Funds GreatLink - Great Eastern Life

Funds GreatLink - Great Eastern Life

Funds GreatLink - Great Eastern Life

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

GREATLINK LIFESTYLE PORTFOLIOS report as at 31 December 2005<br />

STEADY<br />

FUND FACTS<br />

Offer Price S$ 1.220<br />

Bid Price S$ 1.159<br />

Fund Size<br />

S$ 18.16 mil<br />

CPF Approved<br />

CPFIS – OA & SA<br />

Risk Category Medium to High Risk /<br />

Broadly Diversified<br />

Mercer Fund Rating as at 31 Dec 2005 ★★★★<br />

S&P Fund Stars as at 31 Dec 2005 ★<br />

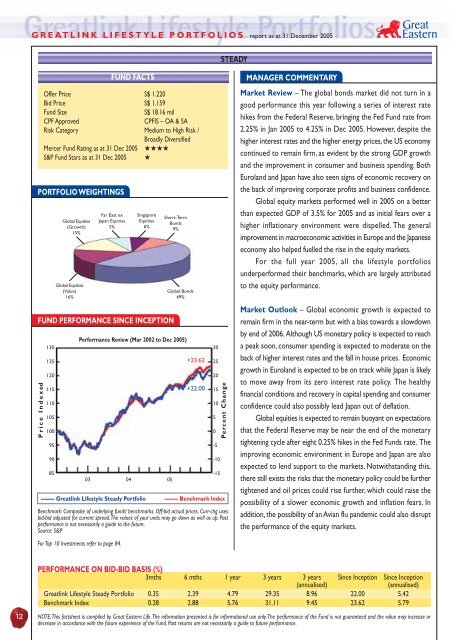

PORTFOLIO WEIGHTINGS<br />

FUND PERFORMANCE SINCE INCEPTION<br />

Price Indexed<br />

130<br />

125<br />

120<br />

115<br />

110<br />

105<br />

100<br />

95<br />

90<br />

85<br />

Global Equities<br />

(Growth)<br />

15%<br />

Global Equities<br />

(Value)<br />

16%<br />

Far East ex<br />

Japan Equities<br />

5%<br />

Singapore<br />

Equities<br />

6%<br />

Performance Review (Mar 2002 to Dec 2005)<br />

03 04 05<br />

Short-Term<br />

Bonds<br />

9%<br />

Global Bonds<br />

49%<br />

+23.62<br />

+22.00<br />

––––– <strong>Great</strong>link <strong>Life</strong>style Steady Portfolio ––––– Benchmark Index<br />

Benchmark: Composite of underlying funds’ benchmarks. Off-bid actual prices. Curr-chg uses<br />

bid-bid adjusted for current spread. The values of your units may go down as well as up. Past<br />

performance is not necessarily a guide to the future.<br />

Source: S&P<br />

For Top 10 Investments refer to page 84.<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

-5<br />

-10<br />

-15<br />

Percent Change<br />

MANAGER COMMENTARY<br />

Market Review – The global bonds market did not turn in a<br />

good performance this year following a series of interest rate<br />

hikes from the Federal Reserve, bringing the Fed Fund rate from<br />

2.25% in Jan 2005 to 4.25% in Dec 2005. However, despite the<br />

higher interest rates and the higher energy prices, the US economy<br />

continued to remain firm, as evident by the strong GDP growth<br />

and the improvement in consumer and business spending. Both<br />

Euroland and Japan have also seen signs of economic recovery on<br />

the back of improving corporate profits and business confidence.<br />

Global equity markets performed well in 2005 on a better<br />

than expected GDP of 3.5% for 2005 and as initial fears over a<br />

higher inflationary environment were dispelled. The general<br />

improvement in macroeconomic activities in Europe and the Japanese<br />

economy also helped fuelled the rise in the equity markets.<br />

For the full year 2005, all the lifestyle portfolios<br />

underperformed their benchmarks, which are largely attributed<br />

to the equity performance.<br />

Market Outlook – Global economic growth is expected to<br />

remain firm in the near-term but with a bias towards a slowdown<br />

by end of 2006. Although US monetary policy is expected to reach<br />

a peak soon, consumer spending is expected to moderate on the<br />

back of higher interest rates and the fall in house prices. Economic<br />

growth in Euroland is expected to be on track while Japan is likely<br />

to move away from its zero interest rate policy. The healthy<br />

financial conditions and recovery in capital spending and consumer<br />

confidence could also possibly lead Japan out of deflation.<br />

Global equities is expected to remain buoyant on expectations<br />

that the Federal Reserve may be near the end of the monetary<br />

tightening cycle after eight 0.25% hikes in the Fed <strong>Funds</strong> rate. The<br />

improving economic environment in Europe and Japan are also<br />

expected to lend support to the markets. Notwithstanding this,<br />

there still exists the risks that the monetary policy could be further<br />

tightened and oil prices could rise further, which could raise the<br />

possibility of a slower economic growth and inflation fears. In<br />

addition, the possibility of an Avian flu pandemic could also disrupt<br />

the performance of the equity markets.<br />

12<br />

PERFORMANCE ON BID-BID BASIS (%)<br />

3mths 6 mths 1 year 3 years 3 years Since Inception Since Inception<br />

(annualised)<br />

(annualised)<br />

<strong>Great</strong>link <strong>Life</strong>style Steady Portfolio 0.35 2.39 4.79 29.35 8.96 22.00 5.42<br />

Benchmark Index 0.28 2.88 5.76 31.11 9.45 23.62 5.79<br />

NOTE: This factsheet is compiled by <strong>Great</strong> <strong>Eastern</strong> <strong>Life</strong>. The information presented is for informational use only. The performance of the Fund is not guaranteed and the value may increase or<br />

decrease in accordance with the future experience of the Fund. Past returns are not necessarily a guide to future performance.