FY2011 Health Benefits Booklet

FY2011 Health Benefits Booklet

FY2011 Health Benefits Booklet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Maryland State Employees and Retirees 17<br />

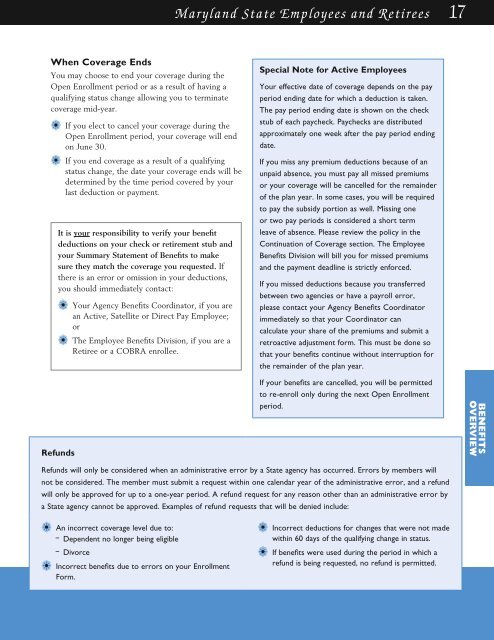

When Coverage Ends<br />

You may choose to end your coverage during the<br />

Open Enrollment period or as a result of having a<br />

qualifying status change allowing you to terminate<br />

coverage mid-year.<br />

a• If you elect to cancel your coverage during the<br />

Open Enrollment period, your coverage will end<br />

on June 30.<br />

a• If you end coverage as a result of a qualifying<br />

status change, the date your coverage ends will be<br />

determined by the time period covered by your<br />

last deduction or payment.<br />

It is your responsibility to verify your benefit<br />

deductions on your check or retirement stub and<br />

your Summary Statement of <strong>Benefits</strong> to make<br />

sure they match the coverage you requested. If<br />

there is an error or omission in your deductions,<br />

you should immediately contact:<br />

a• Your Agency <strong>Benefits</strong> Coordinator, if you are<br />

an Active, Satellite or Direct Pay Employee;<br />

or<br />

a• The Employee <strong>Benefits</strong> Division, if you are a<br />

Retiree or a COBRA enrollee.<br />

Refunds<br />

Special Note for Active Employees<br />

Your effective date of coverage depends on the pay<br />

period ending date for which a deduction is taken.<br />

The pay period ending date is shown on the check<br />

stub of each paycheck. Paychecks are distributed<br />

approximately one week after the pay period ending<br />

date.<br />

If you miss any premium deductions because of an<br />

unpaid absence, you must pay all missed premiums<br />

or your coverage will be cancelled for the remainder<br />

of the plan year. In some cases, you will be required<br />

to pay the subsidy portion as well. Missing one<br />

or two pay periods is considered a short term<br />

leave of absence. Please review the policy in the<br />

Continuation of Coverage section. The Employee<br />

<strong>Benefits</strong> Division will bill you for missed premiums<br />

and the payment deadline is strictly enforced.<br />

If you missed deductions because you transferred<br />

between two agencies or have a payroll error,<br />

please contact your Agency <strong>Benefits</strong> Coordinator<br />

immediately so that your Coordinator can<br />

calculate your share of the premiums and submit a<br />

retroactive adjustment form. This must be done so<br />

that your benefits continue without interruption for<br />

the remainder of the plan year.<br />

If your benefits are cancelled, you will be permitted<br />

to re-enroll only during the next Open Enrollment<br />

period.<br />

BENEFITS<br />

OVERVIEW<br />

Refunds will only be considered when an administrative error by a State agency has occurred. Errors by members will<br />

not be considered. The member must submit a request within one calendar year of the administrative error, and a refund<br />

will only be approved for up to a one-year period. A refund request for any reason other than an administrative error by<br />

a State agency cannot be approved. Examples of refund requests that will be denied include:<br />

a• An incorrect coverage level due to:<br />

– Dependent no longer being eligible<br />

– Divorce<br />

a• Incorrect benefits due to errors on your Enrollment<br />

Form.<br />

a• Incorrect deductions for changes that were not made<br />

within 60 days of the qualifying change in status.<br />

a• If benefits were used during the period in which a<br />

refund is being requested, no refund is permitted.