8 Oligopoly - Luiscabral.net

8 Oligopoly - Luiscabral.net

8 Oligopoly - Luiscabral.net

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

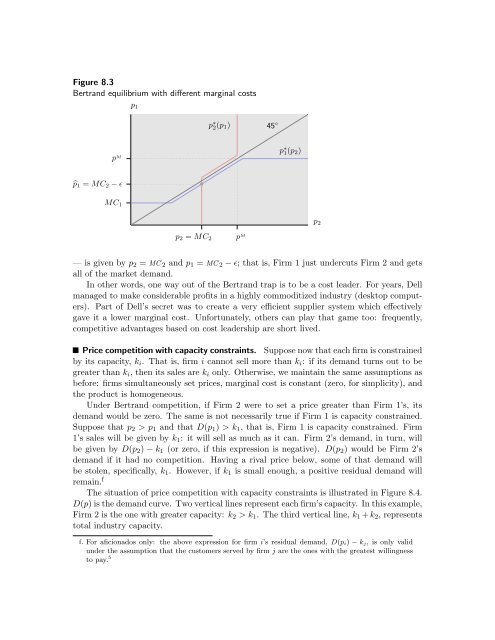

Figure 8.3<br />

Bertrand equilibrium with different marginal costs<br />

p ∗ 2(p 1 )<br />

45 ◦ p ∗ 1(p 2 )<br />

p M p 2 = MC 2 p M<br />

p 1 ... .... .... .... .... .... .... .... .... .... .... .... .... .... .... .... ... .... .... .... .... .... .... .... .... .... .... .... .... .... .... .... .... . ....................<br />

p 2<br />

̂p 1 = MC 2 − ɛ<br />

•<br />

... ..... .... .... .... .... .... .. . .... ... .... .... .... .... ..... .... ... .... .... .... .... .... .<br />

............<br />

MC 1<br />

— is given by p 2 = MC 2 and p 1 = MC 2 − ɛ; that is, Firm 1 just undercuts Firm 2 and gets<br />

all of the market demand.<br />

In other words, one way out of the Bertrand trap is to be a cost leader. For years, Dell<br />

managed to make considerable profits in a highly commoditized industry (desktop computers).<br />

Part of Dell’s secret was to create a very efficient supplier system which effectively<br />

gave it a lower marginal cost. Unfortunately, others can play that game too: frequently,<br />

competitive advantages based on cost leadership are short lived.<br />

Price competition with capacity constraints. Suppose now that each firm is constrained<br />

by its capacity, k i . That is, firm i cannot sell more than k i : if its demand turns out to be<br />

greater than k i , then its sales are k i only. Otherwise, we maintain the same assumptions as<br />

before: firms simultaneously set prices, marginal cost is constant (zero, for simplicity), and<br />

the product is homogeneous.<br />

Under Bertrand competition, if Firm 2 were to set a price greater than Firm 1’s, its<br />

demand would be zero. The same is not necessarily true if Firm 1 is capacity constrained.<br />

Suppose that p 2 > p 1 and that D(p 1 ) > k 1 , that is, Firm 1 is capacity constrained. Firm<br />

1’s sales will be given by k 1 : it will sell as much as it can. Firm 2’s demand, in turn, will<br />

be given by D(p 2 ) − k 1 (or zero, if this expression is negative). D(p 2 ) would be Firm 2’s<br />

demand if it had no competition. Having a rival price below, some of that demand will<br />

be stolen, specifically, k 1 . However, if k 1 is small enough, a positive residual demand will<br />

remain. f<br />

The situation of price competition with capacity constraints is illustrated in Figure 8.4.<br />

D(p) is the demand curve. Two vertical lines represent each firm’s capacity. In this example,<br />

Firm 2 is the one with greater capacity: k 2 > k 1 . The third vertical line, k 1 + k 2 , represents<br />

total industry capacity.<br />

f. For aficionados only: the above expression for firm i’s residual demand, D(p i) − k j, is only valid<br />

under the assumption that the customers served by firm j are the ones with the greatest willingness<br />

to pay. 5