8 Oligopoly - Luiscabral.net

8 Oligopoly - Luiscabral.net

8 Oligopoly - Luiscabral.net

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

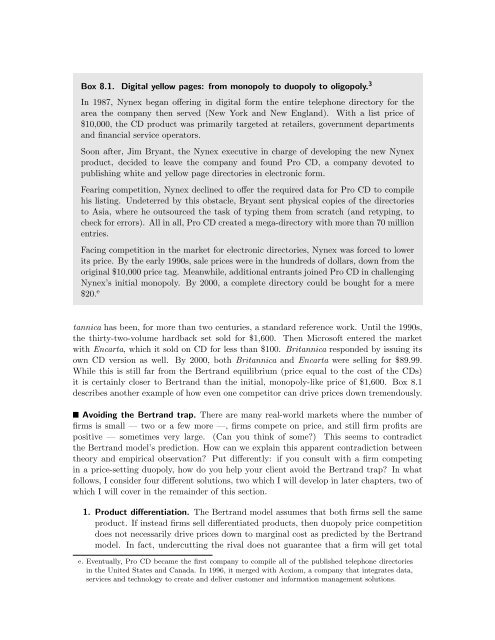

Box 8.1. Digital yellow pages: from monopoly to duopoly to oligopoly. 3<br />

In 1987, Nynex began offering in digital form the entire telephone directory for the<br />

area the company then served (New York and New England). With a list price of<br />

$10,000, the CD product was primarily targeted at retailers, government departments<br />

and financial service operators.<br />

Soon after, Jim Bryant, the Nynex executive in charge of developing the new Nynex<br />

product, decided to leave the company and found Pro CD, a company devoted to<br />

publishing white and yellow page directories in electronic form.<br />

Fearing competition, Nynex declined to offer the required data for Pro CD to compile<br />

his listing. Undeterred by this obstacle, Bryant sent physical copies of the directories<br />

to Asia, where he outsourced the task of typing them from scratch (and retyping, to<br />

check for errors). All in all, Pro CD created a mega-directory with more than 70 million<br />

entries.<br />

Facing competition in the market for electronic directories, Nynex was forced to lower<br />

its price. By the early 1990s, sale prices were in the hundreds of dollars, down from the<br />

original $10,000 price tag. Meanwhile, additional entrants joined Pro CD in challenging<br />

Nynex’s initial monopoly. By 2000, a complete directory could be bought for a mere<br />

$20. e<br />

tannica has been, for more than two centuries, a standard reference work. Until the 1990s,<br />

the thirty-two-volume hardback set sold for $1,600. Then Microsoft entered the market<br />

with Encarta, which it sold on CD for less than $100. Britannica responded by issuing its<br />

own CD version as well. By 2000, both Britannica and Encarta were selling for $89.99.<br />

While this is still far from the Bertrand equilibrium (price equal to the cost of the CDs)<br />

it is certainly closer to Bertrand than the initial, monopoly-like price of $1,600. Box 8.1<br />

describes another example of how even one competitor can drive prices down tremendously.<br />

Avoiding the Bertrand trap. There are many real-world markets where the number of<br />

firms is small — two or a few more —, firms compete on price, and still firm profits are<br />

positive — sometimes very large. (Can you think of some?) This seems to contradict<br />

the Bertrand model’s prediction. How can we explain this apparent contradiction between<br />

theory and empirical observation? Put differently: if you consult with a firm competing<br />

in a price-setting duopoly, how do you help your client avoid the Bertrand trap? In what<br />

follows, I consider four different solutions, two which I will develop in later chapters, two of<br />

which I will cover in the remainder of this section.<br />

1. Product differentiation. The Bertrand model assumes that both firms sell the same<br />

product. If instead firms sell differentiated products, then duopoly price competition<br />

does not necessarily drive prices down to marginal cost as predicted by the Bertrand<br />

model. In fact, undercutting the rival does not guarantee that a firm will get total<br />

e. Eventually, Pro CD became the first company to compile all of the published telephone directories<br />

in the United States and Canada. In 1996, it merged with Acxiom, a company that integrates data,<br />

services and technology to create and deliver customer and information management solutions.