Funds GreatLink - Great Eastern Life

Funds GreatLink - Great Eastern Life

Funds GreatLink - Great Eastern Life

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

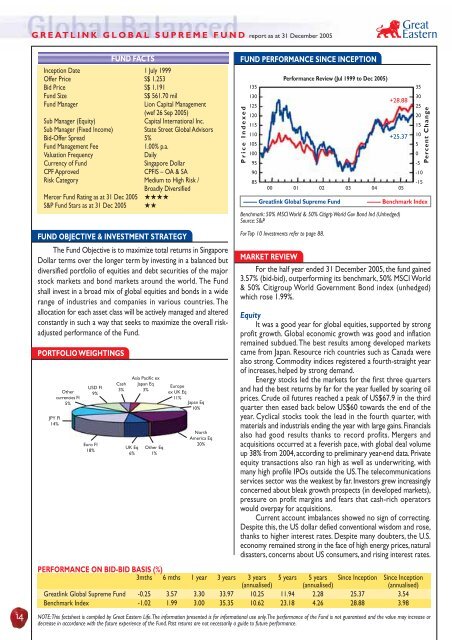

GREATLINK GLOBAL SUPREME FUND report as at 31 December 2005<br />

FUND OBJECTIVE & INVESTMENT STRATEGY<br />

The Fund Objective is to maximize total returns in Singapore<br />

Dollar terms over the longer term by investing in a balanced but<br />

diversified portfolio of equities and debt securities of the major<br />

stock markets and bond markets around the world. The Fund<br />

shall invest in a broad mix of global equities and bonds in a wide<br />

range of industries and companies in various countries. The<br />

allocation for each asset class will be actively managed and altered<br />

constantly in such a way that seeks to maximize the overall riskadjusted<br />

performance of the Fund.<br />

PORTFOLIO WEIGHTINGS<br />

Other<br />

currencies FI<br />

5%<br />

JPY FI<br />

14%<br />

USD FI<br />

9%<br />

Euro FI<br />

18%<br />

FUND FACTS<br />

Inception Date 1 July 1999<br />

Offer Price S$ 1.253<br />

Bid Price S$ 1.191<br />

Fund Size<br />

S$ 561.70 mil<br />

Fund Manager<br />

Lion Capital Management<br />

(wef 26 Sep 2005)<br />

Sub Manager (Equity)<br />

Capital International Inc.<br />

Sub Manager (Fixed Income)<br />

State Street Global Advisors<br />

Bid-Offer Spread 5%<br />

Fund Management Fee<br />

1.00% p.a.<br />

Valuation Frequency<br />

Daily<br />

Currency of Fund<br />

Singapore Dollar<br />

CPF Approved<br />

CPFIS – OA & SA<br />

Risk Category Medium to High Risk /<br />

Broadly Diversified<br />

Mercer Fund Rating as at 31 Dec 2005 ★★★★<br />

S&P Fund Stars as at 31 Dec 2005 ★★<br />

Cash<br />

3%<br />

Asia Pacific ex<br />

Japan Eq<br />

3%<br />

UK Eq<br />

6%<br />

Other Eq<br />

1%<br />

Europe<br />

ex UK Eq<br />

11%<br />

Japan Eq<br />

10%<br />

North<br />

America Eq<br />

20%<br />

FUND PERFORMANCE SINCE INCEPTION<br />

Performance Review (Jul 1999 to Dec 2005)<br />

00 01 02 03 04 05<br />

––––– <strong>Great</strong>link Global Supreme Fund ––––– Benchmark Index<br />

Benchmark: 50% MSCI World & 50% Citigrp World Gov Bond Ind (Unhedged)<br />

Source: S&P<br />

For Top 10 Investments refer to page 88.<br />

MARKET REVIEW<br />

For the half year ended 31 December 2005, the fund gained<br />

3.57% (bid-bid), outperforming its benchmark, 50% MSCI World<br />

& 50% Citigroup World Government Bond index (unhedged)<br />

which rose 1.99%.<br />

Equity<br />

It was a good year for global equities, supported by strong<br />

profit growth. Global economic growth was good and inflation<br />

remained subdued. The best results among developed markets<br />

came from Japan. Resource rich countries such as Canada were<br />

also strong. Commodity indices registered a fourth-straight year<br />

of increases, helped by strong demand.<br />

Energy stocks led the markets for the first three quarters<br />

and had the best returns by far for the year fuelled by soaring oil<br />

prices. Crude oil futures reached a peak of US$67.9 in the third<br />

quarter then eased back below US$60 towards the end of the<br />

year. Cyclical stocks took the lead in the fourth quarter, with<br />

materials and industrials ending the year with large gains. Financials<br />

also had good results thanks to record profits. Mergers and<br />

acquisitions occurred at a feverish pace, with global deal volume<br />

up 38% from 2004, according to preliminary year-end data. Private<br />

equity transactions also ran high as well as underwriting, with<br />

many high profile IPOs outside the US. The telecommunications<br />

services sector was the weakest by far. Investors grew increasingly<br />

concerned about bleak growth prospects (in developed markets),<br />

pressure on profit margins and fears that cash-rich operators<br />

would overpay for acquisitions.<br />

Current account imbalances showed no sign of correcting.<br />

Despite this, the US dollar defied conventional wisdom and rose,<br />

thanks to higher interest rates. Despite many doubters, the U.S.<br />

economy remained strong in the face of high energy prices, natural<br />

disasters, concerns about US consumers, and rising interest rates.<br />

PERFORMANCE ON BID-BID BASIS (%)<br />

3mths 6 mths 1 year 3 years 3 years 5 years 5 years Since Inception Since Inception<br />

(annualised) (annualised) (annualised)<br />

<strong>Great</strong>link Global Supreme Fund -0.25 3.57 3.30 33.97 10.25 11.94 2.28 25.37 3.54<br />

Benchmark Index -1.02 1.99 3.00 35.35 10.62 23.18 4.26 28.88 3.98<br />

14 NOTE: This factsheet is compiled by <strong>Great</strong> <strong>Eastern</strong> <strong>Life</strong>. The information presented is for informational use only. The performance of the Fund is not guaranteed and the value may increase or<br />

decrease in accordance with the future experience of the Fund. Past returns are not necessarily a guide to future performance.<br />

Price Indexed<br />

135<br />

130<br />

125<br />

120<br />

115<br />

110<br />

105<br />

100<br />

95<br />

90<br />

85<br />

+28.88<br />

+25.37<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

-5<br />

-10<br />

-15<br />

Percent Change