Money Laundering: Review of the Reporting ... - Dematerialised ID

Money Laundering: Review of the Reporting ... - Dematerialised ID

Money Laundering: Review of the Reporting ... - Dematerialised ID

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

kpmg<br />

<strong>Review</strong> <strong>of</strong> <strong>the</strong> regime for handling Suspicious Activity Reports<br />

Report <strong>of</strong> recommendations<br />

KPMG LLP<br />

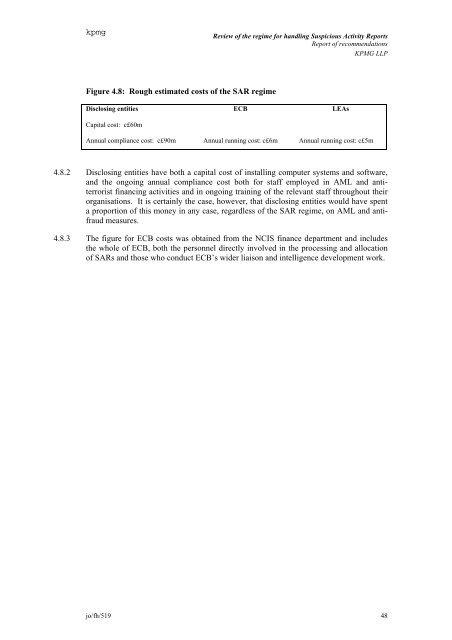

Figure 4.8: Rough estimated costs <strong>of</strong> <strong>the</strong> SAR regime<br />

Disclosing entities ECB LEAs<br />

Capital cost: c£60m<br />

Annual compliance cost: c£90m Annual running cost: c£6m Annual running cost: c£5m<br />

4.8.2 Disclosing entities have both a capital cost <strong>of</strong> installing computer systems and s<strong>of</strong>tware,<br />

and <strong>the</strong> ongoing annual compliance cost both for staff employed in AML and antiterrorist<br />

financing activities and in ongoing training <strong>of</strong> <strong>the</strong> relevant staff throughout <strong>the</strong>ir<br />

organisations. It is certainly <strong>the</strong> case, however, that disclosing entities would have spent<br />

a proportion <strong>of</strong> this money in any case, regardless <strong>of</strong> <strong>the</strong> SAR regime, on AML and antifraud<br />

measures.<br />

4.8.3 The figure for ECB costs was obtained from <strong>the</strong> NCIS finance department and includes<br />

<strong>the</strong> whole <strong>of</strong> ECB, both <strong>the</strong> personnel directly involved in <strong>the</strong> processing and allocation<br />

<strong>of</strong> SARs and those who conduct ECB’s wider liaison and intelligence development work.<br />

jo/fh/519 48