8 Oligopoly - Luiscabral.net

8 Oligopoly - Luiscabral.net

8 Oligopoly - Luiscabral.net

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

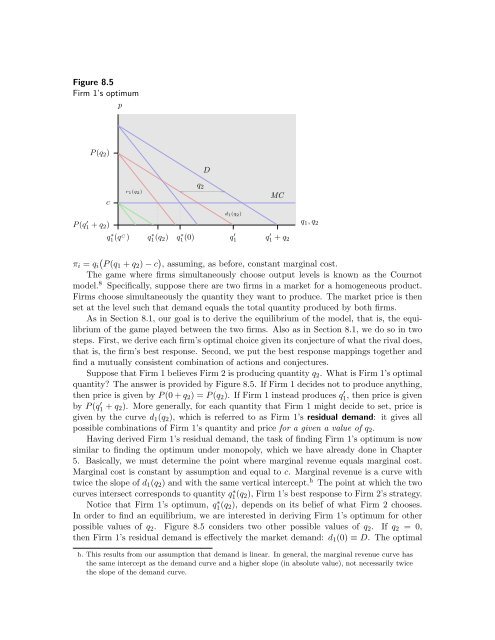

Figure 8.5<br />

Firm 1’s optimum<br />

p<br />

P (q 2 )<br />

D<br />

c<br />

P (q ′ 1 + q 2 )<br />

r 1 (q 2 )<br />

.<br />

.<br />

.<br />

.<br />

.<br />

.<br />

.<br />

.................................................................................................................................................... ....................................................................................................................................................<br />

.<br />

.<br />

.<br />

.<br />

.<br />

.<br />

.<br />

q 2<br />

d 1 (q 2 )<br />

MC<br />

q 1 , q 2<br />

q ∗ 1(q C ) q ∗ 1(q 2 ) q ∗ 1(0) q ′ 1 q ′ 1 + q 2<br />

(<br />

π i = q i P (q1 + q 2 ) − c ) , assuming, as before, constant marginal cost.<br />

The game where firms simultaneously choose output levels is known as the Cournot<br />

model. 8 Specifically, suppose there are two firms in a market for a homogeneous product.<br />

Firms choose simultaneously the quantity they want to produce. The market price is then<br />

set at the level such that demand equals the total quantity produced by both firms.<br />

As in Section 8.1, our goal is to derive the equilibrium of the model, that is, the equilibrium<br />

of the game played between the two firms. Also as in Section 8.1, we do so in two<br />

steps. First, we derive each firm’s optimal choice given its conjecture of what the rival does,<br />

that is, the firm’s best response. Second, we put the best response mappings together and<br />

find a mutually consistent combination of actions and conjectures.<br />

Suppose that Firm 1 believes Firm 2 is producing quantity q 2 . What is Firm 1’s optimal<br />

quantity? The answer is provided by Figure 8.5. If Firm 1 decides not to produce anything,<br />

then price is given by P (0 + q 2 ) = P (q 2 ). If Firm 1 instead produces q 1 ′ , then price is given<br />

by P (q 1 ′ + q 2). More generally, for each quantity that Firm 1 might decide to set, price is<br />

given by the curve d 1 (q 2 ), which is referred to as Firm 1’s residual demand: it gives all<br />

possible combinations of Firm 1’s quantity and price for a given a value of q 2 .<br />

Having derived Firm 1’s residual demand, the task of finding Firm 1’s optimum is now<br />

similar to finding the optimum under monopoly, which we have already done in Chapter<br />

5. Basically, we must determine the point where marginal revenue equals marginal cost.<br />

Marginal cost is constant by assumption and equal to c. Marginal revenue is a curve with<br />

twice the slope of d 1 (q 2 ) and with the same vertical intercept. h The point at which the two<br />

curves intersect corresponds to quantity q1 ∗(q 2), Firm 1’s best response to Firm 2’s strategy.<br />

Notice that Firm 1’s optimum, q1 ∗(q 2), depends on its belief of what Firm 2 chooses.<br />

In order to find an equilibrium, we are interested in deriving Firm 1’s optimum for other<br />

possible values of q 2 . Figure 8.5 considers two other possible values of q 2 . If q 2 = 0,<br />

then Firm 1’s residual demand is effectively the market demand: d 1 (0) ≡ D. The optimal<br />

h. This results from our assumption that demand is linear. In general, the marginal revenue curve has<br />

the same intercept as the demand curve and a higher slope (in absolute value), not necessarily twice<br />

the slope of the demand curve.