Trinidad and Tobago 2012 - invesTT

Trinidad and Tobago 2012 - invesTT

Trinidad and Tobago 2012 - invesTT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

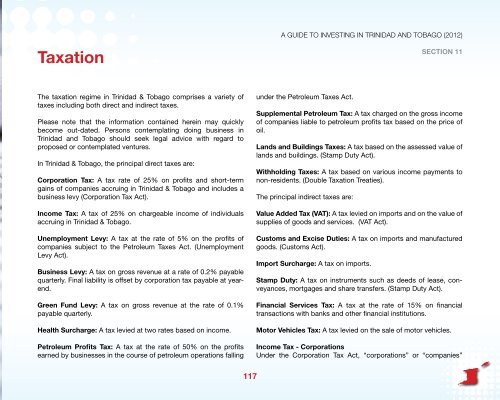

Taxation<br />

A GUIDE TO INVESTING IN TRINIDAD AND TOBAGO (<strong>2012</strong>)<br />

Section 11<br />

The taxation regime in <strong>Trinidad</strong> & <strong>Tobago</strong> comprises a variety of<br />

taxes including both direct <strong>and</strong> indirect taxes.<br />

Please note that the information contained herein may quickly<br />

become out-dated. Persons contemplating doing business in<br />

<strong>Trinidad</strong> <strong>and</strong> <strong>Tobago</strong> should seek legal advice with regard to<br />

proposed or contemplated ventures.<br />

In <strong>Trinidad</strong> & <strong>Tobago</strong>, the principal direct taxes are:<br />

Corporation Tax: A tax rate of 25% on profits <strong>and</strong> short-term<br />

gains of companies accruing in <strong>Trinidad</strong> & <strong>Tobago</strong> <strong>and</strong> includes a<br />

business levy (Corporation Tax Act).<br />

Income Tax: A tax of 25% on chargeable income of individuals<br />

accruing in <strong>Trinidad</strong> & <strong>Tobago</strong>.<br />

Unemployment Levy: A tax at the rate of 5% on the profits of<br />

companies subject to the Petroleum Taxes Act. (Unemployment<br />

Levy Act).<br />

Business Levy: A tax on gross revenue at a rate of 0.2% payable<br />

quarterly. Final liability is offset by corporation tax payable at yearend.<br />

Green Fund Levy: A tax on gross revenue at the rate of 0.1%<br />

payable quarterly.<br />

Health Surcharge: A tax levied at two rates based on income.<br />

Petroleum Profits Tax: A tax at the rate of 50% on the profits<br />

earned by businesses in the course of petroleum operations falling<br />

under the Petroleum Taxes Act.<br />

Supplemental Petroleum Tax: A tax charged on the gross income<br />

of companies liable to petroleum profits tax based on the price of<br />

oil.<br />

L<strong>and</strong>s <strong>and</strong> Buildings Taxes: A tax based on the assessed value of<br />

l<strong>and</strong>s <strong>and</strong> buildings. (Stamp Duty Act).<br />

Withholding Taxes: A tax based on various income payments to<br />

non-residents. (Double Taxation Treaties).<br />

The principal indirect taxes are:<br />

Value Added Tax (VAT): A tax levied on imports <strong>and</strong> on the value of<br />

supplies of goods <strong>and</strong> services. (VAT Act).<br />

Customs <strong>and</strong> Excise Duties: A tax on imports <strong>and</strong> manufactured<br />

goods. (Customs Act).<br />

Import Surcharge: A tax on imports.<br />

Stamp Duty: A tax on instruments such as deeds of lease, conveyances,<br />

mortgages <strong>and</strong> share transfers. (Stamp Duty Act).<br />

Financial Services Tax: A tax at the rate of 15% on financial<br />

transactions with banks <strong>and</strong> other financial institutions.<br />

Motor Vehicles Tax: A tax levied on the sale of motor vehicles.<br />

Income Tax - Corporations<br />

Under the Corporation Tax Act, “corporations” or “companies”<br />

117