Funds GreatLink - Great Eastern Life

Funds GreatLink - Great Eastern Life

Funds GreatLink - Great Eastern Life

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

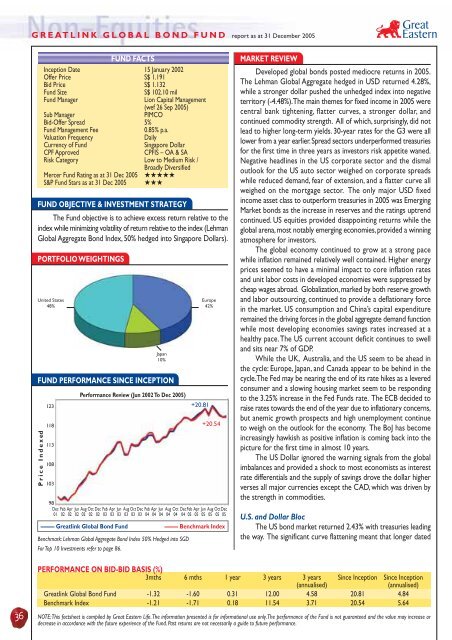

GREATLINK GLOBAL BOND FUND report as at 31 December 2005<br />

FUND FACTS<br />

Inception Date 15 January 2002<br />

Offer Price S$ 1.191<br />

Bid Price S$ 1.132<br />

Fund Size<br />

S$ 102.10 mil<br />

Fund Manager<br />

Lion Capital Management<br />

(wef 26 Sep 2005)<br />

Sub Manager<br />

PIMCO<br />

Bid-Offer Spread 5%<br />

Fund Management Fee<br />

0.85% p.a.<br />

Valuation Frequency<br />

Daily<br />

Currency of Fund<br />

Singapore Dollar<br />

CPF Approved<br />

CPFIS – OA & SA<br />

Risk Category Low to Medium Risk /<br />

Broadly Diversified<br />

Mercer Fund Rating as at 31 Dec 2005 ★★★★★<br />

S&P Fund Stars as at 31 Dec 2005 ★★★<br />

FUND OBJECTIVE & INVESTMENT STRATEGY<br />

The Fund objective is to achieve excess return relative to the<br />

index while minimizing volatility of return relative to the index (Lehman<br />

Global Aggregate Bond Index, 50% hedged into Singapore Dollars).<br />

PORTFOLIO WEIGHTINGS<br />

United States<br />

48%<br />

FUND PERFORMANCE SINCE INCEPTION<br />

Price Indexed<br />

123<br />

118<br />

113<br />

108<br />

103<br />

Japan<br />

10%<br />

Performance Review (Jun 2002 To Dec 2005)<br />

Europe<br />

42%<br />

+20.81<br />

+20.54<br />

98<br />

Dec Feb Apr Jun Aug Oct Dec Feb Apr Jun Aug Oct Dec Feb Apr Jun Aug Oct Dec Feb Apr Jun Aug Oct Dec<br />

01 02 02 02 02 02 02 03 03 03 03 03 03 04 04 04 04 04 04 05 05 05 05 05 05<br />

––––– <strong>Great</strong>link Global Bond Fund ––––– Benchmark Index<br />

Benchmark: Lehman Global Aggregate Bond Index 50% Hedged into SGD<br />

For Top 10 Investments refer to page 86.<br />

MARKET REVIEW<br />

Developed global bonds posted mediocre returns in 2005.<br />

The Lehman Global Aggregate hedged in USD returned 4.28%,<br />

while a stronger dollar pushed the unhedged index into negative<br />

territory (-4.48%). The main themes for fixed income in 2005 were<br />

central bank tightening, flatter curves, a stronger dollar, and<br />

continued commodity strength. All of which, surprisingly, did not<br />

lead to higher long-term yields. 30-year rates for the G3 were all<br />

lower from a year earlier. Spread sectors underperformed treasuries<br />

for the first time in three years as investors risk appetite waned.<br />

Negative headlines in the US corporate sector and the dismal<br />

outlook for the US auto sector weighed on corporate spreads<br />

while reduced demand, fear of extension, and a flatter curve all<br />

weighed on the mortgage sector. The only major USD fixed<br />

income asset class to outperform treasuries in 2005 was Emerging<br />

Market bonds as the increase in reserves and the ratings uptrend<br />

continued. US equities provided disappointing returns while the<br />

global arena, most notably emerging economies, provided a winning<br />

atmosphere for investors.<br />

The global economy continued to grow at a strong pace<br />

while inflation remained relatively well contained. Higher energy<br />

prices seemed to have a minimal impact to core inflation rates<br />

and unit labor costs in developed economies were suppressed by<br />

cheap wages abroad. Globalization, marked by both reserve growth<br />

and labor outsourcing, continued to provide a deflationary force<br />

in the market. US consumption and China’s capital expenditure<br />

remained the driving forces in the global aggregate demand function<br />

while most developing economies savings rates increased at a<br />

healthy pace. The US current account deficit continues to swell<br />

and sits near 7% of GDP.<br />

While the UK, Australia, and the US seem to be ahead in<br />

the cycle: Europe, Japan, and Canada appear to be behind in the<br />

cycle. The Fed may be nearing the end of its rate hikes as a levered<br />

consumer and a slowing housing market seem to be responding<br />

to the 3.25% increase in the Fed <strong>Funds</strong> rate. The ECB decided to<br />

raise rates towards the end of the year due to inflationary concerns,<br />

but anemic growth prospects and high unemployment continue<br />

to weigh on the outlook for the economy. The BoJ has become<br />

increasingly hawkish as positive inflation is coming back into the<br />

picture for the first time in almost 10 years.<br />

The US Dollar ignored the warning signals from the global<br />

imbalances and provided a shock to most economists as interest<br />

rate differentials and the supply of savings drove the dollar higher<br />

verses all major currencies except the CAD, which was driven by<br />

the strength in commodities.<br />

U.S. and Dollar Bloc<br />

The US bond market returned 2.43% with treasuries leading<br />

the way. The significant curve flattening meant that longer dated<br />

36<br />

PERFORMANCE ON BID-BID BASIS (%)<br />

3mths 6 mths 1 year 3 years 3 years Since Inception Since Inception<br />

(annualised)<br />

(annualised)<br />

<strong>Great</strong>link Global Bond Fund -1.32 -1.60 0.31 12.00 4.58 20.81 4.84<br />

Benchmark Index -1.21 -1.71 0.18 11.54 3.71 20.54 5.64<br />

NOTE: This factsheet is compiled by <strong>Great</strong> <strong>Eastern</strong> <strong>Life</strong>. The information presented is for informational use only. The performance of the Fund is not guaranteed and the value may increase or<br />

decrease in accordance with the future experience of the Fund. Past returns are not necessarily a guide to future performance.