FY2011 Health Benefits Booklet

FY2011 Health Benefits Booklet

FY2011 Health Benefits Booklet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Maryland State Employees and Retirees 7<br />

1.<br />

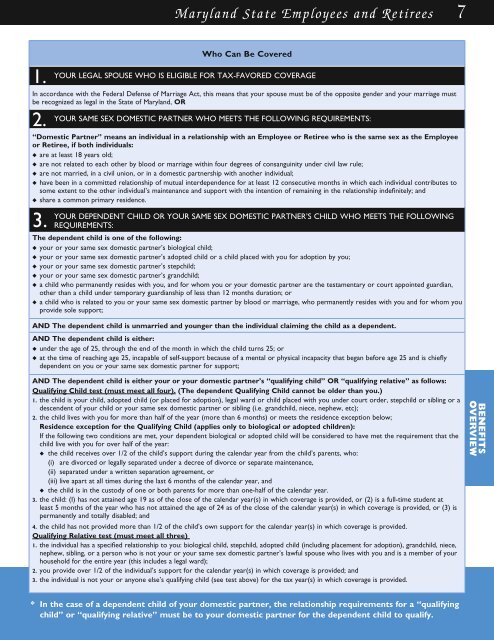

Who Can Be Covered<br />

Your legal spouse who is eligible for tax-favored coverage<br />

In accordance with the Federal Defense of Marriage Act, this means that your spouse must be of the opposite gender and your marriage must<br />

be recognized as legal in the State of Maryland, OR<br />

Your same sex domestic partner who meets the following requirements:<br />

2.<br />

“Domestic Partner” means an individual in a relationship with an Employee or Retiree who is the same sex as the Employee<br />

or Retiree, if both individuals:<br />

u are at least 18 years old;<br />

u are not related to each other by blood or marriage within four degrees of consanguinity under civil law rule;<br />

u are not married, in a civil union, or in a domestic partnership with another individual;<br />

u have been in a committed relationship of mutual interdependence for at least 12 consecutive months in which each individual contributes to<br />

some extent to the other individual’s maintenance and support with the intention of remaining in the relationship indefinitely; and<br />

u share a common primary residence.<br />

3.<br />

Your dependent child or your same sex domestic partner’s child who meets the following<br />

REquirements:<br />

The dependent child is one of the following:<br />

u your or your same sex domestic partner’s biological child;<br />

u your or your same sex domestic partner’s adopted child or a child placed with you for adoption by you;<br />

u your or your same sex domestic partner’s stepchild;<br />

u your or your same sex domestic partner’s grandchild;<br />

u a child who permanently resides with you, and for whom you or your domestic partner are the testamentary or court appointed guardian,<br />

other than a child under temporary guardianship of less than 12 months duration; or<br />

u a child who is related to you or your same sex domestic partner by blood or marriage, who permanently resides with you and for whom you<br />

provide sole support;<br />

AND The dependent child is unmarried and younger than the individual claiming the child as a dependent.<br />

AND The dependent child is either:<br />

u under the age of 25, through the end of the month in which the child turns 25; or<br />

u at the time of reaching age 25, incapable of self-support because of a mental or physical incapacity that began before age 25 and is chiefly<br />

dependent on you or your same sex domestic partner for support;<br />

AND The dependent child is either your or your domestic partner’s “qualifying child” OR “qualifying relative” as follows:<br />

Qualifying Child test (must meet all four). (The dependent Qualifying Child cannot be older than you.)<br />

1. the child is your child, adopted child (or placed for adoption), legal ward or child placed with you under court order, stepchild or sibling or a<br />

descendent of your child or your same sex domestic partner or sibling (i.e. grandchild, niece, nephew, etc);<br />

2. the child lives with you for more than half of the year (more than 6 months) or meets the residence exception below;<br />

Residence exception for the Qualifying Child (applies only to biological or adopted children):<br />

If the following two conditions are met, your dependent biological or adopted child will be considered to have met the requirement that the<br />

child live with you for over half of the year:<br />

u the child receives over 1/2 of the child’s support during the calendar year from the child’s parents, who:<br />

(i) are divorced or legally separated under a decree of divorce or separate maintenance,<br />

(ii) separated under a written separation agreement, or<br />

(iii) live apart at all times during the last 6 months of the calendar year, and<br />

u the child is in the custody of one or both parents for more than one-half of the calendar year.<br />

3. the child: (I) has not attained age 19 as of the close of the calendar year(s) in which coverage is provided, or (2) is a full-time student at<br />

least 5 months of the year who has not attained the age of 24 as of the close of the calendar year(s) in which coverage is provided, or (3) is<br />

permanently and totally disabled; and<br />

4. the child has not provided more than 1/2 of the child’s own support for the calendar year(s) in which coverage is provided.<br />

Qualifying Relative test (must meet all three)<br />

1. the individual has a specified relationship to you: biological child, stepchild, adopted child (including placement for adoption), grandchild, niece,<br />

nephew, sibling, or a person who is not your or your same sex domestic partner’s lawful spouse who lives with you and is a member of your<br />

household for the entire year (this includes a legal ward);<br />

2. you provide over 1/2 of the individual’s support for the calendar year(s) in which coverage is provided; and<br />

3. the individual is not your or anyone else’s qualifying child (see test above) for the tax year(s) in which coverage is provided.<br />

BENEFITS<br />

OVERVIEW<br />

* In the case of a dependent child of your domestic partner, the relationship requirements for a “qualifying<br />

child” or “qualifying relative” must be to your domestic partner for the dependent child to qualify.