Funds GreatLink - Great Eastern Life

Funds GreatLink - Great Eastern Life

Funds GreatLink - Great Eastern Life

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

GREATLINK GLOBAL TECHNOLOGY FUND report as at 31 December 2005<br />

FUND FACTS<br />

Inception Date 15 January 2001<br />

Offer Price S$ 0.437<br />

Bid Price S$ 0.416<br />

Fund Size<br />

S$ 143.92 mil<br />

Fund Manager<br />

Schroder Investment Management<br />

Bid-Offer Spread 5%<br />

Fund Management Fee<br />

1.75% p.a.<br />

Valuation Frequency<br />

Daily<br />

Currency of Fund<br />

Singapore Dollar<br />

CPF Approved<br />

CPFIS – OA<br />

Risk Category<br />

Higher Risk / Narrowly Focused<br />

Mercer Fund Rating as at 31 Dec 2005 N.A<br />

S&P Fund Stars as at 31 Dec 2005 ★<br />

FUND OBJECTIVE & INVESTMENT STRATEGY<br />

The Fund objective is to achieve long-term capital growth through<br />

investment in global technology stocks. The Fund offers exposure to<br />

the rapidly growing adoption of technology across economies worldwide.<br />

Specifically, it aims to achieve high returns by investing in technology<br />

companies as well as in a range of industries where the growth<br />

opportunities have been impacted by technological developments.<br />

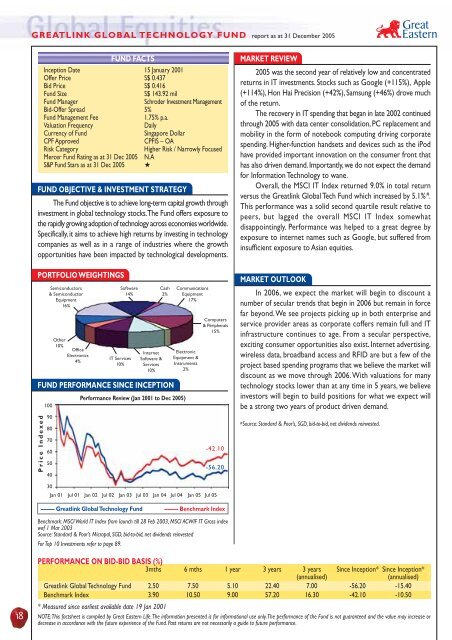

PORTFOLIO WEIGHTINGS<br />

FUND PERFORMANCE SINCE INCEPTION<br />

Price Indexed<br />

Semiconductors<br />

& Semiconductor<br />

Equipment<br />

16%<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

Other<br />

10%<br />

Office<br />

Electronics<br />

4%<br />

Software<br />

14%<br />

IT Services<br />

10%<br />

Internet<br />

Software &<br />

Services<br />

10%<br />

Cash<br />

2%<br />

Performance Review (Jan 2001 to Dec 2005)<br />

Communications<br />

Equipment<br />

17%<br />

Electronic<br />

Equipment &<br />

Instruments<br />

2%<br />

Computers<br />

& Peripherals<br />

15%<br />

-42.10<br />

-56.20<br />

MARKET REVIEW<br />

2005 was the second year of relatively low and concentrated<br />

returns in IT investments. Stocks such as Google (+115%), Apple<br />

(+114%), Hon Hai Precision (+42%), Samsung (+46%) drove much<br />

of the return.<br />

The recovery in IT spending that began in late 2002 continued<br />

through 2005 with data center consolidation, PC replacement and<br />

mobility in the form of notebook computing driving corporate<br />

spending. Higher-function handsets and devices such as the iPod<br />

have provided important innovation on the consumer front that<br />

has also driven demand. Importantly, we do not expect the demand<br />

for Information Technology to wane.<br />

Overall, the MSCI IT Index returned 9.0% in total return<br />

versus the <strong>Great</strong>link Global Tech Fund which increased by 5.1% # .<br />

This performance was a solid second quartile result relative to<br />

peers, but lagged the overall MSCI IT Index somewhat<br />

disappointingly. Performance was helped to a great degree by<br />

exposure to internet names such as Google, but suffered from<br />

insufficient exposure to Asian equities.<br />

MARKET OUTLOOK<br />

In 2006, we expect the market will begin to discount a<br />

number of secular trends that begin in 2006 but remain in force<br />

far beyond. We see projects picking up in both enterprise and<br />

service provider areas as corporate coffers remain full and IT<br />

infrastructure continues to age. From a secular perspective,<br />

exciting consumer opportunities also exist. Internet advertising,<br />

wireless data, broadband access and RFID are but a few of the<br />

project based spending programs that we believe the market will<br />

discount as we move through 2006. With valuations for many<br />

technology stocks lower than at any time in 5 years, we believe<br />

investors will begin to build positions for what we expect will<br />

be a strong two years of product driven demand.<br />

#Source: Standard & Poor’s, SGD, bid-to-bid, net dividends reinvested.<br />

30<br />

Jan 01 Jul 01 Jan 02 Jul 02 Jan 03 Jul 03 Jan 04 Jul 04 Jan 05 Jul 05<br />

––––– <strong>Great</strong>link Global Technology Fund ––––– Benchmark Index<br />

Benchmark: MSCI World IT Index from launch till 28 Feb 2003, MSCI ACWIF IT Gross index<br />

wef 1 Mar 2003<br />

Source: Standard & Poor’s Micropal, SGD, bid-to-bid, net dividends reinvested<br />

For Top 10 Investments refer to page 89.<br />

18<br />

PERFORMANCE ON BID-BID BASIS (%)<br />

3mths 6 mths 1 year 3 years 3 years Since Inception* Since Inception*<br />

(annualised)<br />

(annualised)<br />

<strong>Great</strong>link Global Technology Fund 2.50 7.50 5.10 22.40 7.00 -56.20 -15.40<br />

Benchmark Index 3.90 10.50 9.00 57.20 16.30 -42.10 -10.50<br />

* Measured since earliest available date 19 Jan 2001<br />

NOTE: This factsheet is compiled by <strong>Great</strong> <strong>Eastern</strong> <strong>Life</strong>. The information presented is for informational use only. The performance of the Fund is not guaranteed and the value may increase or<br />

decrease in accordance with the future experience of the Fund. Past returns are not necessarily a guide to future performance.