Funds GreatLink - Great Eastern Life

Funds GreatLink - Great Eastern Life

Funds GreatLink - Great Eastern Life

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

GREATLINK ASEAN GROWTH FUND report as at 31 December 2005<br />

30<br />

FUND FACTS<br />

Inception Date 26 April 1996<br />

Offer Price S$ 1.431<br />

Bid Price S$ 1.360<br />

Fund Size<br />

S$ 130.38 mil<br />

Fund Manager<br />

Lion Capital Management<br />

(wef 26 Sep 2005)<br />

Bid-Offer Spread 5%<br />

Fund Management Fee<br />

1.00% p.a.<br />

Valuation Frequency<br />

Daily<br />

Currency of Fund<br />

Singapore Dollar<br />

CPF Approved<br />

CPFIS – OA<br />

Risk Category<br />

Higher Risk / Narrowly Focused<br />

Mercer Fund Rating as at 31 Dec 2005 N.A<br />

S&P Fund Stars as at 31 Dec 2005 N.A<br />

FUND OBJECTIVE & INVESTMENT STRATEGY<br />

The Fund objective is to achieve long term capital appreciation<br />

by investing in equities in the economies of the ASEAN region.<br />

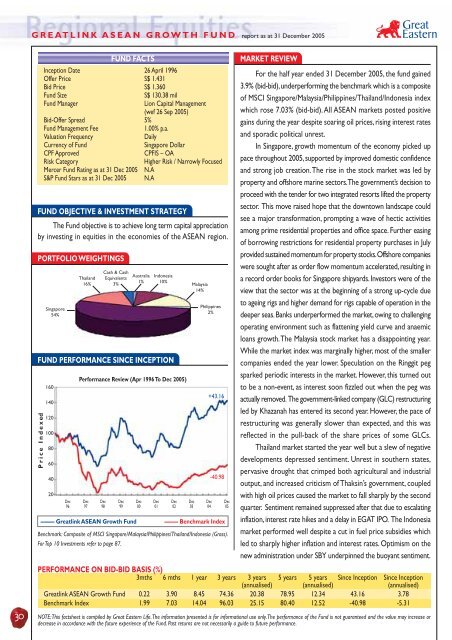

PORTFOLIO WEIGHTINGS<br />

FUND PERFORMANCE SINCE INCEPTION<br />

Price Indexed<br />

Singapore<br />

54%<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

Thailand<br />

16%<br />

Cash & Cash<br />

Equivalents<br />

3%<br />

Australia<br />

1%<br />

Indonesia<br />

10%<br />

Performance Review (Apr 1996 To Dec 2005)<br />

Malaysia<br />

14%<br />

Philippines<br />

2%<br />

+43.16<br />

-40.98<br />

Dec Dec Dec Dec Dec Dec Dec Dec Dec Dec<br />

96 97 98 99 00 01 02 03 04 05<br />

––––– <strong>Great</strong>link ASEAN Growth Fund ––––– Benchmark Index<br />

Benchmark: Composite of MSCI Singapore/Malaysia/Philippines/Thailand/Indonesia (Gross).<br />

For Top 10 Investments refer to page 87.<br />

MARKET REVIEW<br />

For the half year ended 31 December 2005, the fund gained<br />

3.9% (bid-bid), underperforming the benchmark which is a composite<br />

of MSCI Singapore/Malaysia/Philippines/Thailand/Indonesia index<br />

which rose 7.03% (bid-bid). All ASEAN markets posted positive<br />

gains during the year despite soaring oil prices, rising interest rates<br />

and sporadic political unrest.<br />

In Singapore, growth momentum of the economy picked up<br />

pace throughout 2005, supported by improved domestic confidence<br />

and strong job creation. The rise in the stock market was led by<br />

property and offshore marine sectors. The government’s decision to<br />

proceed with the tender for two integrated resorts lifted the property<br />

sector. This move raised hope that the downtown landscape could<br />

see a major transformation, prompting a wave of hectic activities<br />

among prime residential properties and office space. Further easing<br />

of borrowing restrictions for residential property purchases in July<br />

provided sustained momentum for property stocks. Offshore companies<br />

were sought after as order flow momentum accelerated, resulting in<br />

a record order books for Singapore shipyards. Investors were of the<br />

view that the sector was at the beginning of a strong up-cycle due<br />

to ageing rigs and higher demand for rigs capable of operation in the<br />

deeper seas. Banks underperformed the market, owing to challenging<br />

operating environment such as flattening yield curve and anaemic<br />

loans growth. The Malaysia stock market has a disappointing year.<br />

While the market index was marginally higher, most of the smaller<br />

companies ended the year lower. Speculation on the Ringgit peg<br />

sparked periodic interests in the market. However, this turned out<br />

to be a non-event, as interest soon fizzled out when the peg was<br />

actually removed. The government-linked company (GLC) restructuring<br />

led by Khazanah has entered its second year. However, the pace of<br />

restructuring was generally slower than expected, and this was<br />

reflected in the pull-back of the share prices of some GLCs.<br />

Thailand market started the year well but a slew of negative<br />

developments depressed sentiment. Unrest in southern states,<br />

pervasive drought that crimped both agricultural and industrial<br />

output, and increased criticism of Thaksin’s government, coupled<br />

with high oil prices caused the market to fall sharply by the second<br />

quarter. Sentiment remained suppressed after that due to escalating<br />

inflation, interest rate hikes and a delay in EGAT IPO. The Indonesia<br />

market performed well despite a cut in fuel price subsidies which<br />

led to sharply higher inflation and interest rates. Optimism on the<br />

new administration under SBY underpinned the buoyant sentiment.<br />

PERFORMANCE ON BID-BID BASIS (%)<br />

3mths 6 mths 1 year 3 years 3 years 5 years 5 years Since Inception Since Inception<br />

(annualised) (annualised) (annualised)<br />

<strong>Great</strong>link ASEAN Growth Fund 0.22 3.90 8.45 74.36 20.38 78.95 12.34 43.16 3.78<br />

Benchmark Index 1.99 7.03 14.04 96.03 25.15 80.40 12.52 -40.98 -5.31<br />

NOTE: This factsheet is compiled by <strong>Great</strong> <strong>Eastern</strong> <strong>Life</strong>. The information presented is for informational use only. The performance of the Fund is not guaranteed and the value may increase or<br />

decrease in accordance with the future experience of the Fund. Past returns are not necessarily a guide to future performance.