<br />

Others 33,401 2,464 35,865 32,962 - 32,962<br />

31.2 Market risk<br />

Market risk is the risk that changes in interest rates, foreign exchange rates or securities prices will affect on the Bank’s foreign currency<br />

position or investment position, and cause the Bank to incur a financial loss. As such, market risk consists of interest rate risk, foreign exchange<br />

risk and equity position risk.<br />

The Bank’s Assets and Liabilities Management Committee is responsible for determining strategies and operating guidelines for the<br />

management of liquidity risk, interest rate risk and foreign exchange risk, while the Bank’s Risk Management Department is entrusted with the<br />

responsibilities of (a) managing market risk, liquidity risk, and operational risk in line with strategies and guidelines laid down by the Assets and<br />

Liabilities Management Committee, and (b) developing tools for risk evaluation, and procedures for risk auditing, reporting and monitoring, to<br />

ensure risk management is effective.<br />

149