2005 - Asianbanks.net

2005 - Asianbanks.net

2005 - Asianbanks.net

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

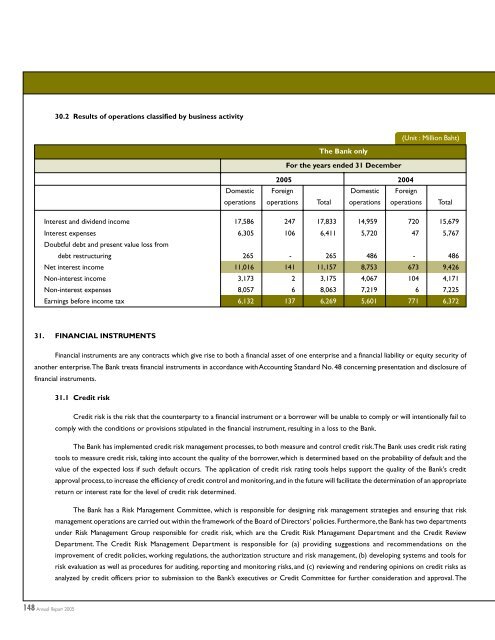

30.2 Results of operations classified by business activity<br />

(Unit : Million Baht)<br />

The Bank only<br />

For the years ended 31 December<br />

<strong>2005</strong> 2004<br />

Domestic Foreign Domestic Foreign<br />

operations operations Total operations operations Total<br />

Interest and dividend income 17,586 247 17,833 14,959 720 15,679<br />

Interest expenses 6,305 106 6,411 5,720 47 5,767<br />

Doubtful debt and present value loss from<br />

debt restructuring 265 - 265 486 - 486<br />

Net interest income 11,016 141 11,157 8,753 673 9,426<br />

Non-interest income 3,173 2 3,175 4,067 104 4,171<br />

Non-interest expenses 8,057 6 8,063 7,219 6 7,225<br />

Earnings before income tax 6,132 137 6,269 5,601 771 6,372<br />

31. FINANCIAL INSTRUMENTS<br />

Financial instruments are any contracts which give rise to both a financial asset of one enterprise and a financial liability or equity security of<br />

another enterprise. The Bank treats financial instruments in accordance with Accounting Standard No. 48 concerning presentation and disclosure of<br />

financial instruments.<br />

31.1 Credit risk<br />

Credit risk is the risk that the counterparty to a financial instrument or a borrower will be unable to comply or will intentionally fail to<br />

comply with the conditions or provisions stipulated in the financial instrument, resulting in a loss to the Bank.<br />

The Bank has implemented credit risk management processes, to both measure and control credit risk. The Bank uses credit risk rating<br />

tools to measure credit risk, taking into account the quality of the borrower, which is determined based on the probability of default and the<br />

value of the expected loss if such default occurs. The application of credit risk rating tools helps support the quality of the Bank’s credit<br />

approval process, to increase the efficiency of credit control and monitoring, and in the future will facilitate the determination of an appropriate<br />

return or interest rate for the level of credit risk determined.<br />

The Bank has a Risk Management Committee, which is responsible for designing risk management strategies and ensuring that risk<br />

management operations are carried out within the framework of the Board of Directors’ policies. Furthermore, the Bank has two departments<br />

under Risk Management Group responsible for credit risk, which are the Credit Risk Management Department and the Credit Review<br />

Department. The Credit Risk Management Department is responsible for (a) providing suggestions and recommendations on the<br />

improvement of credit policies, working regulations, the authorization structure and risk management, (b) developing systems and tools for<br />

risk evaluation as well as procedures for auditing, reporting and monitoring risks, and (c) reviewing and rendering opinions on credit risks as<br />

analyzed by credit officers prior to submission to the Bank’s executives or Credit Committee for further consideration and approval. The<br />

148