Funds GreatLink - Great Eastern Life

Funds GreatLink - Great Eastern Life

Funds GreatLink - Great Eastern Life

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

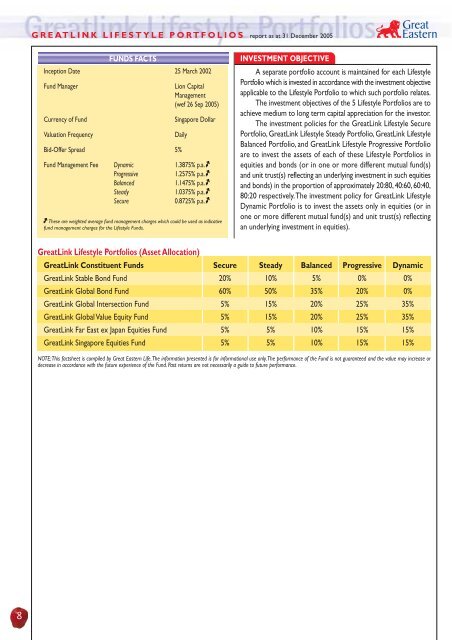

GREATLINK LIFESTYLE PORTFOLIOS report as at 31 December 2005<br />

FUNDS FACTS<br />

Inception Date 25 March 2002<br />

Fund Manager<br />

Lion Capital<br />

Management<br />

(wef 26 Sep 2005)<br />

Currency of Fund<br />

Singapore Dollar<br />

Valuation Frequency<br />

Daily<br />

Bid-Offer Spread 5%<br />

Fund Management Fee Dynamic 1.3875% p.a.<br />

Progressive<br />

1.2575% p.a.<br />

Balanced<br />

1.1475% p.a.<br />

Steady<br />

1.0375% p.a.<br />

Secure<br />

0.8725% p.a.<br />

These are weighted average fund management charges which could be used as indicative<br />

fund management charges for the <strong>Life</strong>style <strong>Funds</strong>.<br />

INVESTMENT OBJECTIVE<br />

A separate portfolio account is maintained for each <strong>Life</strong>style<br />

Portfolio which is invested in accordance with the investment objective<br />

applicable to the <strong>Life</strong>style Portfolio to which such portfolio relates.<br />

The investment objectives of the 5 <strong>Life</strong>style Portfolios are to<br />

achieve medium to long term capital appreciation for the investor.<br />

The investment policies for the <strong><strong>Great</strong>Link</strong> <strong>Life</strong>style Secure<br />

Portfolio, <strong><strong>Great</strong>Link</strong> <strong>Life</strong>style Steady Portfolio, <strong><strong>Great</strong>Link</strong> <strong>Life</strong>style<br />

Balanced Portfolio, and <strong><strong>Great</strong>Link</strong> <strong>Life</strong>style Progressive Portfolio<br />

are to invest the assets of each of these <strong>Life</strong>style Portfolios in<br />

equities and bonds (or in one or more different mutual fund(s)<br />

and unit trust(s) reflecting an underlying investment in such equities<br />

and bonds) in the proportion of approximately 20:80, 40:60, 60:40,<br />

80:20 respectively. The investment policy for <strong><strong>Great</strong>Link</strong> <strong>Life</strong>style<br />

Dynamic Portfolio is to invest the assets only in equities (or in<br />

one or more different mutual fund(s) and unit trust(s) reflecting<br />

an underlying investment in equities).<br />

<strong><strong>Great</strong>Link</strong> <strong>Life</strong>style Portfolios (Asset Allocation)<br />

<strong><strong>Great</strong>Link</strong> Constituent <strong>Funds</strong> Secure Steady Balanced Progressive Dynamic<br />

<strong><strong>Great</strong>Link</strong> Stable Bond Fund 20% 10% 5% 0% 0%<br />

<strong><strong>Great</strong>Link</strong> Global Bond Fund 60% 50% 35% 20% 0%<br />

<strong><strong>Great</strong>Link</strong> Global Intersection Fund 5% 15% 20% 25% 35%<br />

<strong><strong>Great</strong>Link</strong> Global Value Equity Fund 5% 15% 20% 25% 35%<br />

<strong><strong>Great</strong>Link</strong> Far East ex Japan Equities Fund 5% 5% 10% 15% 15%<br />

<strong><strong>Great</strong>Link</strong> Singapore Equities Fund 5% 5% 10% 15% 15%<br />

NOTE: This factsheet is compiled by <strong>Great</strong> <strong>Eastern</strong> <strong>Life</strong>. The information presented is for informational use only. The performance of the Fund is not guaranteed and the value may increase or<br />

decrease in accordance with the future experience of the Fund. Past returns are not necessarily a guide to future performance.<br />

8