FY2011 Health Benefits Booklet

FY2011 Health Benefits Booklet

FY2011 Health Benefits Booklet

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Maryland State Employees and Retirees 43<br />

Out-of-Area Emergencies<br />

The United Concordia DHMO will pay a maximum<br />

of $50, subject to your fee schedule, for emergency<br />

dental services when you are traveling out of the area<br />

(more than 50 miles from your dentist’s office). To<br />

receive payment for out-of-area emergency care, you<br />

must submit a bill itemizing the charges and services<br />

performed, and forward the claim to UCCI for<br />

processing.<br />

DHMO Network<br />

If you live in an area or move to an area that is not in<br />

the DHMO network of dentists, please contact UCCI<br />

to determine other options. To enroll in the DHMO<br />

plan, you must reside within the Maryland service<br />

area (MD, DC, VA, DE, WV, PA). In addition, you<br />

may request that the plan evaluate the dentist of<br />

your choice for inclusion in the network. However,<br />

there is no guarantee that a provider that you request<br />

will choose to participate in the plan network. In<br />

the DHMO plan, you can only receive coverage for<br />

services from a DHMO plan provider.<br />

The DPPO Plan<br />

The DPPO plan is also available through United<br />

Concordia. Under this Plan, you do not have to select<br />

a PDO. You may choose to receive services from<br />

any dentist of your choice whenever you need care.<br />

If you use an out-of-network dentist, you will need<br />

to submit a claim form for reimbursement and may<br />

be billed by the dentist for the amount charged that<br />

exceeds the allowed amount. No referrals are needed<br />

for specialty care. Orthodontia services are only<br />

covered for eligible children age 25 and younger.<br />

When you use an in-network DPPO dentist, the<br />

in-network dentist will directly bill the plan for the<br />

amount the plan will pay, and will bill you for the<br />

amount you are required to pay under the plan.<br />

DENTAL<br />

BENEFITS<br />

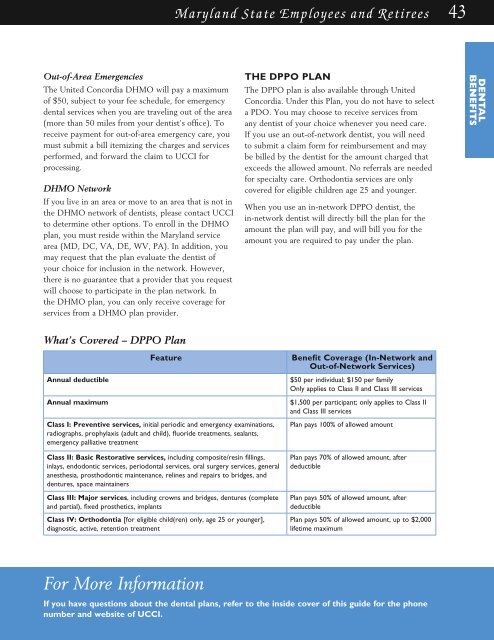

What’s Covered – DPPO Plan<br />

Annual deductible<br />

Annual maximum<br />

Feature<br />

Class I: Preventive services, initial periodic and emergency examinations,<br />

radiographs, prophylaxis (adult and child), fluoride treatments, sealants,<br />

emergency palliative treatment<br />

Class II: Basic Restorative services, including composite/resin fillings,<br />

inlays, endodontic services, periodontal services, oral surgery services, general<br />

anesthesia, prosthodontic maintenance, relines and repairs to bridges, and<br />

dentures, space maintainers<br />

Class III: Major services, including crowns and bridges, dentures (complete<br />

and partial), fixed prosthetics, implants<br />

Class IV: Orthodontia [for eligible child(ren) only, age 25 or younger],<br />

diagnostic, active, retention treatment<br />

Benefit Coverage (In-Network and<br />

Out-of-Network Services)<br />

$50 per individual; $150 per family<br />

Only applies to Class II and Class III services<br />

$1,500 per participant; only applies to Class II<br />

and Class III services<br />

Plan pays 100% of allowed amount<br />

Plan pays 70% of allowed amount, after<br />

deductible<br />

Plan pays 50% of allowed amount, after<br />

deductible<br />

Plan pays 50% of allowed amount, up to $2,000<br />

lifetime maximum<br />

For More Information<br />

If you have questions about the dental plans, refer to the inside cover of this guide for the phone<br />

number and website of UCCI.