FY2011 Health Benefits Booklet

FY2011 Health Benefits Booklet

FY2011 Health Benefits Booklet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Maryland State Employees and Retirees 9<br />

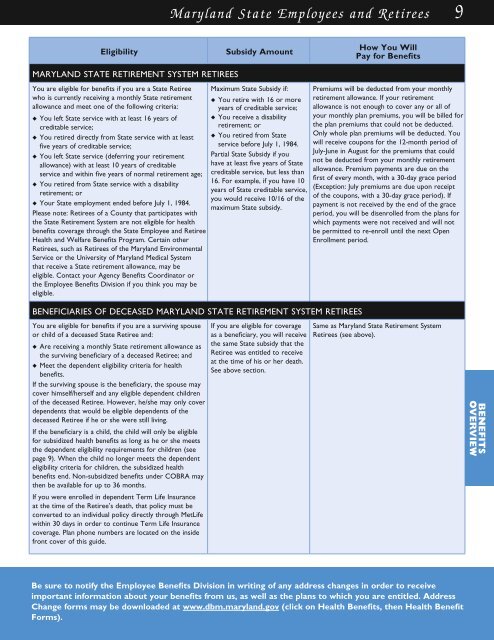

Eligibility<br />

Subsidy Amount<br />

How You Will<br />

Pay for <strong>Benefits</strong><br />

maryland STATE RETIREMENT SYSTEM RETIREES<br />

You are eligible for benefits if you are a State Retiree<br />

who is currently receiving a monthly State retirement<br />

allowance and meet one of the following criteria:<br />

u You left State service with at least 16 years of<br />

creditable service;<br />

u You retired directly from State service with at least<br />

five years of creditable service;<br />

u You left State service (deferring your retirement<br />

allowance) with at least 10 years of creditable<br />

service and within five years of normal retirement age;<br />

u You retired from State service with a disability<br />

retirement; or<br />

u Your State employment ended before July 1, 1984.<br />

Please note: Retirees of a County that participates with<br />

the State Retirement System are not eligible for health<br />

benefits coverage through the State Employee and Retiree<br />

<strong>Health</strong> and Welfare <strong>Benefits</strong> Program. Certain other<br />

Retirees, such as Retirees of the Maryland Environmental<br />

Service or the University of Maryland Medical System<br />

that receive a State retirement allowance, may be<br />

eligible. Contact your Agency <strong>Benefits</strong> Coordinator or<br />

the Employee <strong>Benefits</strong> Division if you think you may be<br />

eligible.<br />

Maximum State Subsidy if:<br />

u You retire with 16 or more<br />

years of creditable service;<br />

u You receive a disability<br />

retirement; or<br />

u You retired from State<br />

service before July 1, 1984.<br />

Partial State Subsidy if you<br />

have at least five years of State<br />

creditable service, but less than<br />

16. For example, if you have 10<br />

years of State creditable service,<br />

you would receive 10/16 of the<br />

maximum State subsidy.<br />

beneficiaries OF DECEASED MARYLAND STATE RETIREMENT SYSTEM RETIREES<br />

Premiums will be deducted from your monthly<br />

retirement allowance. If your retirement<br />

allowance is not enough to cover any or all of<br />

your monthly plan premiums, you will be billed for<br />

the plan premiums that could not be deducted.<br />

Only whole plan premiums will be deducted. You<br />

will receive coupons for the 12-month period of<br />

July-June in August for the premiums that could<br />

not be deducted from your monthly retirement<br />

allowance. Premium payments are due on the<br />

first of every month, with a 30-day grace period<br />

(Exception: July premiums are due upon receipt<br />

of the coupons, with a 30-day grace period). If<br />

payment is not received by the end of the grace<br />

period, you will be disenrolled from the plans for<br />

which payments were not received and will not<br />

be permitted to re-enroll until the next Open<br />

Enrollment period.<br />

You are eligible for benefits if you are a surviving spouse<br />

or child of a deceased State Retiree and:<br />

u Are receiving a monthly State retirement allowance as<br />

the surviving beneficiary of a deceased Retiree; and<br />

u Meet the dependent eligibility criteria for health<br />

benefits.<br />

If the surviving spouse is the beneficiary, the spouse may<br />

cover himself/herself and any eligible dependent children<br />

of the deceased Retiree. However, he/she may only cover<br />

dependents that would be eligible dependents of the<br />

deceased Retiree if he or she were still living.<br />

If the beneficiary is a child, the child will only be eligible<br />

for subsidized health benefits as long as he or she meets<br />

the dependent eligibility requirements for children (see<br />

page 9). When the child no longer meets the dependent<br />

eligibility criteria for children, the subsidized health<br />

benefits end. Non-subsidized benefits under COBRA may<br />

then be available for up to 36 months.<br />

If you were enrolled in dependent Term Life Insurance<br />

at the time of the Retiree’s death, that policy must be<br />

converted to an individual policy directly through MetLife<br />

within 30 days in order to continue Term Life Insurance<br />

coverage. Plan phone numbers are located on the inside<br />

front cover of this guide.<br />

If you are eligible for coverage<br />

as a beneficiary, you will receive<br />

the same State subsidy that the<br />

Retiree was entitled to receive<br />

at the time of his or her death.<br />

See above section.<br />

Same as Maryland State Retirement System<br />

Retirees (see above).<br />

BENEFITS<br />

OVERVIEW<br />

Be sure to notify the Employee <strong>Benefits</strong> Division in writing of any address changes in order to receive<br />

important information about your benefits from us, as well as the plans to which you are entitled. Address<br />

Change forms may be downloaded at www.dbm.maryland.gov (click on <strong>Health</strong> <strong>Benefits</strong>, then <strong>Health</strong> Benefit<br />

Forms).