2005 - Asianbanks.net

2005 - Asianbanks.net

2005 - Asianbanks.net

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

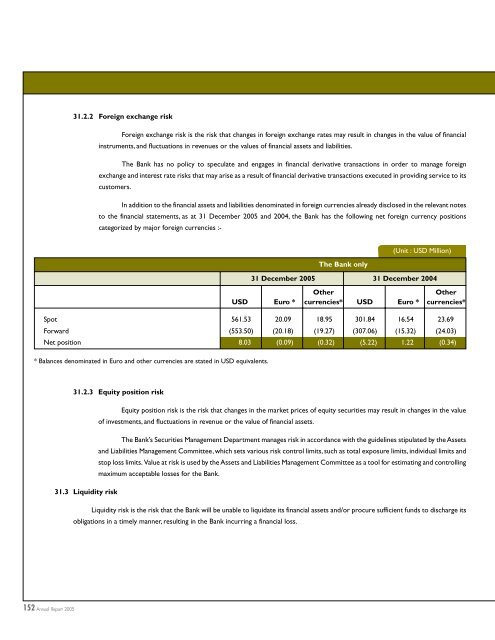

31.2.2 Foreign exchange risk<br />

Foreign exchange risk is the risk that changes in foreign exchange rates may result in changes in the value of financial<br />

instruments, and fluctuations in revenues or the values of financial assets and liabilities.<br />

The Bank has no policy to speculate and engages in financial derivative transactions in order to manage foreign<br />

exchange and interest rate risks that may arise as a result of financial derivative transactions executed in providing service to its<br />

customers.<br />

In addition to the financial assets and liabilities denominated in foreign currencies already disclosed in the relevant notes<br />

to the financial statements, as at 31 December <strong>2005</strong> and 2004, the Bank has the following <strong>net</strong> foreign currency positions<br />

categorized by major foreign currencies :-<br />

(Unit : USD Million)<br />

The Bank only<br />

31 December <strong>2005</strong> 31 December 2004<br />

Other<br />

Other<br />

USD Euro * currencies* USD Euro * currencies*<br />

Spot 561.53 20.09 18.95 301.84 16.54 23.69<br />

Forward (553.50) (20.18) (19.27) (307.06) (15.32) (24.03)<br />

Net position 8.03 (0.09) (0.32) (5.22) 1.22 (0.34)<br />

* Balances denominated in Euro and other currencies are stated in USD equivalents.<br />

31.2.3 Equity position risk<br />

Equity position risk is the risk that changes in the market prices of equity securities may result in changes in the value<br />

of investments, and fluctuations in revenue or the value of financial assets.<br />

The Bank’s Securities Management Department manages risk in accordance with the guidelines stipulated by the Assets<br />

and Liabilities Management Committee, which sets various risk control limits, such as total exposure limits, individual limits and<br />

stop loss limits. Value at risk is used by the Assets and Liabilities Management Committee as a tool for estimating and controlling<br />

maximum acceptable losses for the Bank.<br />

31.3 Liquidity risk<br />

Liquidity risk is the risk that the Bank will be unable to liquidate its financial assets and/or procure sufficient funds to discharge its<br />

obligations in a timely manner, resulting in the Bank incurring a financial loss.<br />

152