Manual for Integrated District Planning - National Institute of Rural ...

Manual for Integrated District Planning - National Institute of Rural ...

Manual for Integrated District Planning - National Institute of Rural ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Manual</strong> <strong>for</strong> <strong>Integrated</strong> <strong>District</strong> <strong>Planning</strong><br />

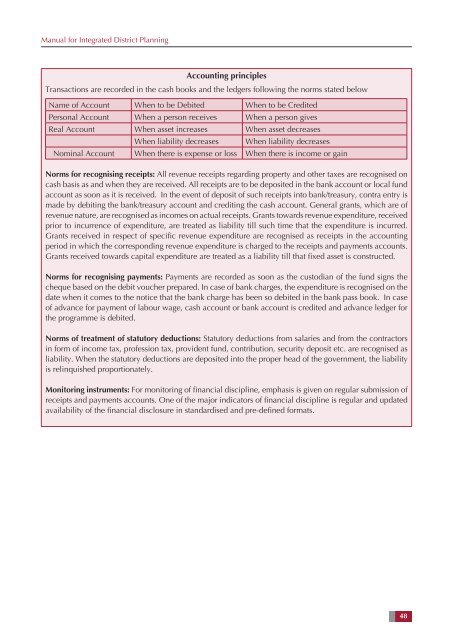

Accounting principles<br />

Transactions are recorded in the cash books and the ledgers following the norms stated below<br />

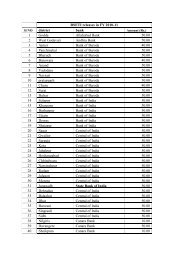

Name <strong>of</strong> Account When to be Debited When to be Credited<br />

Personal Account When a person receives When a person gives<br />

Real Account When asset increases When asset decreases<br />

When liability decreases<br />

When liability decreases<br />

Nominal Account When there is expense or loss When there is income or gain<br />

Norms <strong>for</strong> recognising receipts: All revenue receipts regarding property and other taxes are recognised on<br />

cash basis as and when they are received. All receipts are to be deposited in the bank account or local fund<br />

account as soon as it is received. In the event <strong>of</strong> deposit <strong>of</strong> such receipts into bank/treasury, contra entry is<br />

made by debiting the bank/treasury account and crediting the cash account. General grants, which are <strong>of</strong><br />

revenue nature, are recognised as incomes on actual receipts. Grants towards revenue expenditure, received<br />

prior to incurrence <strong>of</strong> expenditure, are treated as liability till such time that the expenditure is incurred.<br />

Grants received in respect <strong>of</strong> specific revenue expenditure are recognised as receipts in the accounting<br />

period in which the corresponding revenue expenditure is charged to the receipts and payments accounts.<br />

Grants received towards capital expenditure are treated as a liability till that fixed asset is constructed.<br />

Norms <strong>for</strong> recognising payments: Payments are recorded as soon as the custodian <strong>of</strong> the fund signs the<br />

cheque based on the debit voucher prepared. In case <strong>of</strong> bank charges, the expenditure is recognised on the<br />

date when it comes to the notice that the bank charge has been so debited in the bank pass book. In case<br />

<strong>of</strong> advance <strong>for</strong> payment <strong>of</strong> labour wage, cash account or bank account is credited and advance ledger <strong>for</strong><br />

the programme is debited.<br />

Norms <strong>of</strong> treatment <strong>of</strong> statutory deductions: Statutory deductions from salaries and from the contractors<br />

in <strong>for</strong>m <strong>of</strong> income tax, pr<strong>of</strong>ession tax, provident fund, contribution, security deposit etc. are recognised as<br />

liability. When the statutory deductions are deposited into the proper head <strong>of</strong> the government, the liability<br />

is relinquished proportionately.<br />

Monitoring instruments: For monitoring <strong>of</strong> financial discipline, emphasis is given on regular submission <strong>of</strong><br />

receipts and payments accounts. One <strong>of</strong> the major indicators <strong>of</strong> financial discipline is regular and updated<br />

availability <strong>of</strong> the financial disclosure in standardised and pre-defined <strong>for</strong>mats.<br />

48