8 Oligopoly - Luiscabral.net

8 Oligopoly - Luiscabral.net

8 Oligopoly - Luiscabral.net

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

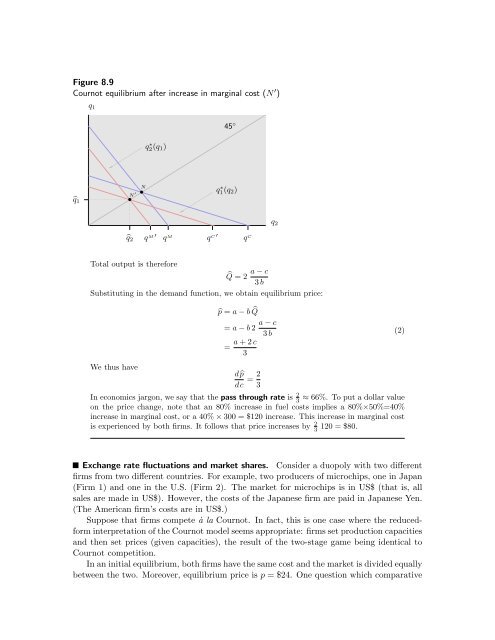

Figure 8.9<br />

Cournot equilibrium after increase in marginal cost (N ′ )<br />

45 ◦<br />

. .<br />

N ′ q ∗ 2(q 1 )<br />

• •N<br />

q ∗ 1(q 2 )<br />

̂q 1<br />

̂q 2 q M ′<br />

q M q C ′<br />

q C<br />

q 1<br />

.... .... .... .... .... ... .... ... ... ... ... .... .... .<br />

.......<br />

q 2<br />

. .<br />

Total output is therefore<br />

̂Q = 2 a − c<br />

3 b<br />

Substituting in the demand function, we obtain equilibrium price:<br />

We thus have<br />

̂p = a − b ̂Q<br />

= a − b 2 a − c<br />

3 b<br />

= a + 2 c<br />

3<br />

d ̂p<br />

dc = 2 3<br />

In economics jargon, we say that the pass through rate is 2 3<br />

≈ 66%. To put a dollar value<br />

on the price change, note that an 80% increase in fuel costs implies a 80%×50%=40%<br />

increase in marginal cost, or a 40% × 300 = $120 increase. This increase in marginal cost<br />

is experienced by both firms. It follows that price increases by 2 3<br />

120 = $80.<br />

(2)<br />

Exchange rate fluctuations and market shares. Consider a duopoly with two different<br />

firms from two different countries. For example, two producers of microchips, one in Japan<br />

(Firm 1) and one in the U.S. (Firm 2). The market for microchips is in US$ (that is, all<br />

sales are made in US$). However, the costs of the Japanese firm are paid in Japanese Yen.<br />

(The American firm’s costs are in US$.)<br />

Suppose that firms compete à la Cournot. In fact, this is one case where the reducedform<br />

interpretation of the Cournot model seems appropriate: firms set production capacities<br />

and then set prices (given capacities), the result of the two-stage game being identical to<br />

Cournot competition.<br />

In an initial equilibrium, both firms have the same cost and the market is divided equally<br />

between the two. Moreover, equilibrium price is p = $24. One question which comparative