Funds GreatLink - Great Eastern Life

Funds GreatLink - Great Eastern Life

Funds GreatLink - Great Eastern Life

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

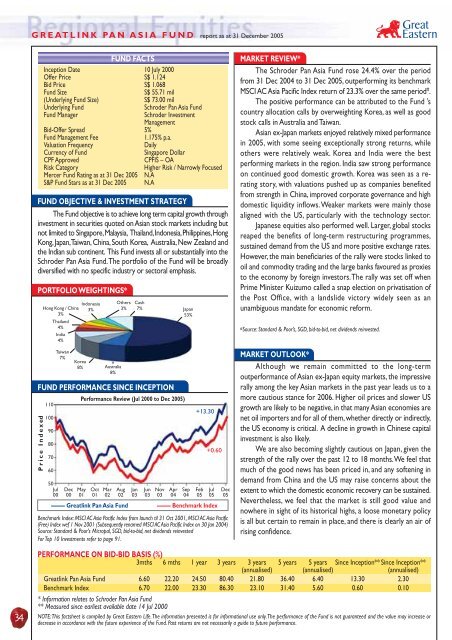

GREATLINK PAN ASIA FUND report as at 31 December 2005<br />

34<br />

FUND FACTS<br />

Inception Date 10 July 2000<br />

Offer Price S$ 1.124<br />

Bid Price S$ 1.068<br />

Fund Size<br />

S$ 55.71 mil<br />

(Underlying Fund Size)<br />

S$ 73.00 mil<br />

Underlying Fund<br />

Fund Manager<br />

Hong Kong / China<br />

3%<br />

Thailand<br />

4%<br />

India<br />

4%<br />

Taiwan<br />

7%<br />

Indonesia<br />

3%<br />

Korea<br />

8% Australia<br />

8%<br />

Others<br />

3%<br />

Cash<br />

7%<br />

Schroder Pan Asia Fund<br />

Schroder Investment<br />

Management<br />

Bid-Offer Spread 5%<br />

Fund Management Fee<br />

1.175% p.a.<br />

Valuation Frequency<br />

Daily<br />

Currency of Fund<br />

Singapore Dollar<br />

CPF Approved<br />

CPFIS – OA<br />

Risk Category<br />

Higher Risk / Narrowly Focused<br />

Mercer Fund Rating as at 31 Dec 2005 N.A<br />

S&P Fund Stars as at 31 Dec 2005 N.A<br />

FUND OBJECTIVE & INVESTMENT STRATEGY<br />

The Fund objective is to achieve long term capital growth through<br />

investment in securities quoted on Asian stock markets including but<br />

not limited to Singapore, Malaysia, Thailand, Indonesia, Philippines, Hong<br />

Kong, Japan, Taiwan, China, South Korea, Australia, New Zealand and<br />

the Indian sub continent. This Fund invests all or substantially into the<br />

Schroder Pan Asia Fund. The portfolio of the Fund will be broadly<br />

diversified with no specific industry or sectoral emphasis.<br />

PORTFOLIO WEIGHTINGS*<br />

FUND PERFORMANCE SINCE INCEPTION<br />

Price Indexed<br />

110<br />

100<br />

90<br />

80<br />

70<br />

60<br />

Performance Review (Jul 2000 to Dec 2005)<br />

Japan<br />

53%<br />

+13.30<br />

+0.60<br />

50<br />

Jul Dec May Oct Mar Aug Jan Jun Nov Apr Sep Feb Jul Dec<br />

00 00 01 01 02 02 03 03 03 04 04 05 05 05<br />

––––– <strong>Great</strong>link Pan Asia Fund ––––– Benchmark Index<br />

Benchmark Index: MSCI AC Asia Pacific Index from launch til 31 Oct 2001, MSCI AC Asia Pacific<br />

(Free) Index wef 1 Nov 2001 (Subsequently renamed MSCI AC Asia Pacific Index on 30 Jan 2004)<br />

Source: Standard & Poor’s Micropal, SGD, bid-to-bid, net dividends reinvested<br />

For Top 10 Investments refer to page 91.<br />

MARKET REVIEW*<br />

The Schroder Pan Asia Fund rose 24.4% over the period<br />

from 31 Dec 2004 to 31 Dec 2005, outperforming its benchmark<br />

MSCI AC Asia Pacific Index return of 23.3% over the same period # .<br />

The positive performance can be attributed to the Fund ’s<br />

country allocation calls by overweighting Korea, as well as good<br />

stock calls in Australia and Taiwan.<br />

Asian ex-Japan markets enjoyed relatively mixed performance<br />

in 2005, with some seeing exceptionally strong returns, while<br />

others were relatively weak. Korea and India were the best<br />

performing markets in the region. India saw strong performance<br />

on continued good domestic growth. Korea was seen as a rerating<br />

story, with valuations pushed up as companies benefited<br />

from strength in China, improved corporate governance and high<br />

domestic liquidity inflows. Weaker markets were mainly those<br />

aligned with the US, particularly with the technology sector.<br />

Japanese equities also performed well. Larger, global stocks<br />

reaped the benefits of long-term restructuring programmes,<br />

sustained demand from the US and more positive exchange rates.<br />

However, the main beneficiaries of the rally were stocks linked to<br />

oil and commodity trading and the large banks favoured as proxies<br />

to the economy by foreign investors. The rally was set off when<br />

Prime Minister Kuizumo called a snap election on privatisation of<br />

the Post Office, with a landslide victory widely seen as an<br />

unambiguous mandate for economic reform.<br />

#Source: Standard & Poor’s, SGD, bid-to-bid, net dividends reinvested.<br />

MARKET OUTLOOK*<br />

Although we remain committed to the long-term<br />

outperformance of Asian ex-Japan equity markets, the impressive<br />

rally among the key Asian markets in the past year leads us to a<br />

more cautious stance for 2006. Higher oil prices and slower US<br />

growth are likely to be negative, in that many Asian economies are<br />

net oil importers and for all of them, whether directly or indirectly,<br />

the US economy is critical. A decline in growth in Chinese capital<br />

investment is also likely.<br />

We are also becoming slightly cautious on Japan, given the<br />

strength of the rally over the past 12 to 18 months. We feel that<br />

much of the good news has been priced in, and any softening in<br />

demand from China and the US may raise concerns about the<br />

extent to which the domestic economic recovery can be sustained.<br />

Nevertheless, we feel that the market is still good value and<br />

nowhere in sight of its historical highs, a loose monetary policy<br />

is all but certain to remain in place, and there is clearly an air of<br />

rising confidence.<br />

PERFORMANCE ON BID-BID BASIS (%)<br />

3mths 6 mths 1 year 3 years 3 years 5 years 5 years Since Inception** Since Inception**<br />

(annualised) (annualised) (annualised)<br />

<strong>Great</strong>link Pan Asia Fund 6.60 22.20 24.50 80.40 21.80 36.40 6.40 13.30 2.30<br />

Benchmark Index 6.70 22.00 23.30 86.30 23.10 31.40 5.60 0.60 0.10<br />

* Information relates to Schroder Pan Asia Fund<br />

** Measured since earliest available date 14 Jul 2000<br />

NOTE: This factsheet is compiled by <strong>Great</strong> <strong>Eastern</strong> <strong>Life</strong>. The information presented is for informational use only. The performance of the Fund is not guaranteed and the value may increase or<br />

decrease in accordance with the future experience of the Fund. Past returns are not necessarily a guide to future performance.