8 Oligopoly - Luiscabral.net

8 Oligopoly - Luiscabral.net

8 Oligopoly - Luiscabral.net

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

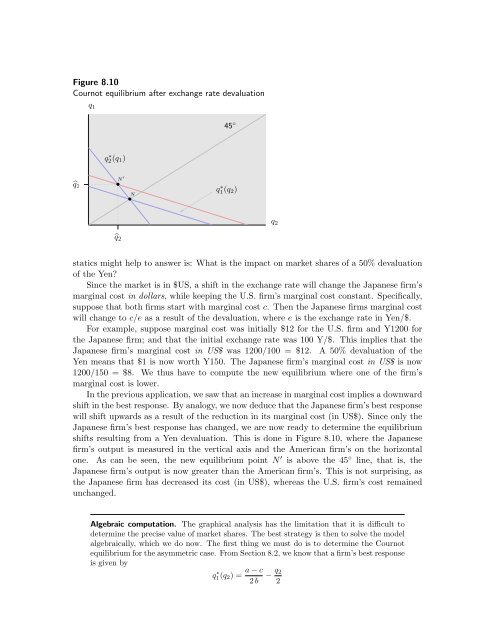

Figure 8.10<br />

Cournot equilibrium after exchange rate devaluation<br />

q 1<br />

45 ◦<br />

q 2<br />

q ∗ 2(q 1 )<br />

̂q 1<br />

̂q 2<br />

• N ′<br />

N<br />

•<br />

q ∗ 1(q 2 )<br />

... .... .... .... .... ... ... ... .... .<br />

............<br />

. .<br />

statics might help to answer is: What is the impact on market shares of a 50% devaluation<br />

of the Yen?<br />

Since the market is in $US, a shift in the exchange rate will change the Japanese firm’s<br />

marginal cost in dollars, while keeping the U.S. firm’s marginal cost constant. Specifically,<br />

suppose that both firms start with marginal cost c. Then the Japanese firms marginal cost<br />

will change to c/e as a result of the devaluation, where e is the exchange rate in Yen/$.<br />

For example, suppose marginal cost was initially $12 for the U.S. firm and Y1200 for<br />

the Japanese firm; and that the initial exchange rate was 100 Y/$. This implies that the<br />

Japanese firm’s marginal cost in US$ was 1200/100 = $12. A 50% devaluation of the<br />

Yen means that $1 is now worth Y150. The Japanese firm’s marginal cost in US$ is now<br />

1200/150 = $8. We thus have to compute the new equilibrium where one of the firm’s<br />

marginal cost is lower.<br />

In the previous application, we saw that an increase in marginal cost implies a downward<br />

shift in the best response. By analogy, we now deduce that the Japanese firm’s best response<br />

will shift upwards as a result of the reduction in its marginal cost (in US$). Since only the<br />

Japanese firm’s best response has changed, we are now ready to determine the equilibrium<br />

shifts resulting from a Yen devaluation. This is done in Figure 8.10, where the Japanese<br />

firm’s output is measured in the vertical axis and the American firm’s on the horizontal<br />

one. As can be seen, the new equilibrium point N ′ is above the 45 ◦ line, that is, the<br />

Japanese firm’s output is now greater than the American firm’s. This is not surprising, as<br />

the Japanese firm has decreased its cost (in US$), whereas the U.S. firm’s cost remained<br />

unchanged.<br />

Algebraic computation. The graphical analysis has the limitation that it is difficult to<br />

determine the precise value of market shares. The best strategy is then to solve the model<br />

algebraically, which we do now. The first thing we must do is to determine the Cournot<br />

equilibrium for the asymmetric case. From Section 8.2, we know that a firm’s best response<br />

is given by<br />

q1(q ∗ 2 ) = a − c − q 2<br />

2 b 2