Annual Report 2001 - Chubb Group of Insurance Companies

Annual Report 2001 - Chubb Group of Insurance Companies

Annual Report 2001 - Chubb Group of Insurance Companies

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

occurred, including both those known to us and those<br />

yet to be reported. In establishing such reserves,<br />

management considers facts currently known and the<br />

present state <strong>of</strong> the law and coverage litigation. How-<br />

ever, given the expansion <strong>of</strong> coverage and liability by the<br />

courts and the legislatures in the past and the possibili-<br />

ties <strong>of</strong> similar interpretations in the future, particularly as<br />

they relate to asbestos and toxic waste claims, additional<br />

increases in loss reserves may emerge in future periods.<br />

Any such increases would have an adverse eÅect on<br />

future operating results. However, management does not<br />

expect that any such increases would have a material<br />

adverse eÅect on the Corporation's consolidated Ñnancial<br />

condition or liquidity.<br />

Litigation costs remain substantial, particularly for hazardous<br />

waste claims. Primary policies provide a limit on<br />

indemnity payments but many do not limit defense<br />

costs. This unlimited defense provided in the policies<br />

sometimes leads to the payment <strong>of</strong> defense costs<br />

substantially exceeding the indemnity exposure. A substantial<br />

portion <strong>of</strong> the funds we have expended to date<br />

has been for legal fees incurred in the prolonged<br />

litigation <strong>of</strong> coverage issues.<br />

The tragic event <strong>of</strong> September 11 changed the way the<br />

property and casualty insurance industry views cata-<br />

strophic risk. Numerous classes <strong>of</strong> business have become<br />

exposed to terrorism related catastrophic risks in addition<br />

to the catastrophic risks related to natural occur-<br />

rences. This has required us to change how we identify<br />

and evaluate risk accumulations. We have changed our<br />

underwriting protocols to address terrorism and the<br />

limited availability <strong>of</strong> terrorism reinsurance. However,<br />

given the uncertainty <strong>of</strong> the potential threats, we cannot<br />

be sure that we have addressed all the possibilities.<br />

Reserves for asbestos and toxic waste claims cannot be<br />

estimated with traditional loss reserving techniques that<br />

rely on historical accident year loss development factors.<br />

We have established case reserves and expense reserves<br />

for costs <strong>of</strong> related litigation where suÇcient information<br />

has been developed to indicate the involvement <strong>of</strong> a<br />

speciÑc insurance policy. In addition, IBNR reserves<br />

have been established to cover additional exposures on<br />

both known and unasserted claims.<br />

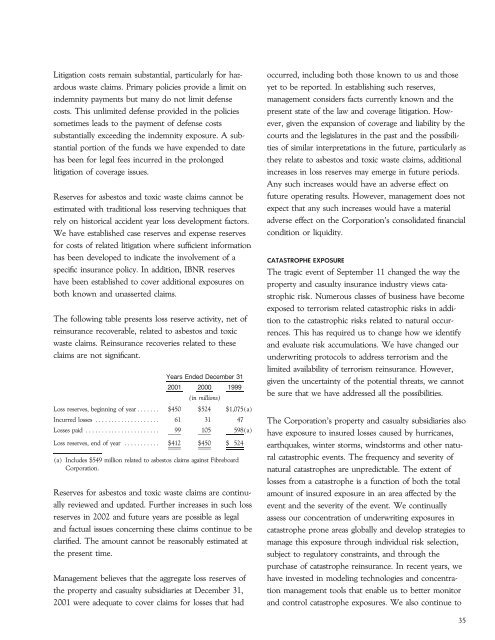

The following table presents loss reserve activity, net <strong>of</strong><br />

reinsurance recoverable, related to asbestos and toxic<br />

waste claims. Reinsurance recoveries related to these<br />

claims are not signiÑcant.<br />

Years Ended December 31<br />

<strong>2001</strong> 2000 1999<br />

(in millions)<br />

CATASTROPHE EXPOSURE<br />

Loss reserves, beginning <strong>of</strong> yearÏÏÏÏÏÏÏ $450 $524 $1,075(a)<br />

Incurred losses ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 61 31 47 The Corporation's property and casualty subsidiaries also<br />

Losses paid ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 99 105 598(a)<br />

have exposure to insured losses caused by hurricanes,<br />

Loss reserves, end <strong>of</strong> year ÏÏÏÏÏÏÏÏÏÏÏ $412 $450 $ 524 earthquakes, winter storms, windstorms and other natural<br />

(a) Includes $549 million related to asbestos claims against Fibreboard<br />

catastrophic events. The frequency and severity <strong>of</strong><br />

Corporation.<br />

natural catastrophes are unpredictable. The extent <strong>of</strong><br />

losses from a catastrophe is a function <strong>of</strong> both the total<br />

Reserves for asbestos and toxic waste claims are continu- amount <strong>of</strong> insured exposure in an area aÅected by the<br />

ally reviewed and updated. Further increases in such loss event and the severity <strong>of</strong> the event. We continually<br />

reserves in 2002 and future years are possible as legal assess our concentration <strong>of</strong> underwriting exposures in<br />

and factual issues concerning these claims continue to be catastrophe prone areas globally and develop strategies to<br />

clariÑed. The amount cannot be reasonably estimated at manage this exposure through individual risk selection,<br />

the present time.<br />

subject to regulatory constraints, and through the<br />

purchase <strong>of</strong> catastrophe reinsurance. In recent years, we<br />

Management believes that the aggregate loss reserves <strong>of</strong> have invested in modeling technologies and concentrathe<br />

property and casualty subsidiaries at December 31, tion management tools that enable us to better monitor<br />

<strong>2001</strong> were adequate to cover claims for losses that had and control catastrophe exposures. We also continue to<br />

35