Funds GreatLink - Great Eastern Life

Funds GreatLink - Great Eastern Life

Funds GreatLink - Great Eastern Life

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

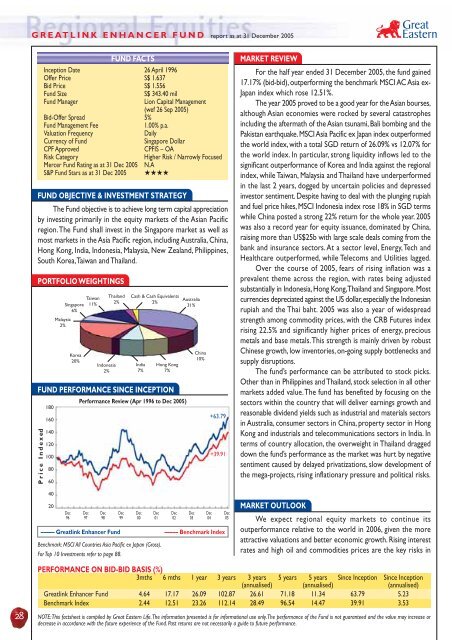

GREATLINK ENHANCER FUND report as at 31 December 2005<br />

FUND FACTS<br />

Inception Date 26 April 1996<br />

Offer Price S$ 1.637<br />

Bid Price S$ 1.556<br />

Fund Size<br />

Fund Manager<br />

FUND OBJECTIVE & INVESTMENT STRATEGY<br />

The Fund objective is to achieve long term capital appreciation<br />

by investing primarily in the equity markets of the Asian Pacific<br />

region. The Fund shall invest in the Singapore market as well as<br />

most markets in the Asia Pacific region, including Australia, China,<br />

Hong Kong, India, Indonesia, Malaysia, New Zealand, Philippines,<br />

South Korea, Taiwan and Thailand.<br />

PORTFOLIO WEIGHTINGS<br />

S$ 343.40 mil<br />

Lion Capital Management<br />

(wef 26 Sep 2005)<br />

Bid-Offer Spread 5%<br />

Fund Management Fee<br />

1.00% p.a.<br />

Valuation Frequency<br />

Daily<br />

Currency of Fund<br />

Singapore Dollar<br />

CPF Approved<br />

CPFIS – OA<br />

Risk Category<br />

Higher Risk / Narrowly Focused<br />

Mercer Fund Rating as at 31 Dec 2005 N.A<br />

S&P Fund Stars as at 31 Dec 2005 ★★★★<br />

Taiwan<br />

Singapore 11%<br />

6%<br />

Malaysia<br />

2%<br />

Korea<br />

20%<br />

Indonesia<br />

2%<br />

Thailand<br />

2%<br />

Cash & Cash Equivalents<br />

2%<br />

India<br />

7%<br />

Hong Kong<br />

7%<br />

FUND PERFORMANCE SINCE INCEPTION<br />

Performance Review (Apr 1996 to Dec 2005)<br />

Price Indexed<br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

Australia<br />

31%<br />

China<br />

10%<br />

+63.79<br />

+39.91<br />

MARKET REVIEW<br />

For the half year ended 31 December 2005, the fund gained<br />

17.17% (bid-bid), outperforming the benchmark MSCI AC Asia ex-<br />

Japan index which rose 12.51%.<br />

The year 2005 proved to be a good year for the Asian bourses,<br />

although Asian economies were rocked by several catastrophes<br />

including the aftermath of the Asian tsunami, Bali bombing and the<br />

Pakistan earthquake. MSCI Asia Pacific ex Japan index outperformed<br />

the world index, with a total SGD return of 26.09% vs 12.07% for<br />

the world index. In particular, strong liquidity inflows led to the<br />

significant outperformance of Korea and India against the regional<br />

index, while Taiwan, Malaysia and Thailand have underperformed<br />

in the last 2 years, dogged by uncertain policies and depressed<br />

investor sentiment. Despite having to deal with the plunging rupiah<br />

and fuel price hikes, MSCI Indonesia index rose 18% in SGD terms<br />

while China posted a strong 22% return for the whole year. 2005<br />

was also a record year for equity issuance, dominated by China,<br />

raising more than US$25b with large scale deals coming from the<br />

bank and insurance sectors. At a sector level, Energy, Tech and<br />

Healthcare outperformed, while Telecoms and Utilities lagged.<br />

Over the course of 2005, fears of rising inflation was a<br />

prevalent theme across the region, with rates being adjusted<br />

substantially in Indonesia, Hong Kong, Thailand and Singapore. Most<br />

currencies depreciated against the US dollar, especially the Indonesian<br />

rupiah and the Thai baht. 2005 was also a year of widespread<br />

strength among commodity prices, with the CRB Futures index<br />

rising 22.5% and significantly higher prices of energy, precious<br />

metals and base metals. This strength is mainly driven by robust<br />

Chinese growth, low inventories, on-going supply bottlenecks and<br />

supply disruptions.<br />

The fund’s performance can be attributed to stock picks.<br />

Other than in Philippines and Thailand, stock selection in all other<br />

markets added value. The fund has benefited by focusing on the<br />

sectors within the country that will deliver earnings growth and<br />

reasonable dividend yields such as industrial and materials sectors<br />

in Australia, consumer sectors in China, property sector in Hong<br />

Kong and industrials and telecommunications sectors in India. In<br />

terms of country allocation, the overweight in Thailand dragged<br />

down the fund’s performance as the market was hurt by negative<br />

sentiment caused by delayed privatizations, slow development of<br />

the mega-projects, rising inflationary pressure and political risks.<br />

28<br />

40<br />

20<br />

Dec Dec Dec Dec Dec Dec Dec Dec Dec Dec<br />

96 97 98 99 00 01 02 03 04 05<br />

––––– <strong>Great</strong>link Enhancer Fund ––––– Benchmark Index<br />

Benchmark: MSCI All Countries Asia Pacific ex Japan (Gross).<br />

For Top 10 Investments refer to page 88.<br />

MARKET OUTLOOK<br />

We expect regional equity markets to continue its<br />

outperformance relative to the world in 2006, given the more<br />

attractive valuations and better economic growth. Rising interest<br />

rates and high oil and commodities prices are the key risks in<br />

PERFORMANCE ON BID-BID BASIS (%)<br />

3mths 6 mths 1 year 3 years 3 years 5 years 5 years Since Inception Since Inception<br />

(annualised) (annualised) (annualised)<br />

<strong>Great</strong>link Enhancer Fund 4.64 17.17 26.09 102.87 26.61 71.18 11.34 63.79 5.23<br />

Benchmark Index 2.44 12.51 23.26 112.14 28.49 96.54 14.47 39.91 3.53<br />

NOTE: This factsheet is compiled by <strong>Great</strong> <strong>Eastern</strong> <strong>Life</strong>. The information presented is for informational use only. The performance of the Fund is not guaranteed and the value may increase or<br />

decrease in accordance with the future experience of the Fund. Past returns are not necessarily a guide to future performance.